HAVING touched a record high yesterday near RM3.22 yesterday (July 27), the upside risks for the Singapore dollar (SGD)-ringgit exchange rate seems “intact but modest”, according to Maybank IB Research.

“Recent SGD/ringgit strength can be attributed in part to monetary policy divergence as well as differentiated exposures of SG/MY to external risk events,” the research house pointed out in a forex update.

“In particular, the on-going Fed (US Federal Reserve) tightening, China growth concerns and softer oil outlook could have weighed on the ringgit to a larger extent even as the SGD benefited from relative ‘safe haven’ characteristics on robust macro fundamentals.”

In Maybank IB Research’s view, positive spill-overs to the SGD from the Monetary Authority of Singapore’s (MAS) recent re-centring move appear to be moderating.

“By our estimates, SGD’s NEER (nominal effective exchange rate) has touched +1.0% above the new implied mid-point vs lows of +0.3% above par earlier this month. The current reading is notably in the middle of our +0.5% to +1.5% projection range flagged in our July 14 note,” observed the research house.

“While room for SGD upsides is still intact, the basket could start seeing more two-way swings instead.”

Moreover, Maybank IB Research also noted signs of slowing trade and activity indicators in Singapore which could constrain positive sentiments somewhat near-term. On the contrary, the commodity and technology sectors continue to underpin robust double-digit exports growth and healthy trade surpluses in Malaysia.

“In addition, we also note that (i) China activity shows signs of bottoming out even as COVID-zero policy weighs, while (ii) signs of production challenges among OPEC+ members and reports of shrinking US stockpiles could lend some support to oil despite recession fears,” revealed the research house.

“Concomitantly, the ringgit drag factors could moderate in extent.”

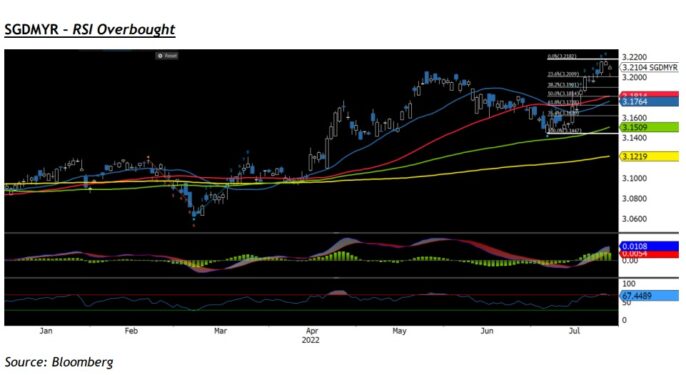

Given its assessment, Maybank IB Research expects the SGD/ringgit upsides to be constrained moving forward.

“On net, we look for SGD/ringgit to remain in elevated ranges near-term but maintain end-2022, end-2023 forecasts at 3.16 and 3.12 respectively,” projected the research house.

“Any upswings could be capped by key resistance near 3.25. On technicals, while momentum in cross remains bullish on daily chart, RSI is overbought and there could be tentative signs of a turn lower.” – July 28, 2022