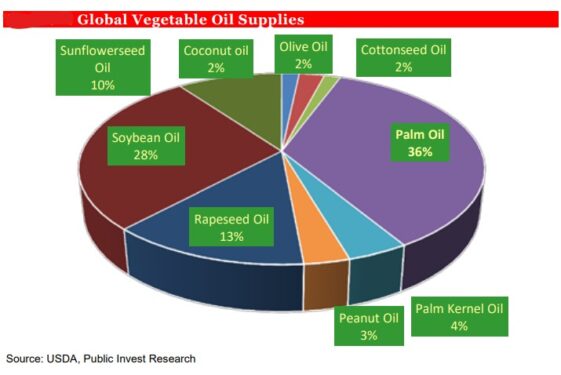

MARKET analysts doubt Indonesia’s ban on its palm oil exports effective Thursday (April 28) to ensure the country has an abundant supply of affordable cooking oil in its domestic market will have the effect it desires.

On the contrary, the move is poised to raise crude palm oil (CPO) and other vegetable oil prices even further, thus worsening inflationary pressures or further encouraging hoarding activities.

“CPO exporters in Indonesia would suffer as a result while downstream players with refining capacity would benefit as there would be a significant shift in the demand-supply mechanics that causes domestic supply to be abundant,” observed RHB Research analyst Hoe Lee Leng in a regional plantation sector update.

“We believe there is also no guarantee that there will be additional supply released to the market as CPO refiners may also decide to hold back their refined oil stocks to benefit from higher prices if and when the (Indonesian) Government lifts the ban.”

Refined oils can be kept for as long as six to eight months with no impact to quality while after packaging, they can be kept for a further 12-18 months.

“Vegetable oil prices will spike as a result of this news but should Indonesia change its stance, this will also reverse quickly,” projected RHB Research.

“We continue to stay ‘neutral’ on the sector, advocating a trading strategy with “buy” on the winners – pure planters in Malaysia like Sarawak Oil Palms Bhd (SOP) and Ta Ann Holdings Bhd as well as downstream planters in Indonesia notably Kuala Lumpur Kepong Bhd (KLK).

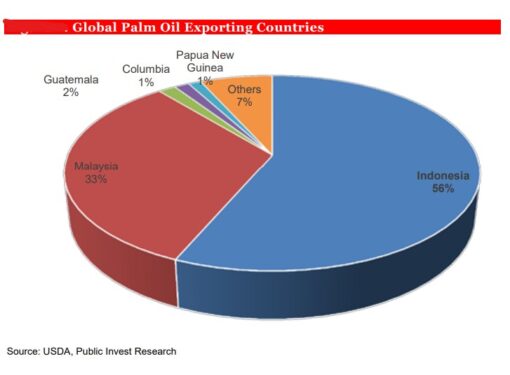

Meanwhile, Maybank IB Research expects the Indonesian palm oil export ban to worsen the tightness in global edible oil supply given the country’s position as the world’s largest producer and exporter with 31% of global exports in 2020.

“But we think the ban will be a short one to two months. Prices of edible oils will remain lofty in 2Q 2022 to ration demand,” projected analyst Ong Chee Ting.

“For now, the research house foresees Malaysia-based planters to be clear winners. Pure Malaysia plays include SOP, Ta Ann, Boustead Plantations Bhd and Hap Seng Plantations Holdings Bhd. Among the large caps, IOI Corp Bhd has the least exposure to Indonesia.”

Maybank IB Research also raised concern of the lifting of the export ban as it expects Indonesia to flood the global market with its inventory accumulated during the ban.

“And as the industry enters into its seasonal peak output period in 2H 2022, this could trigger sharp price correction. 2022 will likely be a year of two halves for CPO price. CPO spot price has averaged RM6,248/metric tonne (MT) year-to-date,” reckoned the research house.

“Given the high prices and new export ban, we now raise our 2022E/2023E CPO average selling price (ASP) to RM5,000/RM3,400 per MT (from RM4,100/RM3,200 per MT).” – April 25, 2022