CIGARETTE smuggling has long been a prevalent issue in Malaysia with an estimated 1,000 containers worth of illicit cigarettes entering the country each year, according to the Illicit Cigarette Study 2022 Report. But now, with the rise of smuggled e-vapes, such concern has only heightened concerns of Malaysia becoming a hub for illicit tobacco/smoking products.

“E-vape liquids containing nicotine are illegal under the Poisons Act 1952 yet they continue to be widely available in the market,” observed leading tobacco player Japan Tobacco International (JTI) Malaysia.

“The absence of a regulatory framework for this product category has prevented the government from collecting the RM1.20/milliliter excise tax, resulting in a loss of RM866 mil in revenues in 2022 alone.”

To combat the illegal entry of e-vape liquids, JTI Malaysia has highlighted the need for regulations on marketing, sponsorships, retail sales, product packaging, health warnings, and ingredients to better protect consumers while supporting the government’s revenue collection efforts.

“Developed jurisdictions such as the UK and European Union (EU) have tight ingredient regulations to protect their consumers while Malaysia is still struggling to combat cigarette smuggling,” JTI Malaysia’s general manager Khoo Bee Leng told FocusM.

“This means that criminals are incentivised by the significant price difference between legal and illicit cigarettes. As such, JTI Malaysia suggests a moratorium against any excise increase on legal cigarettes until the problem of illicit cigarettes can be stamped out.”

Currently, the Malaysian government has introduced stricter transhipment controls which should remain in place as a barrier to curb smuggled illicit cigarettes while the Control of Tobacco Products Regulation 2004 requires all cigarettes to be sold at not less than RM12 per packet and printed with pictorial health warnings.

But still inadequacies abound with JTI Malaysia deeming the Health Ministry (MOH) needing to increase enforcement of its own regulations against illicit operators.

“Moreover, the government should strengthen existing laws such as the Security Offences (Special Measures) Act 2012 (SOSMA), Prevention of Crime Act 1959 (POCA) and Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) to provide law enforcement agencies with sufficient investigative powers to tackle organised crime syndicates,” stressed Khoo.

“The government should also allocate more resources to law enforcers to conduct enforcement against these syndicates.”

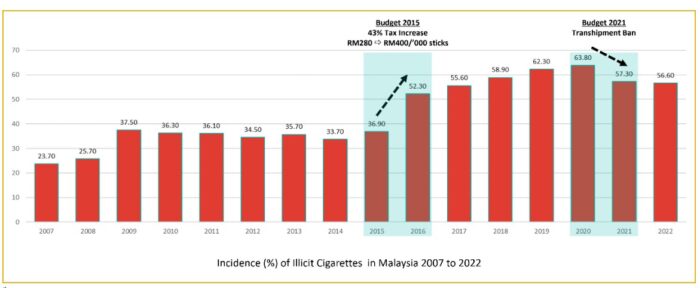

To combat the shadow economy and reduce illicit numbers, a multi-agency task force (MATF) was established previously, resulting in a drop in illicit cigarettes from 64.8% in 2020 to 56.60% in 2022.

But JTI Malaysia suggests the need for a special operations task force to focus specifically on illicit cigarette smuggling.

“Collaborations between the government and industry players such as JTI Malaysia are crucial in identifying and combating the smuggling of illicit cigarettes and e-vapes in the country,” Khoo pointed out.

On a bigger picture, JTI Malaysia also urged the government to remain steadfast in maintaining controls against efforts by illicit operators even as the incidence of illegal cigarettes has declined to 56.6% in 2022 from 64.8% in 2020 following stricter transshipment controls introduced in Budget 2021.

This is given the total volume of legal cigarettes in Malaysia has declined by 33% since 2015 after the massive 43% excise tax increase shifted consumer demand towards cheaper cigarettes that were smuggled without paying taxes. The decline in volume was further compounded by rise of substitutes such as e-vapes.

“Malaysia risks becoming a large illicit e-vape market – just like the current situation with illicit cigarettes – because there is no control over nicotine levels and ingredients in smuggled e-vapes,” envisages Khoo.

“Moreover, smuggled e-vapes can be sold at a fraction of the price of legal cigarettes by not paying the applicable tax.” – Feb 17, 2023