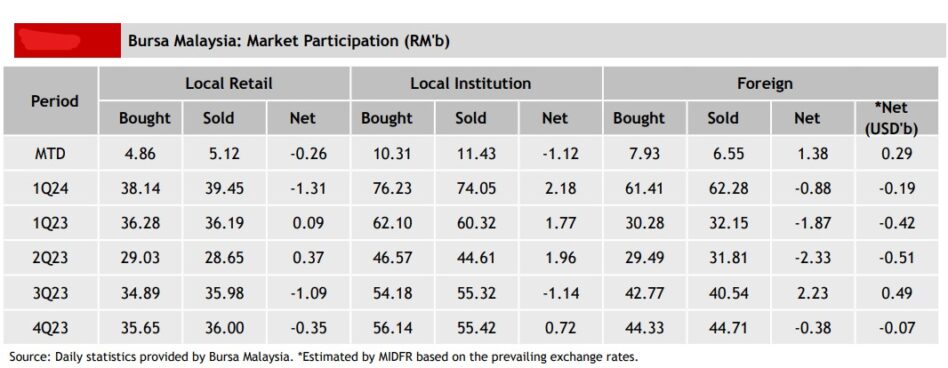

FOREIGN investors continued their trend of net buying on Bursa Malaysia for the third consecutive week with a net inflow of RM961.1 mil which is a slight moderation from the previous week’s RM1.06 bil.

The trend which somehow coincided with the FBM KLCI holding steady at 1,600 points saw net buying activity on every trading day except Thursday (May 9), according to MIDF Research.

“Foreign investors reverted to net buyers again on Friday (May 10), likely influenced by Bank Negara Malaysia’s (BNM) decision to maintain the overnight policy rate (OPR) at 3.0%,” the research house pointed out in its weekly fund flow report.

The sectors that recorded the highest net foreign inflows were financial services (RM268.2 mil), utilities (RM242.9 mil) and transportation & logistics (RM114.0 mil) while two sectors with net foreign outflows were industrial products & services (-RM8.9 mil) and REITs (-RM3.8 mil).

On the contrary, local institutions continued their trend of net selling for the second consecutive week at -RM724.9 mil.

Likewise, local retailers continued to dispose of domestic equities amounting to -RM236.2 mil for the ninth consecutive week.

In terms of participation, average daily trading volume (ADTV) increased for local retailers (+17.4%) and local institutions (+1.3%) whereas foreign investors (-9.9%) experienced a decline.

In comparison with another four Southeast Asian markets tracked by MIDF Research, all markets again posted net foreign outflows last week led by Indonesia which extended its streak of net selling to seven weeks with -US$320.1 mil.

Vietnam continued its trend of net foreign outflows for 10 weeks in a row totalling -US$123.5 mil while the Philippines registered its seventh consecutive week of net foreign outflow at-US$47.1 mil, followed by Thailand with a second straight week of outflow at -US$43.4 mil.

The top three stocks with the highest net money inflow from foreign investors last week were Tenaga Nasional Bhd (RM124.3 mil), Malayan Banking Bhd (Maybank) (RM82.2 mil).and CIMB Group Holdings Bhd (RM81.7 mil). – May 13, 2024