THE NATIONAL House Buyers Association (HBA) refers to the article entitled “Look before you leap into debts” that was published by The Star on June 23, 2022.

We agree with the findings of the article on the possible repercussions of failing to repay your loan obligations, which can include being declared bankrupt.

HBA would like to remind all aspiring house buyers that buying a property is the single biggest financial purchase and commitment that the average rakyat will make in their lifetime. As such, careful thought and planning are needed before buying a property and taking a housing loan.

Based on Bank Negara Malaysia’s (BNM) Financial Stability Review – Second Half 2021 report (FSR 2H 2021), the median property price in Malaysia is 4.7 times the median income in Malaysia and can be classified as “seriously unaffordable” by international standards.

This means that house buyers have to pay more for their houses as compared to what they can ideally afford and be saddled with burdensome housing loans, which can collectively lead to financial ruin if they are not able to service the housing loans over the tenure of their loans.

Although we are not accredited financial planners, we would like to offer some financial advice to aspiring house buyers on what to do when buying your first home – in layman’s terms.

Don’t take out a loan before buying your first home

The most important advice for aspiring first-time house buyers is: Don’t take out a car or personal loan until you have bought your first home.

Based on BNM’s FSR 2H-2021, 65% of borrowers already possess either a car or personal loans, thereby limiting their capacity to take on new borrowings for housing.

Typically, the “rule of thumb” by banks in Malaysia pertaining to loan instalments are:

- Single loan instalments should not exceed ⅓ or 33.3% of their gross income; and

- Combined loan instalments should not exceed ½ or 50% of their gross income.

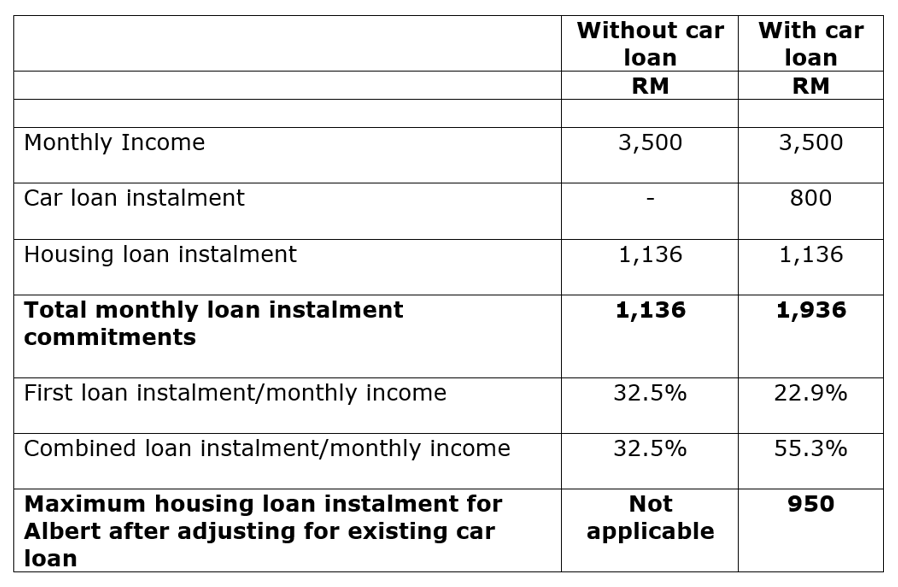

Let’s take the hypothetical example of Albert, who is currently earning RM3,500 a month.

Based on the above rule of thumb, the maximum loan instalment that banks will give to Albert is RM1,167 for a single loan instalment and RM1,750 for all combined loan instalments.

Albert is now looking to buy a property worth RM290,000 and which will be financed via a 30-year housing loan of RM261,000 (90% margin of financing) at an effective interest rate of 3.25% per annum. The monthly instalment for the housing loan will be RM1,136 per month.

Will Albert qualify for the above housing loan? What if Albert already has an existing car loan with a monthly instalment of RM800 per month which may not seem to be very high?

Based on the above example, if Albert does not have any existing loan obligations, he will qualify for the above housing loan (which has a monthly loan instalment of RM1,136) as it is only 32.5% of his monthly income and is below the rule of thumb of ⅓ or 33.3%.

However, if Albert has an existing car loan with a monthly instalment of RM800, he will not qualify for said housing loan as the combined loan instalments of the car loan and housing loan is 55.3% – above the rule of thumb of ½ or 50%.

The maximum instalment that Albert will be able to qualify for is only RM950, which will limit his choices of properties that he is able to buy.

Be able to maintain your current lifestyle after paying your home instalments

Next, do a proper budget on what you can really afford before buying your first home.

Aspiring first-time house buyers need an extensive budget to see if they can afford the monthly loan instalments and maintain their current lifestyle.

After that, they need to factor in potential changes in their lifestyle such as having children or ageing parents to take care of, and see whether they can still afford the loan instalments.

There is no point in having to skip meals or not having children just to be able to afford the housing loan instalment.

They also need to factor additional costs into their monthly budget aside from the monthly housing loan instalments. This includes maintenance charges and contributions to sinking funds for stratified properties, insurance, quit rent and assessment charges.

In addition, aspiring house buyers should (ideally) have at least 10% of their gross income as savings after factoring in the above expenses and the loan instalments, to cater for sudden emergencies.

This is important as many people in Malaysia don’t have enough savings for emergencies. Based on a study by Perbadanan Insurans Deposit Malaysia (PIDM), a Government agency under the finance ministry, the majority of respondents (55%) have less than RM10,000 in available savings to draw on in the event of an emergency.

Don’t be pressured to buy a property until you are financially ready

Third, don’t get pressured into buying a property.

This will be your single largest purchase in your entire lifetime and you do not want to be pressured, coerced or forced to buy your first home just because all your friends or relatives have already done so.

If you are not ready to buy your first home, just continue renting or staying with your parents or relatives.

For those who are renting, do make sure that your rental rates are lower than the equivalent cost of a housing loan to purchase the same property. If not, you are better off buying said property, right?

Your current rental should always be a steep discount to owning the same property so that you can use the savings as funds to acquire your dream home in the future.

Don’t shrug off buying completed properties

One of the biggest mistakes that first-time house buyers make is that they want a brand-new property.

However, the problem is that property developers keep on increasing their prices and aspiring house buyers overspend on their purchases and get into financial difficulty in the future.

Or they buy something much further or much smaller, which they later regret because the commute time is too long or there is just not enough space in the property if they end up having children.

Our advice is based on the “old is gold” adage: consider existing completed properties.

There are benefits of buying existing completed properties or secondary properties such as – “what you see is what you get”; you can see the actual property and the surrounding neighbourhood before deciding if you like it.

In contrast, buying brand-new properties means relying on just the artist’s impression from developers, which sometimes is not even close to the artist’s impression upon completion.

Also, existing properties are already renovated so if you like it, you don’t need to do anything more: just move your stuff in.

However, for new properties, the first-time house buyer needs to spend a lot to get it up and running before being able to move in.

Buying a property is not a simple process. It will be your most expensive purchase and you will be tied to a long-term housing loan.

There are also severe legal and financial consequences if you cannot meet your loan obligations, including being declared bankrupt.

Aspiring first-time house buyers must understand all their financial and legal obligations before making the purchase.

As the saying goes, “look before you leap” and sign the dotted lines for your dream property. – Aug 6, 2022

Sharifah Razali is a concerned citizen while Datuk Chang Kim Loong is the honorary secretary-general of the National House Buyers Association (HBA), a non-Government, non-political and not-for-profit organisation manned wholly by volunteers.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.