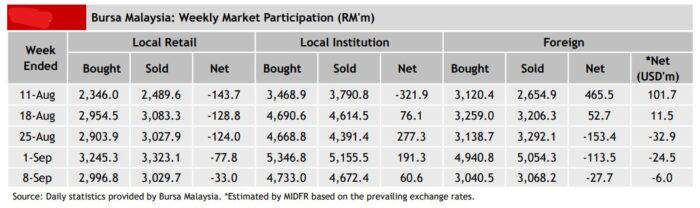

FOREIGN investors have remained net sellers on Bursa Malaysia for the third week in a row at a much slower outflow pace of -RM27.7 mil last week as compared to -RM113.5 mil the week before.

The net selling on Monday (Sept 4) and Tuesday (Sept 5) could not reverse the net buying thereafter, according to MIDF Research.

“Foreign funds net sold -RM107.4 mil on Monday (Sept 4) nd -RM58.3 mil on Tuesday (Sept 5) before net buying RM95.5 mil on Wednesday (Sept 6), RM11.8 mil on Thursday (Sept 7) and RM30.8 mil on Friday (Sept 8),” the research house pointed out in its weekly fund flow report.

The top three sectors that saw net foreign inflows were utilities (RM211.6 mil), property (RM40.4 mil) and energy (RM32.9 mil).

The bottom three sectors with net foreign outflows for the week were financial products & services (-RM226.0 mil), industrial products & services (-RM33.5 mil) and consumer products & services (-RM30.2 mil). Year-to-date (YTD), foreigners have net sold -RM2.70 bil.

On the other hand, local institutions maintained their net buying pace for the fourth consecutive week with an amount of RM60.6 mil last week.

The net buying amounts of RM92.3 mil on Monday (Sept 4) and RM87.7 mil on Tuesday (Sept 5) was sufficient to cushion the outflows on Wednesday (Sept 6) (-RM79.6 mil), Thursday (Sept 7) (-RM11.1 mil) and Friday (Sept 8) (-RM28.8 mil). YTD, local institutions have net bought RM3.29 bil of equities on Bursa Malaysia.

Meanwhile, local retail investors continued to net sell for the ninth consecutive week with an outflow amounting to -RM33.0 mil last week.

They only net bought RM15.1 mil on Monday (Sept 4) but were net sellers for the rest of the week. YTD, local retailers have net sold -RM583.6 mil.

In terms of participation, there was a decline in average daily trading volume (ADTV) across the board among foreign investors (-51.1%), institutional investors (-28.4%) and retail investors (-26.6%).

In comparison with another four Southeast Asian markets tracked by MIDF Research last week, all markets encountered net outflows with the Philippines having the biggest at US$163.5 mil followed by Thailand (US$161.2 mil), Indonesia (US$104.7 mil), Vietnam (US$54.1 mil) and Malaysia (US$6.0 mil).

The top three stocks with the highest net money inflow from foreign investors last week were Tenaga Nasional Bhd (RM107.1 mil), YTL Power Bhd (RM55.6 mil) and Top Glove Corp Bhd (RM37.2 mil). – Sept 11, 2023