THE world is currently under an edge of transition. The spill-over of the Russia and Ukraine conflict has exacerbated the importance of energy security and we believe that all of these will fuel growth toward electric vehicles (EVs) which will not be affected by fluctuations in fuel prices.

Though fully driverless cars are still many years away, the transition toward EVs and away from those with internal combustion engines is a nearer-term.

Battery and EV’s value chain

The most valuable component of the EV is its battery which is what powers the vehicle. Battery stood at 40% of EVs’ total value chain which is why companies such as Tesla, General Motors, Toyota and others have begun making their own.

China, Japan and South Korea dominate the EV battery market with less than 3% of the global demand supplied from companies outside these three countries in 2018.

There are four main kinds of batteries use in EVs, namely lithium-ion, nickel-metal hydride, lead-acid and ultra-capacitors. Of them, lithium-ion batteries are the most important battery as they are light, small and able to store a lot of energy.

Raw materials used in producing lithium-ion batteries are cobalt, lithium and nickel. Raw lithium is produced in Australia, Chile, China and Argentina.

After being mined and produced, the raw materials are sent to China, South Korea or Japan for cell assembly, module production and pack assembly before being sent to the EV manufacturer. Battery recycling is also part of the EV supply chain but it’s still not profitable.

Astonishing growth pace

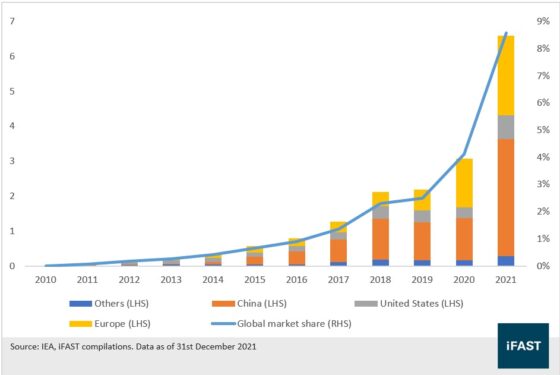

Global sales of EV over the past decade have been growing at a compounded annualised growth rate (CAGR) of 60% in the past decade. Most significantly, the sales of electric vehicles have grown two-fold from 3.07 million in 2020 to 6.6 million in 2021.

- Savings on Greenhouse Gas Emissions (GHG)

To deliver on these stretching targets of achieving net zero greenhouse gas emissions as stated in COP26 (the 2021 United Nations Climate Change Conference), countries will need to accelerate the phase out of coal, encourage investment in renewables, curtail deforestation and speed up the switch to electric vehicles.

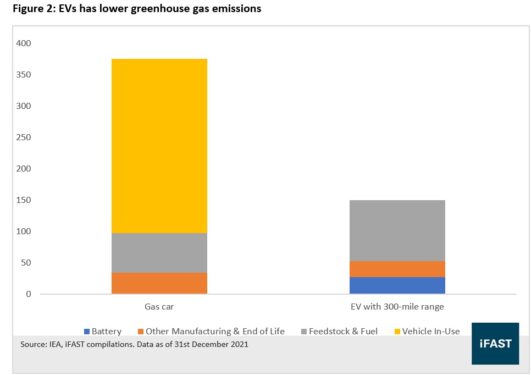

Transportation accounts for 17% of global energy-related greenhouse gas emissions (see Figure 2). In order to achieve net zero carbon emission, the world needs to switch away from fuel-powered vehicle as they have the highest carbon emissions.

Greenhouse gas emissions (GHG) over the lifetime of the EVs are still lower than a typical gasoline car after taking into account the GHG emissions in the process of manufacturing, charging, and driving the car.

- Cost competitive battery prices will lead to lower cost of goods sold for car makers

Cost competitive battery prices will lead to lower cost of goods sold for car makers. Battery prices are the key for EVs to maintain cost competitiveness.

The cost-competitive lithium iron phosphate (LFP) batteries are critical for automakers to keep battery electric vehicles (BEVs) affordable while minimising the blow to their profits as they battle for share in the hyper-competitive EV market.

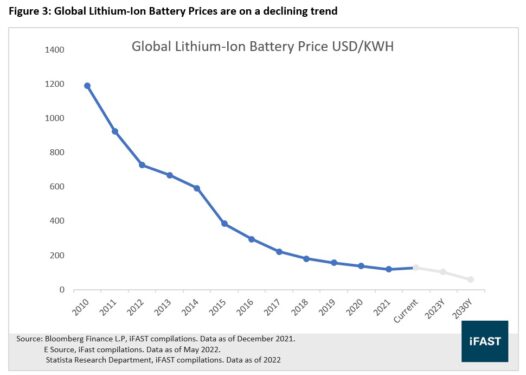

Battery makers such as CATL and BYD’s innovation to directly integrate cells into packs without modules has boosted batteries’ energy density, powering longer driving ranges. As shown in Figure 3, the average cost of lithium-ion batteries has declined by 89% since 2010.

Although the surge of battery costs could drive up the price of EVs sold as there is an uptick in battery prices recently, battery makers are constantly competing to come out with cheaper and more efficient batteries while battery prices are expected to further decline in the coming years.

- Government support will facilitate exponential growth

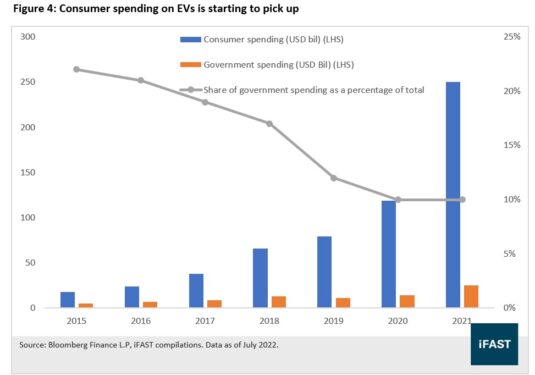

Many governments have been very supportive to the EV industry, especially in China and Europe. Government spending on EV investments from previous years have ramped up production capacity and bear fruit.

This can be seen in Figure 4 where share of government spending has been in a declining trend over the years as consumer spending stared to pick up. Notably in 2021, consumer spending on EV grew more than double compared to a year ago while share of government spending still maintain at 10% of total consumer spending.

This is evident that government spending on EVs in the past has been bearing result.

Ample room for upside potential

Although the EV industry has experienced a tremendous rise in terms of sales volume and market share in the past few years, there is still a lot of market share left to capture.

This is especially in the emerging markets where EV penetration rate is lower due to fewer available models and expensive. In addition, the lack of widely accessible charging infrastructure and weaker regulatory push also contribute to slower market uptake in emerging markets.

Therefore, we believe that the decreasing EV prices due to economies of scale and increasing driving ranges in the future years as well as the installation of more charging stations will boost the EV industry in the emerging markets.

Overall, we are positive on the global EV market given the valuations are attractive. – Aug 25, 2022

iFAST Capital Sdn Bhd provides a comprehensive range of services such as assisting in dealing, investment administration, research support, IT services and backroom functions to financial planners.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.