AS tragic as the last two years of geopolitical and geoeconomics shockwaves are, they have become the long-needed litmus test to expose how far the country can go on pure “narratives” as a bad substitute for credible policies and logical crisis management.

With the recent developments in Malaysia’s food security, it is becoming unimaginable to speak earnestly that amidst all this — in many ways self-inflict and self-exacerbated disaster — Malaysia’s economy is “heading in the right direction”.

Especially when the whole world is facing similar challenges, it is very easy to shift responsibility and blame those external geopolitical and geoeconomics shockwaves, including the Asian region. Catastrophic events such as wars, pandemics or natural disasters always help write off serious governing flaws.

However, perhaps, not in the eyes of an average Malaysian anymore!

The current Malaysian inflation is presented as “relatively low” and “under control”. It was up only 2.3% in April 2022 year-on-year, as reported by the Department of Statistics Malaysia (DOSM), with the food inflation at 4.1%. This is while, the price increases globally, are breaking records for at least a decade.

For example, in April, prices for food increased 6.7% for the UK (3rd on Global Food Security Index 2021) and 10.8 percent for the US (9th on Global Food Security Index)—the largest 12-month percentage increase since the period ending November 1980.

However, let’s remind ourselves where inflation comes from and how it can get out of control.

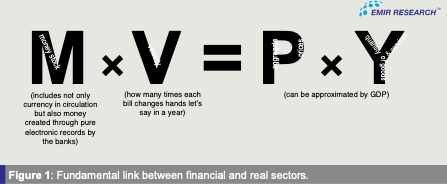

From the equation of exchange, the flow of money in the economy must equate to the flow of goods and services exchanged (Figure 1). This mathematical expression of the fundamental definition of money — money is only information about the value by which goods and services are being exchanged.

However, in our world, this fundamental law is violated. Money stock grows out of proportion (through credit creation as mere electronic entries). It creates immense upward pressure on both variables on the right-hand side of the equation (hence the inflation), leading to a periodic collapse of the market during which money stock (in the electronic form) gets destroyed.

From the above equation comes the apparent solution to the inflation problem — tightening the fiscal or monetary policy, which both, in current economic circumstances, would be a gross mistake, as Professor Jomo Kwame Sundaram and his colleague elaboratively explain in “Finance Drives World to Stagflation”.

Yet there is another way of looking at the inflation problem glaring at us from the above equation (Figure 1). Since the real value of money is determined by the state of the country’s economy, there is no need even to expand money stock to trigger inflation — the economy needs just to slow down.

Furthermore, the equation also suggests there should be less money circulating in a weak economy. However, although sometimes necessary temporary measures, subsidies and Government handouts also create the excess of unsecured money supply in the financial system, thus fueling inflation.

Therefore, inflation should be addressed by increasing aggregate economic productivity (industry’s breadth and depth) and not by adjusting the policy rates or constant subsidies!

This fundamental idea is incisively illustrated in the autopsy of the recent Sri Lanka collapse by the Governor of Central Bank Sri Lanka himself (see “Inflation is not the problem, but the solution”).

And here in Malaysia, we see the carbon copy of the Sri Lanka scenario — the decades of addiction to subsidies and Government handouts as bad substitutes for credible governing and crisis preparedness policies.

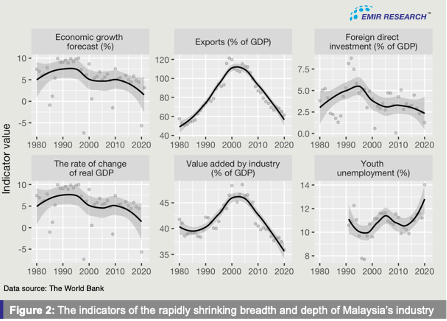

This led to a gradual loss of competitiveness, innovativeness and productivity, turning Malaysia into a nation of consumers versus producers, specifically in value-added products and services (Figure 2). The ballooning national debt, even though not external, represents a considerable opportunity cost for the nation, leaving it with little space for productive use of the scarce revenue.

Dr Rais Hussin is President and CEO at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.