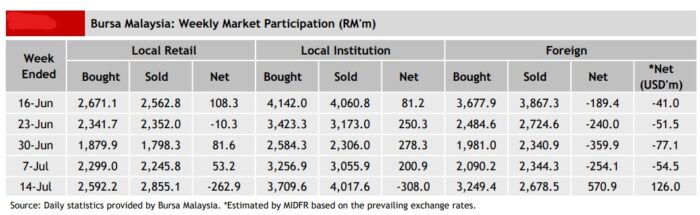

FOREIGN investors turned net buyers on Bursa Malaysia at a rate of RM570.9 mil last week after having emerged as net sellers for the past 12 consecutive weeks.

Their interest began on Wednesday (July 12) with a net inflow of RM84.2 mil. This coincides with the release of positive economic data, including a +6.6% year-on-year (yoy) growth in monthly sales value for Malaysia’s wholesale and retail trade sector which reached RM138.0 bil in May 2023, according to MIDF Research.

“Additionally, the country’s manufacturing sector saw an increase in sales value to RM146.8b (+3.3% yoy) in May 2023,” the research house pointed out in its weekly fund flow report.

The net inflows continued on Thursday (July 13) and Friday (July 14) with the highest amount recorded on Friday with RM468.9 mil. This was the largest net inflow since Feb 28 last year before the hiking of interest rates by the US Federal Reserve.

The top three sectors that saw net foreign inflows were technology (RM115.0 mil), transportation & logistics (RM102.0 mil) and plantation (RM97.0 mil) while the only three sectors that posted net foreign outflows were healthcare (-RM29.7 mil), REITs (-RM10.2 mil) and energy (-RM7.1 mil).

Nevertheless, foreigners on a year-to-date (YTD) basis have been net sellers of domestic equities for 21 out of 28 weeks with a total net outflow of -RM3.88 bil.

On the contrary, local institutional investors turned to net sellers of domestic equities with an outflow of -RM308.0 mil after net buying for the past 12 consecutive weeks. YTD, institutional investors have been net buyers of domestic equities for 21 out of 28 weeks with a total net inflow of RM3.62 bil.

Elsewhere, local retailers also turned to net sellers with a disposal of -RM262.9 mil worth of domestic equities last week. YTD, local retailers have been buyers for 15 out of 28 weeks with net buying amounting to RM253.5 mil.

In terms of participation, there was an increase in average daily trading volume (ADTV) by retailers (+19.9%), local institutions (+22.4%) and foreign investors (+33.7%).

In comparison with another four Southeast Asian markets tracked by MIDF Research last week, Malaysia posted the highest net foreign fund inflow with US$126.0 mil followed by Indonesia (US78.9 mil) and the Philippines (US$47.3 mil) while Vietnam posted the highest net outflow at -US$43.2 mil followed by Thailand (-US$14.7 mil).

The top three stocks with the highest net money inflow from foreign investors last week were Malaysia Airports Holdings Bhd (RM107.4 mil), Malayan Banking Bhd (RM101.1 mil) and Inari Amerton Bhd (RM65.7 mil) – July 17, 2023