APEX Securities Research has accorded EPB Group Bhd, a one-stop food processing and packaging machinery solutions provider, a “subscribe” recommendation with a target price of 66 sen or 17.9% premium over its initial public offering (IPO) price of 56 sen.

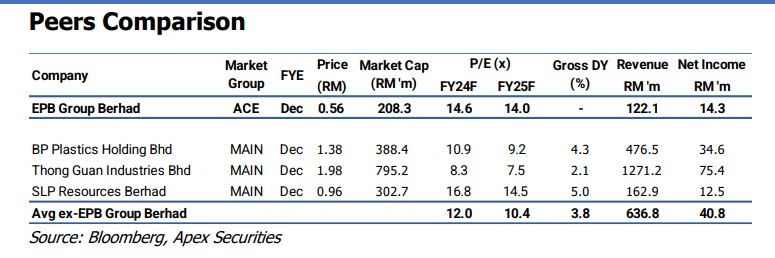

According to the research house, its fair value of 66 sen is derived at by assigning a target price-to-earnings ratio (PE) of 14.0x to EPB’s FY2025F earnings per share (EPS).

“The assigned target PE represents approximately 15.0% premium to selected peers such as BP Plastics Holdings, Thong Guan Industries and SLP Resources which are engaged in food packaging,” Apex Securities pointed out in an IPO note.

“These peers’ stocks are currently trading at an average P/E ratio of 12.0x for FY2024F. The premium to selected peers is justified due to several factors. Firstly, EPB’s margins are approximately two times higher than the selected peers.”

Apex Securities further opined that EPB is more exposed to overseas markets and faces less competition in providing one-stop solution for food processing and packaging machinery.

“Moreover, EPB’s core net profit margin stands at circa10% and above whereas the margin of selected peers hover around 8.0%-12.0%,” justified the research house.

Elsewhere, Apex Securities also favoured EPB for its established position in food processing and packaging machinery which is bolstered by in-house manufacturing capabilities.

“EPB also stands out for its close collaboration with customers, acting as advisors to enhance efficiency using their proprietary machines,” it revealed. “One promising future prospect is their initiative in robotic solutions for food processing and packaging which is aimed at mitigating labour shortages.”

Given the promising outlook for increased demand across various countries, including Malaysia, the research house expects EPB to emerge as a primary beneficiary in the food processing and packaging machinery sector.

“This positions them well to capitalise on growing demand and drive sales in these segments” added Apex Securities.

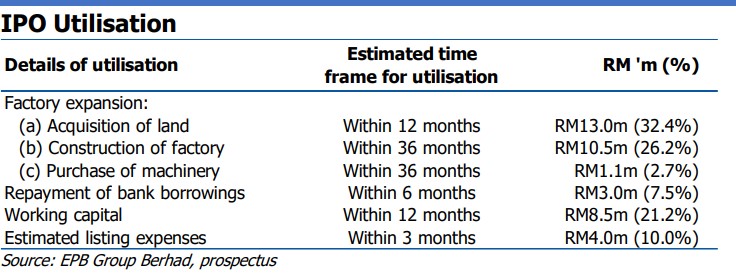

Applications for EPB’s IPO which targets to raise RM40.8 mil have started on June 27 following its prospectus launch and will close at 5pm on July 31.

Slated for listing on Aug 23, the IPO priced at 56 sen boasts a market capitalisation of RM208.32 mil ahead of its debut. – July 11, 2024