THE Malaysian banking sector is expected to remain stable, underpinned by strong capitalisation buffers and loan loss provisions.

This is despite a likely further increase in non-performing loans (NPLs) ratio over the coming quarters as support measures are phased out amid a sustained economic recovery, according to Fitch Solutions Country Risk & Industry Research.

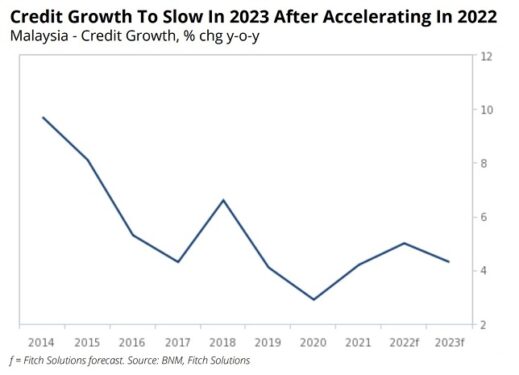

“We still expect an acceleration in loan growth to 5.0% in 2022 as the economy recovers from the pandemic,” projected the research house which is independent of Fitch Ratings in a commentary.

“However, credit growth is likely to slow to 4.3% going into 2023 as tighter financing conditions feed through which will likely weigh on borrowers’ appetite and result in faster loan repayments.”

Likewise, Fitch Solutions expects broader economic growth headwinds to be mounting with real gross domestic product (GDP) growth poised to slow over the coming quarters.

Delving further on NPLs, the research house expects them to continue rising over the coming quarters following the tapering of support measures since 1Q 2022.

According to the latest Financial Stability Review, the system-wide gross and net impaired loans ratios edged up to 1.8% and 1.1% of total loans respectively as of end-June 2022.

The increase was driven by a handful of households and small and medium enterprises (SME) who were unable to resume loan repayments after exiting repayment assistance programmes, and defaults of specific corporate borrowers.

On the contrary, the share of loans under repayment assistance as of June 2022 has declined to just 7.2% of total banking system loans from 26.1% in December 2021.

“Higher interest rates and rising inflation will also cause defaults to rise further over the coming quarters albeit the increase in overall impairments should continue to remain modest given the ongoing economic recovery and improving labour market conditions,” projected Fitch Solutions.

Moving forward, the research house expects credit growth to reach 5.0% at end-2022, exceeding the 4.2% in 2021 after the banking system’s total loans and advances grew by 5.4% year-on-year (yoy) in August in line with the ongoing economic recovery.

“However, we expect credit growth to decelerate slightly over the coming quarters to reach 4.3% at end-2023,” opined Fitch Solutions. “Loan repayments will likely pick up in the face of rising interest rates while new loan disbursements will likely moderate due to a softening economic backdrop.”

The research house further expects an additional 25 basis points (bps) of overnight policy rate (OPR) hikes by Bank Negara Malaysia before end-2022 even though the central bank has already hiked interest rates by a cumulative 75bps (to 2.50%) at its last three monetary meetings.

“Moreover, we expect growth in Malaysia to slow over the coming quarters given the weaker outlook for exports due to deteriorating global growth prospects and tightening monetary policy around the world,” added Fitch Solutions. – Oct 18, 2022

Main photo credit: Free Malaysia Today