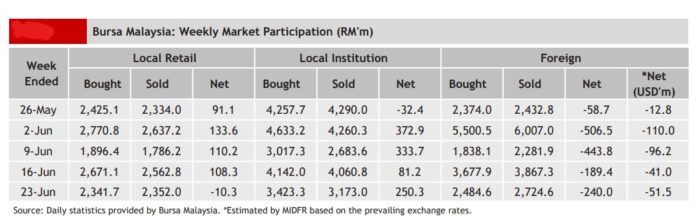

NET selling by foreign investors on the local bourse has remained unabated for 10 weeks in a row with an outflow of -RM240.0 mil from the local bourse last week.

This is the longest streak of net selling by foreigners this year, according to MIDF Research.

“Over the past 10 weeks, the net foreign outflow from Bursa Malaysia was -RM2.06 bil,” the research house pointed out in its weekly fund flow report. “Foreigners net sold every day last week by having been net sellers for nine consecutive trading days.”

Tracking the weak sentiments on Wall Street, foreign funds net sold -RM19.9 mil on Monday (June 19), -RM91.0 mil on Tuesday (June 20), -RM17.7 mil on Wednesday (June 21), -RM15.2 mil on Thursday (June 22) and -RM96.2 mil on Friday (June 23).

The top three sectors that saw net foreign inflows last week were property (RM14.5 mil), financial services (RM14.1 mil) and technology (RM11.5 mil). Sectors with the most outflows were consumer products & services (-RM92.2 mil), energy (-RM47.2 mil) and industrials (-RM34.5 mil).

Year-to-date (YTD), foreigners have net sold Malaysian equities for 19 out of 25 weeks with total outflow of -RM3.83 bil. This makes Malaysia the second worst performing market in terms of foreign fund flows in comparison to the eight Asian exchanges tracked by MIDF Research.

On the contrary, local institutional investors continued to net buy for the fourth straight week at RM250.3 mil. They net bought every day at RM31.8 mil on Monday (June 19), RM67.1 mil on Tuesday (June 20), RM34.4 mil on Wednesday (June 21), RM23.1 mil (June 22) on Thursday and RM94.0 mil on Friday (June 23).

In contrast to foreign investors, local institutions have been net buyers for 19 out of 25 weeks with a total amount of RM3.45 bil.

However, it was a mixed trading week for local retailers who ended with a net selling of -RM10.3 mil.

They net bought RM23.9 on Tuesday (June 20) and RM2.3 mil (June 23) on Friday but net sold -RM11.9 on Monday (June 19), -RM16.7 mil on Wednesday (June 21) and -RM7.9 mil on Thursday (June 22). YTD, retailers have been net buyers for 13 out of 25 weeks with RM381.6 mil.

In terms of participation, there was a decline in average daily trading volume (ADTV) across the board among retail investors (-10.3%), local institutions (-19.6%) and foreign investors (-31.0%).

In comparison with another four Southeast Asian markets tracked by MIDF Research last week, all bourses recorded foreign fund outflows with Thailand posted the biggest outflow at US$140.7 mil followed by Indonesia (US$115.9 mil), Malaysia (US$51.5 mil), Vietnam (US$39.2 mil) and the Philippines (US$14.8 mil).

The top three stocks with the highest net money inflow from foreign investors last week were Malayan Banking Bhd (Maybank) (RM 79.3 mil), Gamuda Bhd (RM18.6 mil) and KPJ Healthcare Bhd (RM13.0 mil) – June 26, 2023