FOREIGN investors continued to purchase domestic equities on Bursa Malaysia for the second week in a row with net inflows totalling RM478.2 mil despite the shortened trading days in view of the Awal Muharam public holiday on Monday (July 8).

The majority of last week’s (July 9 to 12) influx which amounted to RM389.2 mil occurred on Thursday (July 11) when Bank Negara Malaysia (BNM) decided to maintain its overnight policy rate (OPR) at 3.00% after concluding its two-day Monetary Policy Committee (MPC) meeting.

The last adjustment to the OPR was an increase from 2.75% to 3.00% in May 2023 with the central bank having kept this benchmark rate unchanged through seven consecutive MPC meetings.

“The top three sectors that foreign investors net bought were construction (RM198.2 mil), utilities (RM116.1 mil) and industrial products & services (RM111.8 mil),” reported MIDF Research in its weekly fund flow report.

“Sectors they net sold were consumer products & services (-RM92.7 mil), energy (-RM33.4 mil) and healthcare (-RM21.9 mil).”

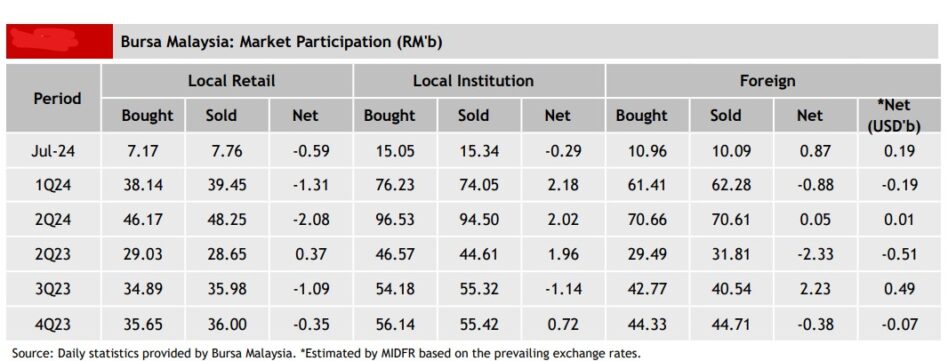

On the contrary, local institutions shifted to be net sellers of domestic equities by unloading – RM318.5 mil following three consecutive weeks of net buying while local retailers remained net sellers for the second consecutive week with sales totalling -RM159.8 mil.

Last week, local retailers saw a -1.3% decline in their average daily trading volume (ADTV) but foreign investors posted a +24.7% surge followed in ADTV followed by local institutions with a +10.9% rise.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Indonesia recorded net foreign inflows for the third consecutive week at US$97.0 mil while the Philippines raked in US$4.3 mil, also marking its third successive week of inflows.

However, Vietnam experienced a 19th straight week of net foreign outflows at -US$177.1 mil with foreign funds having withdrawn from the country since early March 2024. Likewise, Thailand experienced its eighth consecutive week of net foreign outflow amounting to -US$86.7 mil.

The top three stocks with the highest net money inflow from foreign investors last week were Tenaga Nasional Bhd (RM235.0 mil), CIMB Group Holdings Bhd (RM192.2 mil) and Gamuda Bhd (RM152.4 mil) – July 15, 2024