THE Finance Ministry has named the five successful applicants for the digital bank licences from a pool of 29 applications in its quest to expand access to the Malaysian banking system for those who are currently underserved.

Three of the five consortiums to be licensed under the Financial Services Act 2013 (FSA) include (i) a consortium of Boost Holdings Sdn Bhd and RHB Bank Bhd; (ii) a consortium led by GXS Bank Pte Ltd and Kuok Brothers Sdn Bhd; and (iii) a consortium led by SEA Ltd and YTL Digital Capital Sdn Bhd.

The two consortiums licensed under the Islamic Financial Services Act 2013 (IFSA) are (i) a consortium of AEON Financial Service Co Ltd, AEON Credit Service (M) Bhd and MoneyLion Inc; and (ii) a consortium led by KAF Investment Bank Sdn Bhd.

“Three out of the five consortiums are majority-owned by Malaysians namely Boost Holdings and RHB Bank Bhd; SEA Ltd and YTL Digital Capital Sdn Bhd; and KAF Investment Bank Sdn Bhd,” Bank Negara Malaysia (BNM) said in a media statement.

“All 29 applications received were thoroughly assessed pursuant to Section 10(1) of the FSA and IFSA which require BNM to consider all the factors in Schedule 5 of the Acts and other relevant policy requirements.”

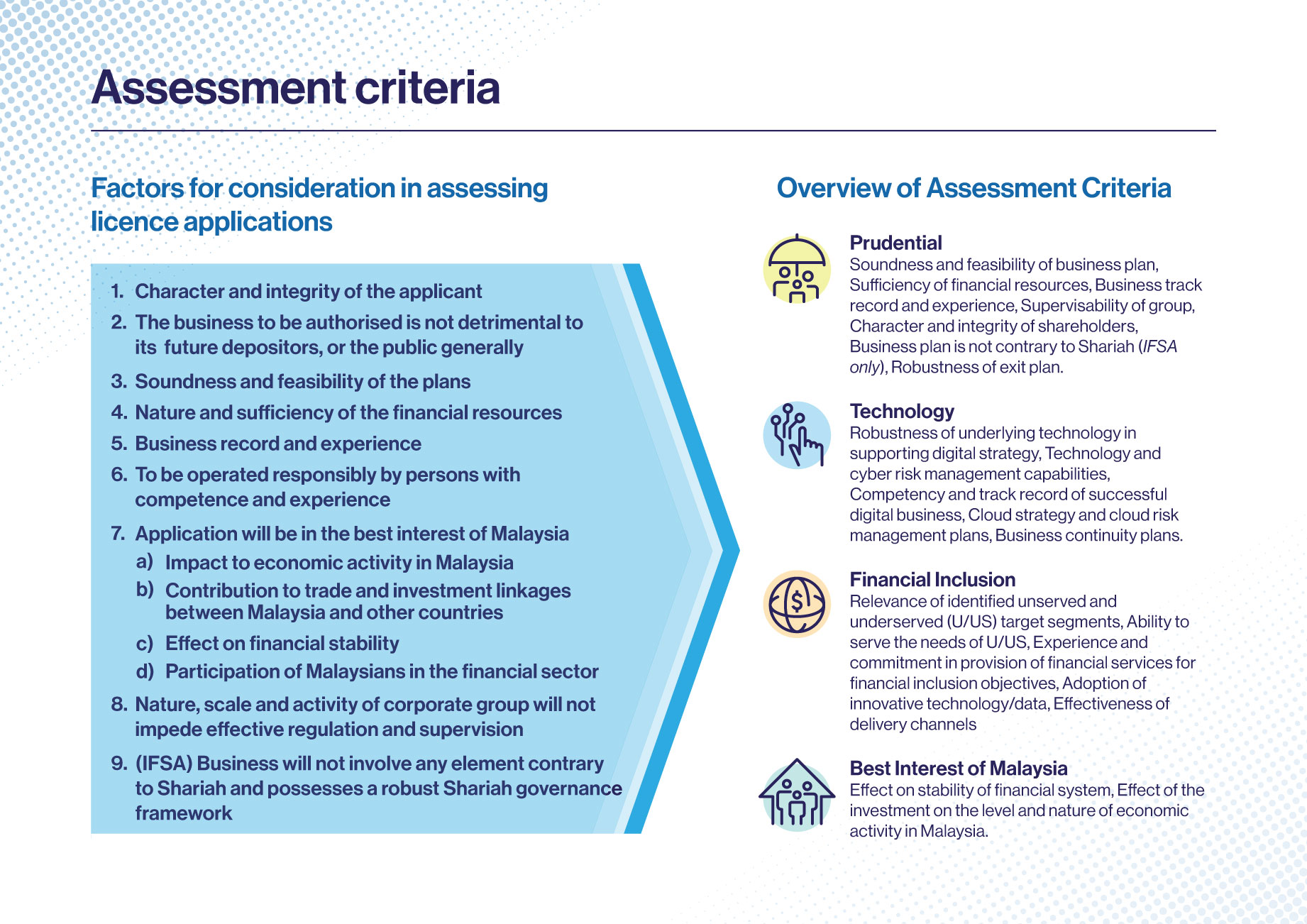

The assessment criteria cover the character and integrity of applicants, nature and sufficiency of financial resources, soundness and feasibility of business and technology plans as well as ability to meaningfully address financial inclusion gaps.

“Applications were assessed on their individual merits as well as relative to other applications based on consistent evaluations of each assessment criteria,” revealed BNM. “This horizontal review is based on the assessment criteria applied across all applicants to determine the relative strength of each application and identify successful applicants.”

Throughout the assessment process, BNM instituted strict governance and evaluation procedures to ensure robust, objective and consistent assessments across all 29 applications received.

Four levels of assessment were carried out, supported by a cross-functional technical team, a review team and internal independent observers from BNM’s risk and legal departments. The final recommendations to the Finance Minister were deliberated and endorsed by BNM’s management committee.

Following this announcement, the successful applicants will undergo a period of operational readiness that will be validated by BNM through an audit before they can commence operations. This process may take between 12 and 24 months.

“We will see banking services offered to the underserved and this will allow retail customers and small and medium-sized enterprises access to critical financial services that would radically alter how businesses function in Malaysia,” the Fintech Association of Malaysia (FAOM) said in a media statement.

“Bank Negara Malaysia anticipates that the new digital banks will begin operations in mid-2023.”

FAOM president Karen Puah said she hopes to see new digital banks re-define banking by building a sustainable bank focused on serving Malaysians with personalised, assessable and relevant financial products. – April 29, 2022