MALAYSIA’S traditional PC market, which covers desktops, notebooks and workstations, declined by 9.6% year-over-year (yoy) in the second quarter of the year (2Q 2022), with only 455,000 units shipped to the country from April to June.

This was revealed by premier global market intelligence firm International Data Corporation (IDC) in their worldwide quarterly personal computing device tracker yesterday (Sept 26).

In a statement, IDC said the demand for PC devices in the country has weakened in the consumer and commercial segments since the reopening of the economy and easing of movement restrictions in the third quarter of last year.

For instance, notebook shipments declined by 15.5% yoy while desktops posted 7.6% yoy growth.

“Spending in the consumer market shifted away from devices when lockdowns were lifted, providing opportunities for people to travel, celebrate festive occasions and engage in other recreational activities,” IDC explained.

It added that the demand for notebooks and even desktops decreased compared to the previous year as the market returned to normal and most purchases for such devices were already fulfilled in preceding quarters.

However, despite the improving supply situation in the market, PC vendors are concerned about the increasing difficulty of selling devices as demand continues to weaken.

“Inventory across channels has begun to build up, resulting in vendors taking less stock this quarter,” said IDC Malaysia market analyst Justin Peterson Lo.

“Notebook sales dropping since lockdown measures lifted”

IDC also noted that notebook sales have been on the decline, especially in the commercial market as the workforce was allowed to work on-site, ever since lockdown restrictions were lifted.

On the other hand, the demand for desktops increased over time and was initially driven by purchases from the public sector, while small and medium-sized businesses (SMB) and enterprise segments are also experiencing increased demand for desktops as more companies return to the office.

But the overall commercial market still posted a 13.3% yoy decline due to the large education fulfillment that happened last year, with even the recent education deployment by the Education Ministry (MOE) that came through in the quarter being unable to offset the decline.

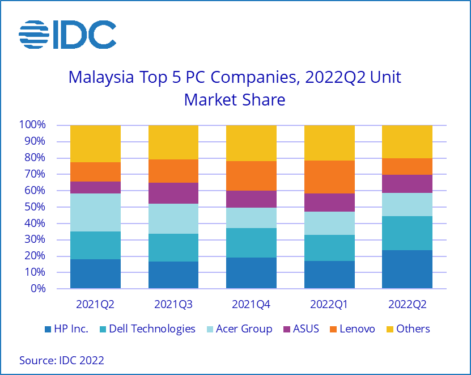

IDC also highlighted the unit market shares for the country’s top five PC companies for 2Q 2022:

HP Inc. led the overall PC market in Malaysia in the quarter, with a 23.7% market share and 16.7% yoy shipment growth.

HP also led the consumer space as vendors stocked up during the quarter due to better supplies and healthy inventory levels, while HP commercial shipments benefited from backlog fulfillments.

Dell Technologies came in second place, with a 20.7% market share and 12.3% yoy growth.

The company leads the commercial market, performing well across most segments – particularly the education sector – thanks to the large fulfillment of the MOE 12 zones project in Q2 2022. However, Dell’s consumer shipments declined.

“Decline in shipments”

Acer Group, on the other hand, ranked third place, with a 14.2% share in the market but a 44.6% yoy decline in shipments compared to last year’s Cerdik Initiative project for 37,000 Chromebooks in the education sector.

IDC said while Acer’s consumer shipments continued to grow sequentially, it posted a yoy decline due to strong demand during the COVID-19 pandemic.

ASUS occupies fourth place in the market, with an 11.2% share and 36.8% yoy growth.

The company grew a significant 50.1% in the consumer segment – credited to strong inventory replenishment and clearance of ageing stock – but lost momentum in the commercial segment due to the slowdown in demand.

Lenovo was at the bottom of the list in fifth place, recording a 9.9% market share and 24.2% decline in shipment.

IDC said while Lenovo performed well in the commercial desktop category, posting 55.3% yoy growth as it fulfilled many public sector transactions during Q2 2022, consumer shipments dropped significantly due to pent-up stocks across channels and weak market demand.

Lo forecasted that PC shipments in Malaysia are expected to go up after weak sales during the first half of the year but will still be lower than the second half of last year (2H 2021) due to the big inventory replenishment that happened in 2021.

On the other hand, the consumer market will likely see an increase in demand during the second half of the year (2H 2022) as vendors seek to run more promotional activities and physical IT events to boost sales.

“The third quarter of 2022 (3Q 2022) will remain quiet, but the upcoming education deals in the fourth quarter (4Q 2022) will help bolster shipments in the commercial market,” he added. – Sept 27, 2022

Main photo credit: Reuters