LOCAL strategic policy think tank EMIR Research has derived “conservative approximations” of RM4.5 tril as the economic loss of Malaysia to corruption over the 26-year period between the Asian Financial Crisis in 1997and 2023.

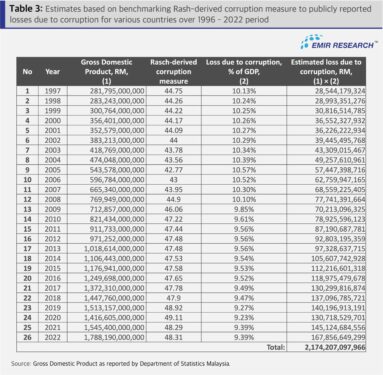

“The RM4.5 tril figure was derived from totalling Malaysia’s estimated total economic cost of corruption of RM2.3 tril over the last 26 years (Table 2) with estimates based on benchmarking the Rasch modelling techniques of measuring publicly-reported losses due to corruption which amounted to RM2.17 bil (Table 3).

“Yet, still, we must remember that all the above are frugally conservative estimates!” revealed EMIR Research’s president and CEO Datuk Dr Rais Hussin in the think tank’s latest findings.

“The total monetary loss figure can still be significantly higher due to the investment multiplier effect which refers to the stimulative impact of public or private investments.”

“This is given that productive government spending creates productive economic activities across industries, boosting workers’ income in various economic sectors and the effect is bound to ripple a few times through the economy.

“However, public money lost through leakages and corruption will not result in this wide spreading of the economic stimulus, thus constituting additional opportunity cost to the public,” he justified.

Nevertheless, Rais caveated that many indirect costs of corruption are bound to remain immeasurable and unaccounted for “as corruption does more than anything else to destroy the various central relationships needed for peaceful, harmonious development”.

“It undermines the very glue that holds society together. It is often at the root of political dysfunction and social disunity,” asserted the former Bersatu supreme council member and strategist who is now a PKR member.

“Corruption also leaves the nation bare open to neo-colonisation and exploitation and poised to lose its global competitive advantage. It discourages local and foreign investment, especially the ones that can create high-value jobs and economic activities while exploitative foreign investment will still be there and thrive with the high level of corruption.

“Through a distortion in spending priorities, corruption undermines the ability of the state to promote sustainable and inclusive growth. This is why despite its massive wealth of oil, gas, palm oil, rubber, timber, agriculture and many others, Malaysia was not able to keep pace with many other countries in the region that are less blessed with natural resources.”

Added Rais: “If we look at the declared national debts including liabilities reaching RM1.5 tril – almost 80% of the gross domestic product (GDP) as of end-2022 – and look at the conservative estimated loss due to corruption and leakages for the last 26 years at RM4.5 tril, Malaysia could have prospered without any debt and/or borrowings.” – May 10, 2023