DESPITE share price of Top Glove Corp Bhd skyrocketed to a two-year high after the world’s largest glovemaker by capacity hit limit up yesterday (May 15) by 30 sen or 31.25% higher to RM1.26, it may still be too early to speculate if a glove stock rally the magnitude of the bygone COVID-19 pandemic days is crystalising on Bursa Malaysia.

For starters, research houses have offered mixed reaction with Maybank IB Research being bullish of President Joe Biden having raised tariffs on China’s medical and surgical rubber gloves in 2026 to 25% from the current 7.5% while its local peer Hong Leong IB (HLIB) Research retained its “neutral” outlook on the Malaysian glove sector.

Following yesterday’s (May 15) share price rally driven by positive sentiment from the US tariff increase, HLIB Research believes that its recovery thesis by CY2025 has been” fairly priced in”.

Moreover, HLIB Research does not expect the Big Four glovemakers to reap similar benefits given their respective business strategies shall determine their business prospects.

“If trade is diverted to Malaysia, we believe US medical rubber glove distributors will prefer (i) reputable companies (ie the listed Big Four glovemakers); (ii) consistent business relationship; and (iii) competitive pricing,” reckoned the research house in its sector outlook note.

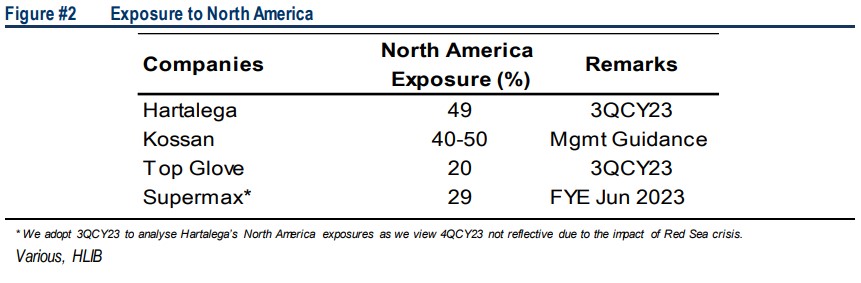

“(In this regard), Hartalega Holdings Bhd and Kossan Rubber Industries Bhd have a relatively higher exposure to North America compared to Top Glove and Supermax Corp Bhd.”

Moreover, HLIB Research contended that Hartalega and Kossan have not been served with Withhold Release Orders (WRO) by the US Customs and Border Protection (CBP) previously in addition to both glovemakers boasting the lowest cost structures among the Big Four as of 3Q CY2023.

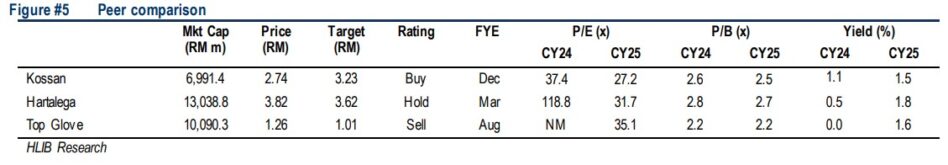

Given the above scenario, HLIB Research favours Kossan most by upgrading the counter to “buy” from “hold” with its target price (TP) elevated to RM3.23 (from RM1.79).

“We raise our FY2024/FY2025 earnings forecasts upwards to RM187.1 mil/RM257.4 mil (from RM183 mil/RM222.9 mil previously),” noted the research house. “We also introduce FY2026f earnings of RM357.3 mil (+60% year-on-year).”

Although it retained Hartalega’s “hold” rating, HLIB Research has nevertheless upped the glovemaker’s TP to RM3.60 (from RM2.44) while raising the former’s FY2024/FY2025/FY2026 forecast upwards to RM15.8 ml/RM197.8 mil/RM481.1 mil (from -RM24.9 mil/RM197 mil/RM271.3 mil previously).

However, HLIB Research downgraded Top Glove to “sell” (from “buy”) given yesterday’s (May 15) sharp rally.

“We widen its FY8/2024f losses to -RM234.3 mil from -RM159.9 mil previously. On the other hand, we raise Top Glove’s FY2025f/FY2026f earnings to RM163.8 mil/RM573.9 mil (from RM156.6 mil/RM282.1 mil previously),” added HLIB Research.

At the time of writing, all four Big Four glovemakers have succumbed to heavy profit taking following their sharp rises yesterday (May 15).

Leading the pack is Hartalega (down 40 sen or 10.47% tp RM3.42) followed by Kossan (down 26 sen or 9.49% to RM2.48), Top Glove (down 13 sen or 10.32% to RM1.13) and Supermax (down 10.5 sen or 9.72% to 97.5 sen). – May 16, 2024