DOMESTICALLY, Bank Negara Malaysia will continue to be data dependent in its monetary policy decisions.

With inflation rate within the target of 2%-3.5% and AM Investment Bank (AIMB)’s economic team expecting 2024 gross domestic product growth to trend closer to 5%, they forecast the Overnight Policy Rate (OPR) to remain unchanged at 3% this year.

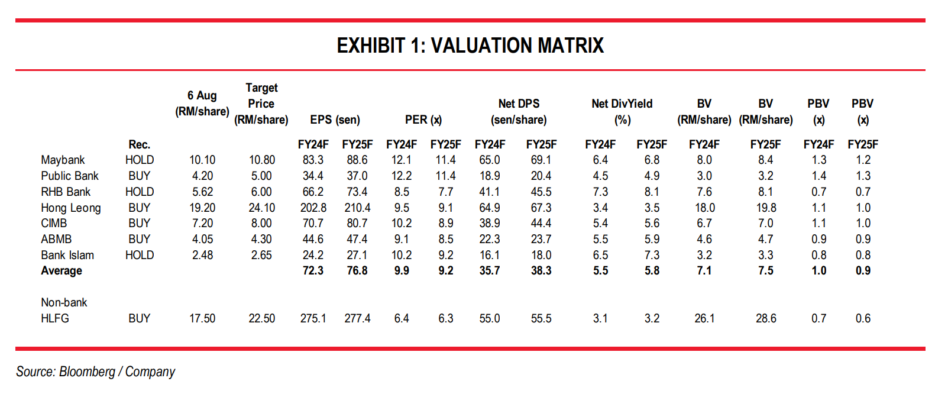

Malaysia has yet to fully normalise the OPR back to 3.25% in the pre-pandemic years. AIMB sees opportunities to look into more defensive names, Public Bank, trading at 1.3x Fiscal Year 2025 Forecast (FY25F) Price-to-Book Value (P/BV) and Hong Leong Bank, trading at 1x FY25F P/BV with a more resilient asset quality, high loan loss coverage than industry and less vulnerability to potential interest rate cuts for operations in foreign markets.

For Public Bank, overseas operations account for 6% of the group’s Profit Before Tax (PBT) with Cambodia as the main contributor.

Meanwhile, for Hong Leong Bank, international markets contribute to 33% of the group’s PBT, with 30.8% derived from Chengdu, China.

AMIB sees exposures to China market operations to be less susceptible to impacts of rate cuts as the 1-year prime lending rate in the country had already been gradually lowered to 3.35% from 4.2% since late-2019.

In contrast, the US has hiked its Fed Funds rate steeply by 525 basis points to 5.50% from 0.25% in early 2022.

Alliance Bank is seen as trading at a compelling valuation of 0.9x FY25F P/BV with a dividend yield of 5.9%.

Valuation at below 1x P/BV is seen as attractive based on projected FY25F Return On Equity (ROE) of 10.5%.

Meanwhile, Alliance Bank’s loan growth is projected at 10% for FY25F and expected to outpace the industry average of 5%-6%. The group has the highest Net Interest Margin (NIM) among peers at 2.5%.

AMIB is staying cautious on Maybank with HOLD in the near term on potential rate cuts in Singapore, a significant foreign market which contributes to more than 20% of the group’s PBT.

“Based on a projected FY25F ROE of 10.8%, we see Maybank as fair valued,” said AMIB.

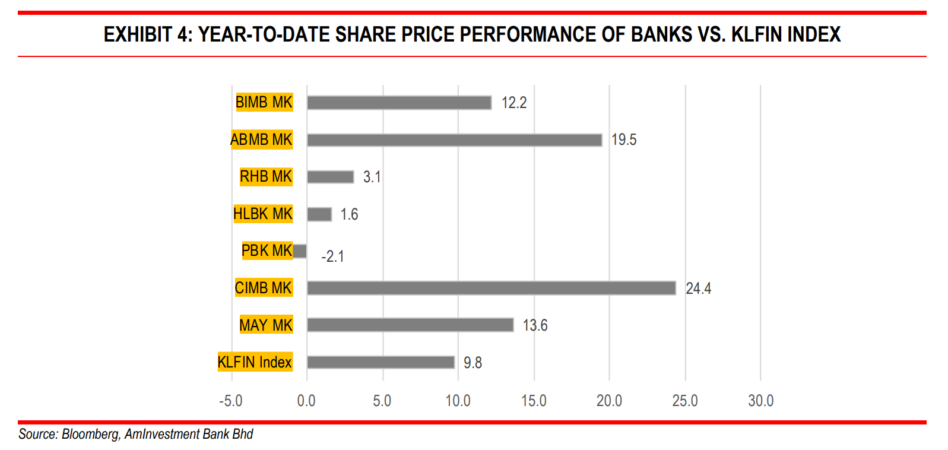

CIMB is the best performer from a share price movement of +24.4% year-to-date (YTD) highest among the stocks under their coverage, outperforming the KLFIN Index.

The stock now trades at FY25F P/BV of 1x, an improved valuation from a low of 0.8x in FY20, reflecting more upbeat sentiments on improved earnings, ROE and asset quality. As the share price has performed well, this presents opportunities to lock in gains.

“We see any retracements in valuation to below 1x P/BV as an opportunity to add exposure.

“Operations in Singapore contribute to 11% of group PBT, lower than Maybank comparatively.

“Indonesia is a significant foreign market for CIMB, accounting for more than 20% of its PBT. Dividend yield for the stock is decent at 5.6% for FY25F,” said AMIB.

In conclusion, AMIB maintains NEUTRAL on the banking sector and remains selective on stocks.

Improving NIM remains a challenge for banks on the back of a still-elevated cost of funds with limited room for deposit campaign rates to be further reduced in the second half of 2024 while lending rates have been competitive.

Three digital banks, which commenced operations, have offered higher rates on savings deposits (GXBank: 3% per annum, Aeon Bank: 3.88% per annum and Boost Bank: up to 3.6% per annum).

This should keep deposit rates elevated even though pricing is now more rational compared to early 2023 and late 2022. Asset quality of banks is anticipated to be stable.

“Nevertheless, credit cost in the near term will be flattish with provisions unlikely to trend lower to improve earnings. Earnings growth remains moderate at 5.4% for the sector in 2024,” said AMIB. – Aug 7, 2024

Main photo credit: businesspostbd.com