ALIGNED with the growing trend towards digital banking, Fitch Solutions Country Risk & Industry Research believes that the five groups of companies awarded the digital bank licences by Bank Negara Malaysia (BNM) are well-positioned to seize this market opportunity to become a viable digital bank in the long run.

Judging from their individual strengths and capabilities, the research house expects the sector’s emergence would even benefit their associated services such as e-wallets and digital investment platforms.

“Enterprises may also look forward to the possibility of integrating digital payment options into their platforms which could lower their transaction fees and bring convenience to their customers,” Fitch Solutions which is independent of Fitch Ratings pointed out in a report.

“In our view, the move to digital banking is a positive development for Malaysia, benefitting both consumers and enterprises alike.”

Recall that BNM awarded digital bank licences to five groups of companies on April 29. Malaysia will become just the second country in ASEAN to issue digital banking licences after Singapore which issued four in 2020.

The five groups which bagged licences were:

- A consortium of e-wallet company comprising Boost Holdings Sdn Bhd and RHB Bank Bhd;

- A consortium led by GXS Bank Pte Ltd (a Grab-Singtel joint venture) and Kuok Brothers Sdn Bhd;

- A consortium led by SEA Ltd (the parent of Shopee) and YTL Digital Capital Sdn Bhd;

- A consortium of AEON Financial Service Co Ltd, AEON Credit Service (M) Bhd and US-listed fintech firm MoneyLion; and

- A consortium led by KAF Investment Bank Bhd.

Fitch Solutions named the below as advantages that digital banks can offer to consumers and enterprises:

- Digital banks offer banking and financial services completely online without the need for traditional physical branches. This increases convenience for consumers who are increasingly looking for a faster and easy method of payments and banking;

- Digital banks will benefit businesses, especially small and medium-sized enterprises (SMEs) as they can enjoy easier access to loans, more competitive borrowing rates, and quicker fund approvals and disbursements.

Margins will be more attractive for digital banks as they will not be investing as much in physical infrastructure and people. Additionally, as digital banks utilise data analytics to generate insights regarding consumer behaviour, businesses can gain better access to more personalised solutions for consumers. - Digital banking is better placed than traditional channels, which serve financially underserved segments such as gig economy workers or rural residents who may lack the credit history, to receive loans or to gain access to a wider variety of financial services.

This can help to improve financial inclusivity, and is in fact one of the objectives of the digital banks being established in Malaysia.

“Finally, the move increases competition and consumer choice in a market dominated by large financial services players that have had little incentive to develop more sophisticated services and lower costs to consumers,” opined Fitch Solutions.

“We expect to see considerable innovation in the breadth and complexity of financial services over the next five to10 years. The downside risk is that not all of these new businesses will survive to maturity as a poor choice of business model, lack of capitalisation and the dominance of just one or two players could see some investments fail to pan out.”

More broadly, the growth of Malaysia’s financial technology (fintech) market will be underpinned by strong regulatory support and positive demographic factors, namely the large youth population, high levels of urbanisation, and a growing middle-class.

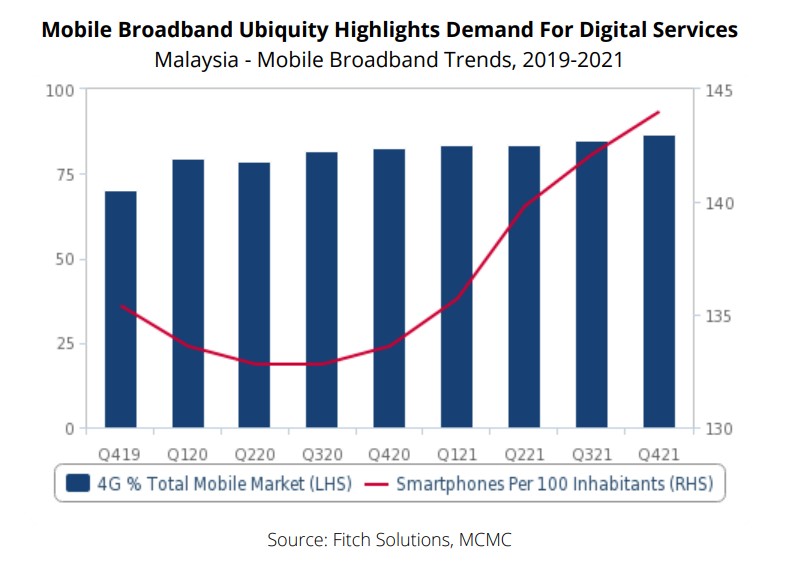

“High levels of smartphone penetration together with the widespread availability of reliable mobile broadband networks also provide tailwinds for the uptake of mobile-centric technologies,” added Fitch Solutions. – May 9, 2022