AMID mixed performances by Malaysian initial public offering (IPO) debutants in recent times, Unique Fire Holdings Bhd commenced its maiden trading day on the ACE Market of Bursa Malaysia at 21 sen today or 5 sen (19.2%) lower than its IPO price of 26 sen.

The weak debut performance is somehow in tandem with the bearish FBM KLCI sentiment whereby the benchmark index slipped by 7.51 points or 0.49% to 1,500.20 as of 3pm today. At the same time, Unique Fire was down 3.5 sen or 13.46% to 22.5 sen with 80.59 million shares traded, thus valuing the company at RM90 mil.

Essentially, Unique Fire is an investment holding company involved in the assembly, distribution and manufacture of active fire protection systems, equipment and accessories for the built environment.

The company’s IPO exercise has successfully raised proceeds of RM21.78 mil, of which RM2.50 mil has been earmarked for the expansion of manufacturing facilities and RM6 mil for expansion of its geographical coverage.

Moreover, RM5.30 mil and RM4.58 mil will be set aside for expansion of operational capabilities and working capital respectively. The remaining RM3.40 mil will be utilised to fund the listing expenses.

In total, Unique Fire’s IPO involves both a public issue of 83.75 million shares and an offer for sales of 30 million shares by way of private placement to selected investors. The breakdown of share issuance for its public issue is as follows:

- 20 million shares to the Malaysian public;

- 8 million shares to eligible directors, employees and persons who have contributed to the group’s success;

- 5.75 million shares by way of private placement to selected investors; and

- 50 million shares by way of private placement to Bumiputera investors approved by the Ministry of International Trade and Industry (MITI).

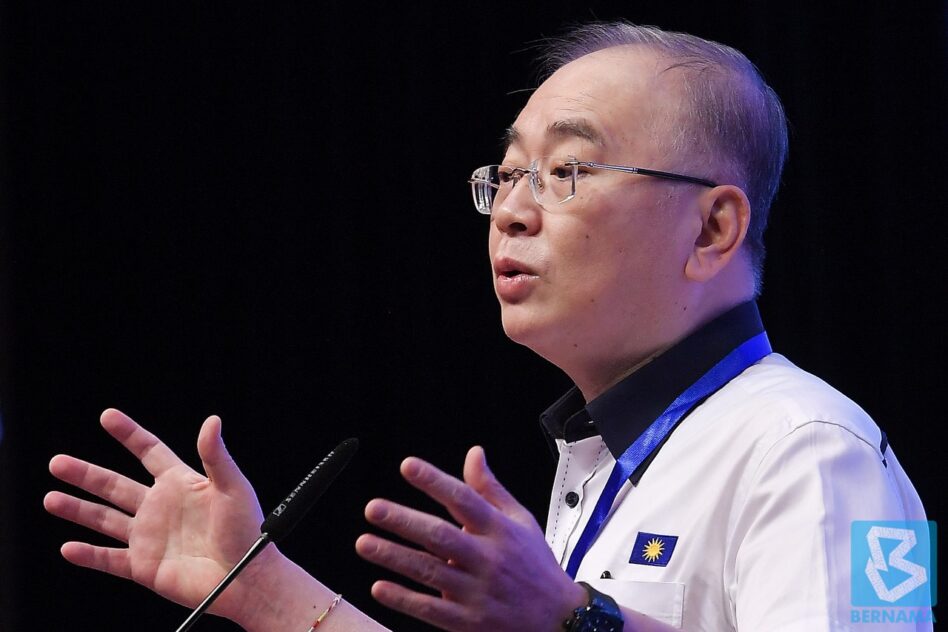

“Our listing today marks a momentous milestone in our journey towards becoming the preferred brand of fire protection equipment within the region and beyond,” commented Unique Fire’s managing director Liew Sen Hoi.

“Correspondingly, we have laid out strategic and exciting plans to spearhead our growth and improve our market penetration in line with our expansion of operation capabilities. We trust that the IPO will be able to unleash Unique Fire’s full potential and to ensure that all our strategies are executed as planned.”

Alliance Islamic Bank Bhd is the principal adviser, sponsor, sole underwriter and placement agent for Unique Fire’s listing exercise. – Aug 5, 2022