THE Malaysian government has recently announced the Facility Support Account 2 (FSA2) to provide personal financing options to over four million Employees’ Provident Fund (EPF) contributors.

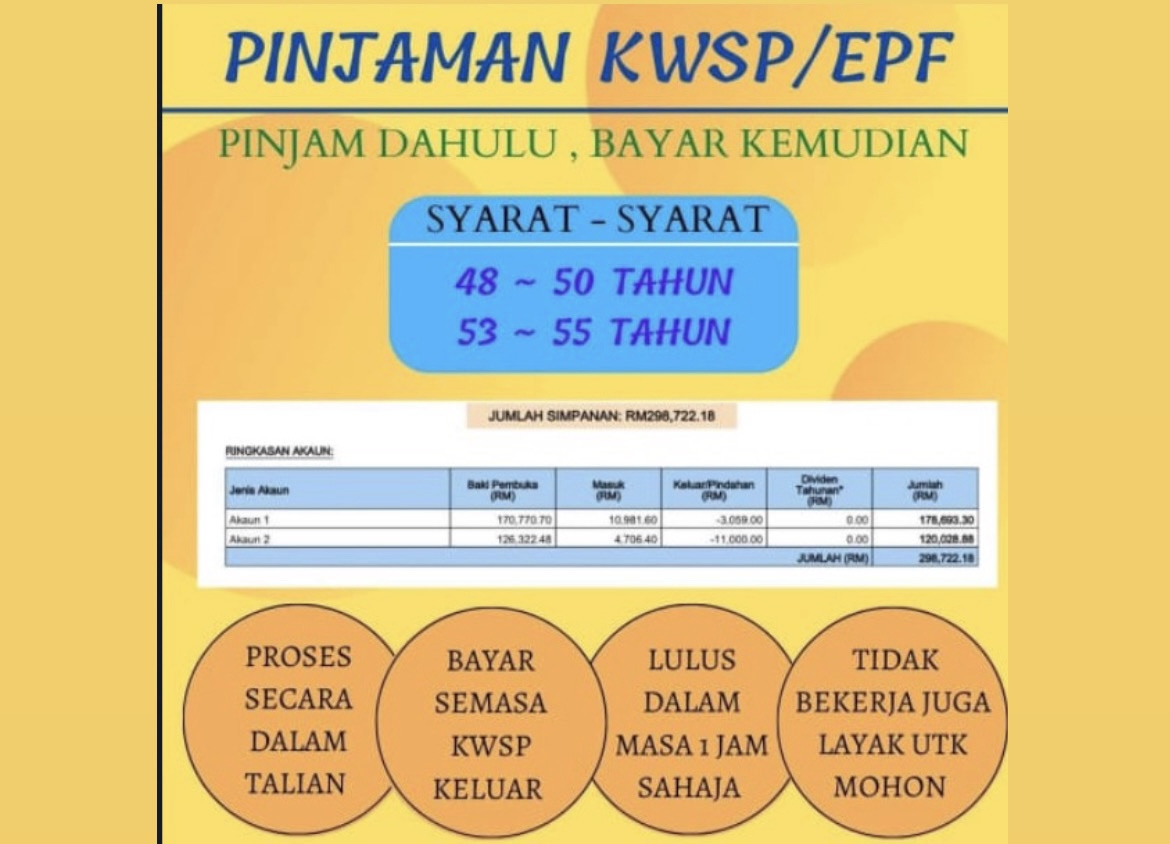

Facebook is now filled with advertisements in Malay, enticing EPF account holders to take up the offer of using their Account 2 as collateral.

The FSA2 facility enables EPF members to apply for loans ranging from RM3,000 to RM50,000 using their savings in Account 2 as collateral, with lower interest rates between 4% and 5% annually instead of the typical 8%-15%.

Over four million EPF contributors will be eligible for loans from banking institutions, using their Account 2 balance as support or collateral.

The Finance Ministry has clarified that EPF savings can be used to support loan applications, with the initiative being finalised to allow withdrawals from Account 2. It is of the opinion that this will not be burdensome to borrowers as they are expected to pay interest and profit rates of between 4% and 5%.

The ads are emphasising the ‘Pinjam Dahulu, Bayar Kemudian’ condition that comes with the use of Account 2 as collateral.

The EPF has laid down certain conditions for eligible members to apply under Phase 1 of the scheme.

Firstly, the scheme is open only to EPF members who have not yet reached the age of 55 and are Malaysian citizens.

Additionally, the application is a one-time-only opportunity, and once approved, it cannot be cancelled.

The facility will remain open for a year from the implementation date, which will be announced later. Furthermore, the minimum savings required in EPF Account 2 for an individual to be eligible for the loan is RM3,000. The maximum amount for conditional withdrawal should not exceed RM50,000.

Finally, the withdrawal amount will be paid to the banking institution when the member reaches the withdrawal age option between 50 and 55 years, depending on the withdrawal age option of the member.

Therefore, the FSA2 scheme is specifically aimed at members aged 40 and above, while Phase 2 for members under 40 will be announced later.

The primary goal of the scheme is to facilitate better Shariah-compliant facilities for EPF members, ensuring that banking institutions do not charge any form of usury while offering personal financing options. — April 8, 2023