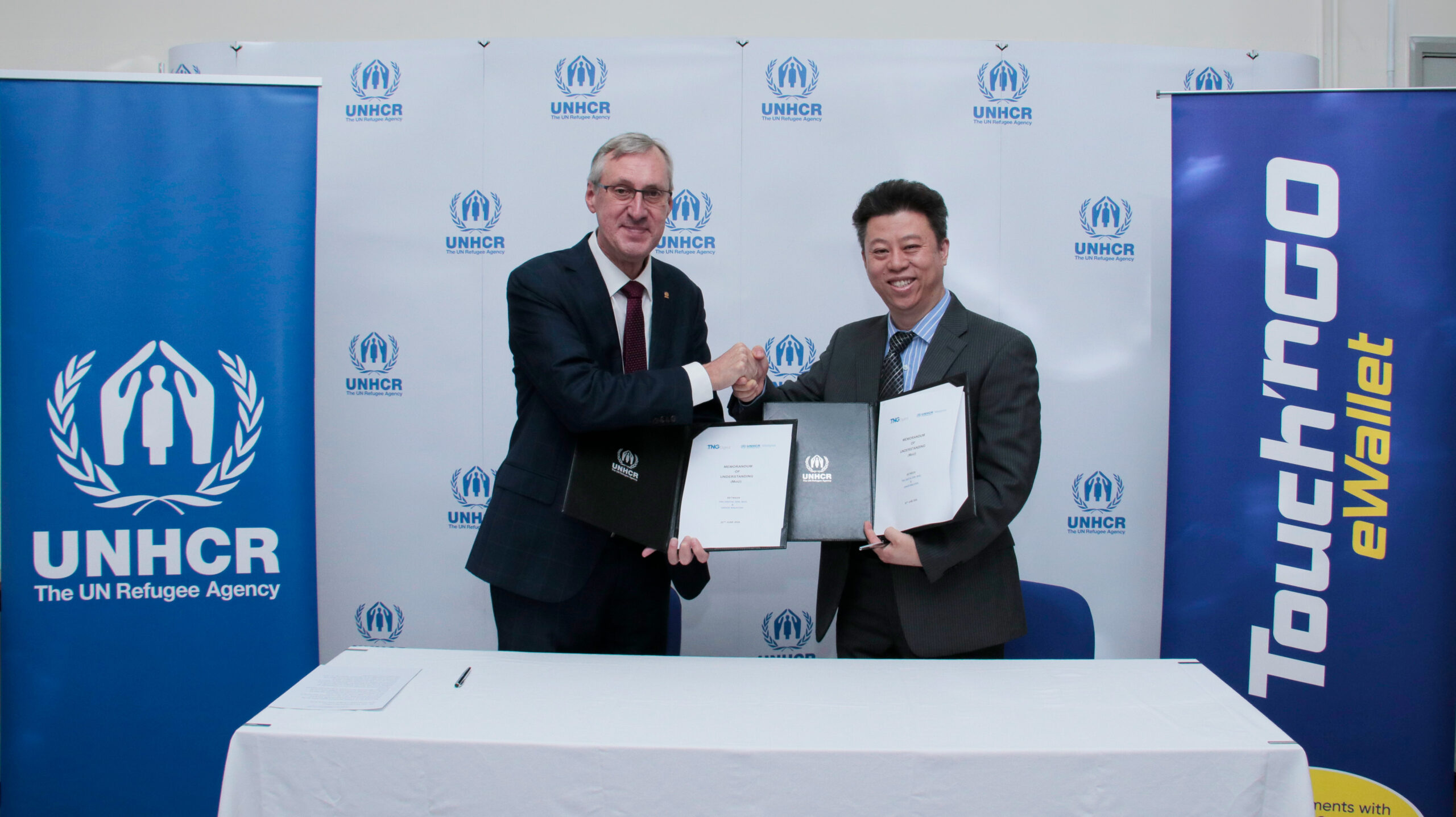

TNG Digital Sdn Bhd has signed a Memorandum of Understanding (MOU) with UNHCR, the United Nations Refugee agency to bridge the financial inclusion gap for refugees and asylum seekers.

The collaboration, announced in conjunction with World Refugee Day, aim to tackle the challenges of financial inclusion faced by the underbanked and underserved refugee and asylum-seeking communities in the country.

For context, as of end May 2024, there are approximately 189,340 refugees and asylum seekers registered with UNHCR in Malaysia.

The majority are refugees and asylum seekers from Myanmar from conflict-affected areas or fleeing persecution, while the remaining are those from 50 countries fleeing war and persecution including Pakistanis, Yemenis and Afghans.

For these communities, access to essential financial services remains a significant hurdle in Malaysia.

According to TNG Digital CEO Alan Ni, the company is dedicated to advancing financial inclusion for all, especially the underbanked and underserved.

“By joining forces and harnessing the unique strengths and resources of both TNG Digital and UNHCR, we aim to empower refugee communities with the financial tools they need to build stable, self-sufficient lives,” he remarked.

“This initiative not only supports refugees but also contributes to Malaysia’s economic growth by fostering a more inclusive and resilient financial ecosystem.”

UNHCR Representative in Malaysia Thomas Albrecht added that refugees face many constraints when it comes to accessing financial services and without such access, they cannot fully participate in a country’s economy or build a stable life for themselves and their families, and are vulnerable to exploitation.

“Encouraging self-reliance through economic and financial inclusion is a key component of achieving protection and long-term solutions for refugees. UNHCR is deeply appreciative of this partnership with TNG Digital in strengthening our work to meet these aims,” he added.

This partnership seeks to significantly improve access to critical financial services for communities that are underserved and lack adequate banking facilities.

By providing refugees with access to digital financial services and improving financial literacy, the initiative aims to stabilise refugee communities financially, empowering them to contribute to the Malaysian economy. – June 20, 2024