AM Investment Bank (AMIB) is underweight on the power sector as valuations are no longer appealing.

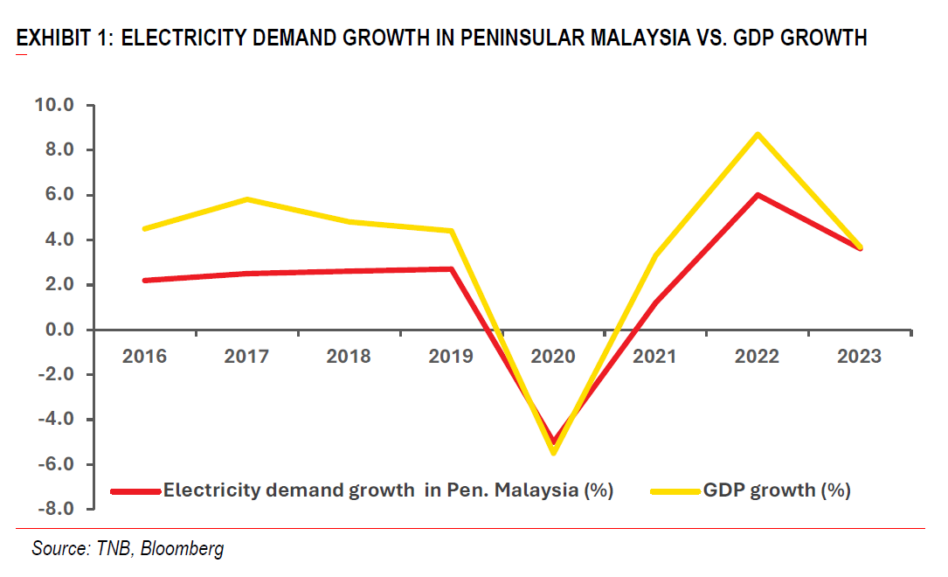

“We believe that RP4 (Regulatory Period 4) would be neutral for TNB, as we expect allowable demand growth to range from 2% to 4% and the rate of return is unlikely to fall below 7%,” said AMIB in the recent sector report.

As such, the group may not benefit from any exceptional demand coming from data centres. AMIB has BUYs on YTL Power and Mega First.

Also, AMIB is positive on Mega First as the unfavourable impact from the depreciation of the USD has already been reflected in the share price.

In fact, the USD has risen by 9% against the Ringgit since touching a low of RM4.12 on 30 September.

YTL Power’s FY25F price-to-earnings (PE) ratio is appealing at 8x as the share price has fallen by 41% from the peak of RM5.30 per share on 12 May.

“We downgrade TNB to UNDERWEIGHT from HOLD as its share price has exceeded our new target price of RM12.00 per share. Our target price for TNB is based on a FY26F PE of 16x, which is the five-year average,” said AIMB.

Also, AMIB reckons that the two-fold jump in TNB’s share price from the low of RM7.06 per share in July 2022 has already accounted for any positive outcome from RP4 and favourable impact of the proliferation of data centres (DC) in Malaysia.

Bloomberg consensus estimates Malaysia’s gross domestic product to be 4.6% in the 2025 forecast.

Hence if actual electricity demand exceeds the cap, TNB has to return the excess returns to the Energy Industry Fund.

Under RP3, the allowable demand growth was 1.7%. TNB returned RM1.1bil to the Fund in the first half of financial year 2024.

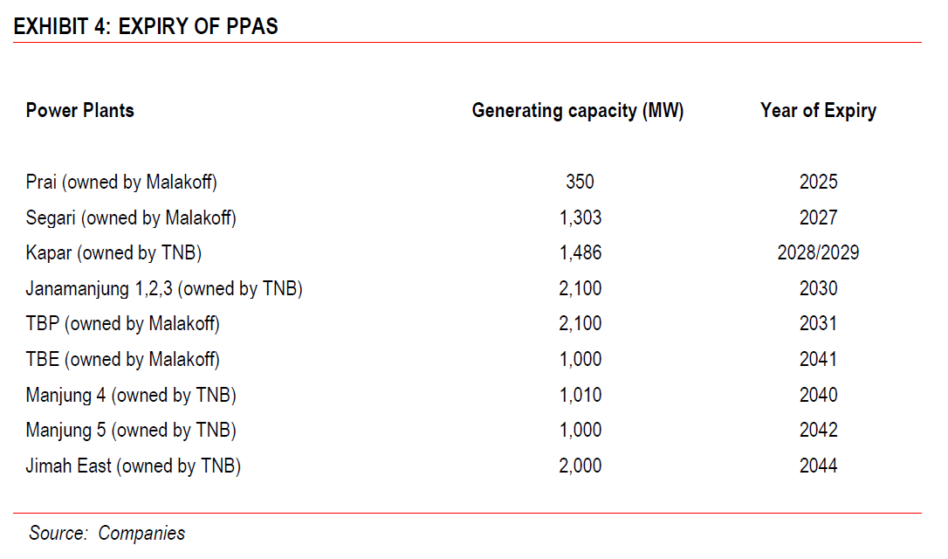

There is a possibility that the country’s energy reserve margin may drop below 30% in 2031 forecast due to the expiry of a few power plants.

These include TNB’s Janamanjung 1-3 in 2030F and Malakoff’s TBP in 2031F. As such, AMIB thinks that the government may approve new power plants to replace the expired ones.

“We reckon that companies like Malakoff and YTL Power would be interested in setting up and owning new power plants,” said AMIB.

AIMB thinks that the terms for LSS6 would be similar to LSS5. The size of LSS6 is likely to be 2,000 megawatt without reference tariffs.

They believe that the IRR for the LSS projects would range from 8% to 12%.

Returns are expected to be decent as the cost of solar panels is still low, that is below US$0.10 per kilowatt hour. Interested parties include Malakoff, Solarvest, Mega First and SD Guthrie. —Nov 20, 2024

Main image: premiumread.com