CREDIT and business information provider Experian Information Services Malaysia Sdn Bhd (formerly RAM Credit Information), has raised concerns on arrears on unsecured credit lines (credit cards and personal loans) with an average 9.1% of Malaysians being 90 days past due on repayment of their credit lines in 2022.

This means that nine out of 100 Malaysians have taken 90 days or longer to repay their unsecured credit facilities in 2022.

“A particular concern is consumers aged 22-28 years of age,” Experian Malaysia pointed out in its latest i-SCORE analysis which outlines the credit score trends and credit facility trends of Malaysians for the period 2019-2022 (till March 31).

“Non-secured credit repayments, which have fallen to 90 days past due, are high within this segment at 26.4% in 2022. This implies that 26 out of 100 consumers within this age group are finding it challenging to repay 90 days after their payment is due.”

To put such concern into perspective, despite Malaysia transitioning into the endemic phase and with the re-opening of international borders shoring up consumer sentiment, consumers are facing a significant cost of living headwinds amid inflationary pressures, rising cost of essential goods as well a higher cost of borrowing.

With this, some Malaysians may be at risk of relying on personal loans and credit cards to fuel daily necessities.

This calls for awareness among Malaysians to equip themselves with the knowledge to identify exactly what is at risk with respect to their current credit and financial position in order to better manage their credit scores in the future.

In light of this, Experian is currently running its ‘Uplift Your Score’ campaign in conjunction with its Credit Health Month (CHM) from June 1-30. This campaign serves to increase awareness and highlight the importance of maintaining good credit health in managing personal finance.

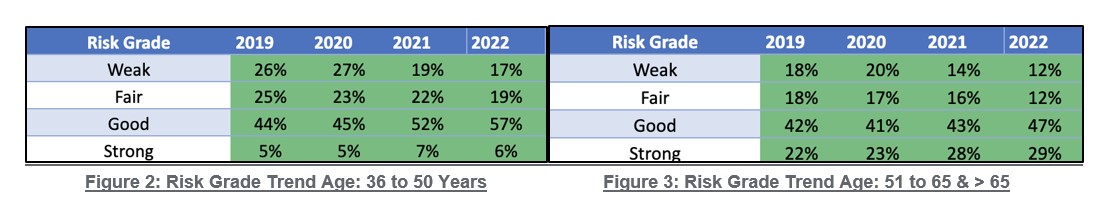

On a more positive note, credit risk grades continue to be stronger for age groups 36-50 with 6% and 29% of those 51 and older lodging “strong” risk grades which imply a less than 1% default rate. Overall, it demonstrates that as Malaysian consumers mature, they can manage their credit risk better over time.

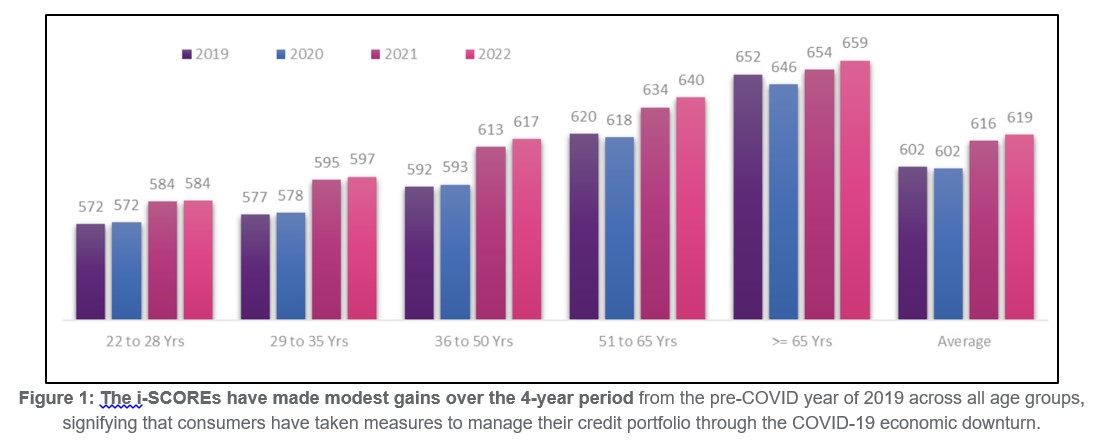

Furthermore, the average Experian i-SCORE across five age groups of Malaysians (22-28, 29-35, 36-50, 51-65 and above 65) improved from 602 in 2019 to 619 in 2022 (as of March 31).

The consumer score improvements may have been facilitated through government measures such as the loan moratoriums, the RM10,000 special withdrawal from the Employees’ Provident Fund (EPF), Bantuan Keluarga Malaysia (BKM) payments and the Financial Management and Resilience Programme (URUS) repayment assistance obtained by more than 2.7 million individual borrowers throughout 2H 2021.

“Experian believes that the lending ecosystem in Malaysia is fast evolving and consumer literacy on financial knowledge is a fundamental life skill that one must-have,” commented Experian Malaysia’s CEO Dawn Lai.

“As we work with traditional banks and neo-lenders, our ability to make sense of these new credit facilities has been added to our Credit Health Month knowledge base so that Malaysians can get the right tools, knowledge and insights to best manage their credit portfolios to face the financial challenges ahead of us.” – June 16, 2022