BMI retains their forecast for Malaysia’s federal government budget deficit to narrow from 5% of gross domestic product (GDP) in 2023 to 4.3% in 2024 and then to 3.9% in 2025.

“Thus far in 2024, the unity government has made significant strides in reining in spending, and we think that they will continue to work towards achieving Malaysia’s medium term-goal of narrowing its budget deficit to 3.5% of GDP by 2025,” said BMI.

They forecast revenue growth to slow marginally from 15.3% of GDP in 2023 to 15.1% of GDP in 2024.

Timely data from the Ministry of Finance showed that the federal government’s revenue collection stood at 54.5% of the prevailing 2024 target, the lowest in five years.

This is in spite of the rise in sales and services tax from 6% to 8% effective from March 2024 and the introduction of capital gains tax on the sale of unlisted shares at the start of 2024.

“We highlight growing risks that the government could fall short of its revenue target this year, amid a decrease in non-tax revenue income,” said BMI.

Their commodities team expects the price of brent crude to average USD81 per barrel in 2024, down from USD85 per barrel previously, which will in turn translate into reduced petroleum-related income from PETRONAS.

And the World Bank is aligned on this, having urged Malaysia to stipulate an explicit revenue target as its tax base of 11.2% of GDP in 2023 remains lacklustre and is some way below the average 15% recorded between 2000 and 2015.

More recently in August, policymakers have dismissed speculations surrounding the reintroduction of the goods and services tax (GST) despite the Organisation for Economic Co-operation and Development (OECD)’s recommendation to do so.

“If history serves as an indication, we expect Prime Minister Anwar to exercise caution in reinstating the GST. The introduction of GST back in 2015 led to the downfall of then-Prime Minister Najib Razak, an outcome we think Prime Minister Anwar will be mindful of avoiding given his low approval rating thus far,” said BMI.

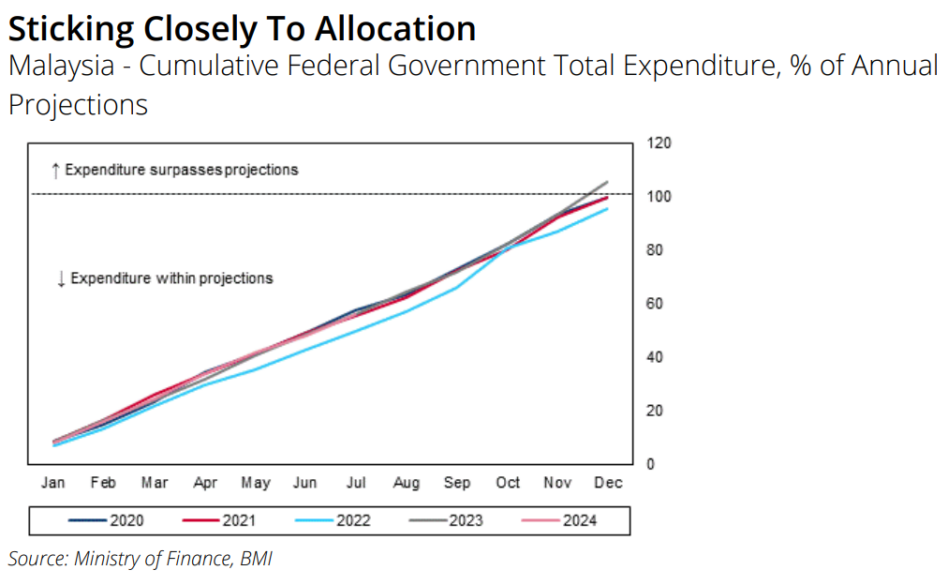

Meanwhile, BMI continues to expect that expenditure will remain on track with the government’s projections.

In the first seven months of the year, total spending reached 56% of the 2024 target, and is broadly in line with the five-year average of 55%.

“Since our previous update in April, the unity government announced the removal of blanket diesel subsidies on June 10, which it expects to save up to RM4bil annually,” said BMI.

BMI views this as a necessary move given that the government has confirmed it will be raising civil servants’ salaries by more than RM10bil, the first revision in more than a decade.

What is more, Malaysia spent approximately RM81bil on subsidies in 2023, with blanket fuel subsidies constituting the bulk of the expense.

And while little details have been made known regarding the removal of the more popular RON95 petrol, BMI expects the government to implement further subsidy rationalisation plans in order to meet their fiscal targets.

“All told, we retain our forecast for expenditure to drop marginally to 19.4% of GDP in 2024, down from 20.3% in 2023,” said BMI.

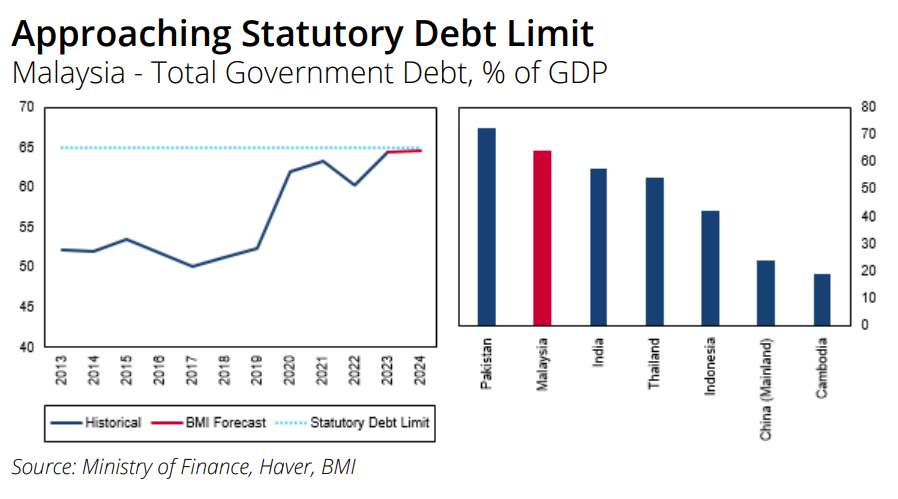

BMI forecasts total government debt as a share of GDP to remain elevated around 64% of GDP. This will remain just a touch below the revised statutory debt limit of 65%.

Indeed, total government debt rose from RM1.17tril as at end-2023 to RM1.22tril as of end April 2024 amid rising investment costs to fund infrastructure developments under the Twelfth plan.

“And while public debt levels in Malaysia ranks relatively high compared to its emerging market peers, we expect fiscal risks to remain limited as more than 95% of total debt were ringgit-denominated securities,” said BMI.

Apart from the medium-term fiscal framework 2024-2026, which targets an average deficit of 3.5% of GDP during this time, the Fiscal Responsibility Act passed on October 11 2023 further mandates the government deficit to fall below 3.0% of GDP in the next three to five years.

If so, BMI expects more substantial measures to be implemented in the upcoming Budget 2025 (to be tabled on October 18) to achieve these medium-term targets. – Sept 30, 2024

Main image: centralbanking