BASED on latest indicators, Hong Leong Investment Bank (HLIB) now expect quarter two 2024 (2Q24) gross domestic product (GDP) to record stronger growth of +6.1% YoY (year-on-year) higher than Department Of Statistics (DOSM)’s advance estimate and consensus median forecast of +5.8% YoY.

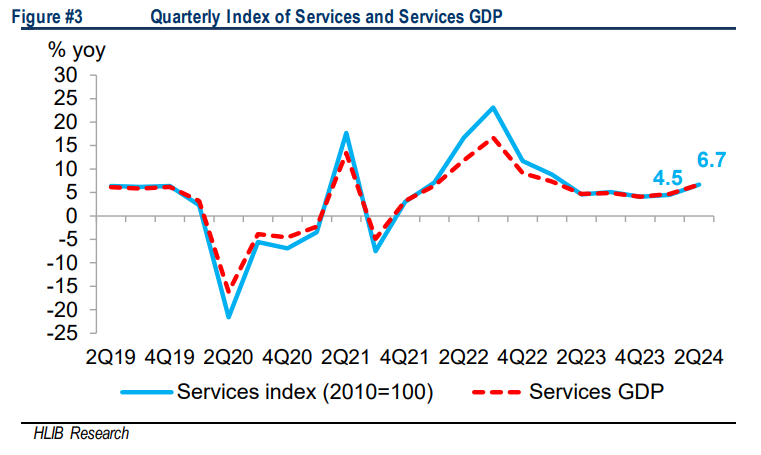

Full 2Q24 GDP print will be released on Aug 16, 2024. Growth is expected to accelerate to +6.1% YoY on the back of stronger growth across most sectors, particularly the services sector.

On the demand side, private consumption is expected to remain the key driver of growth, along with continued improvement in exports activity.

HLIB expects an acceleration in the services sector, in line with the stronger volume of index of services showing in 2Q24 (+6.7% YoY), mainly attributed to the stronger growth in the business services & finance segment (+10.4% YoY), followed by the wholesale & retail trade, food & beverage & accommodation segment (+5.1% YoY) in tandem with the rise in tourism activities and the Hari Raya celebrations in April.

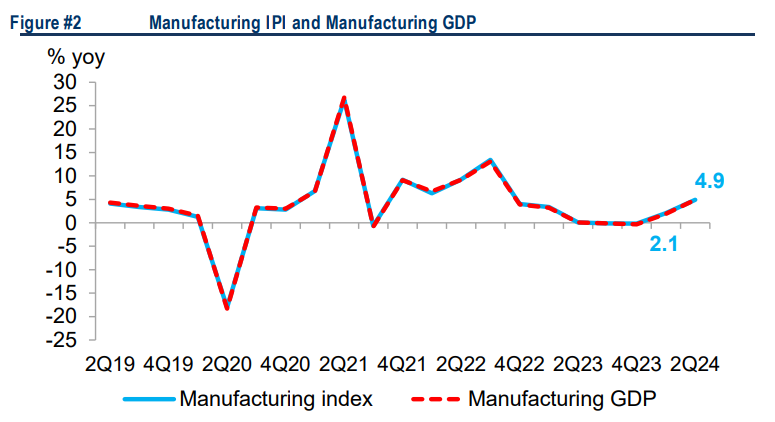

Growth in the manufacturing sector is also expected to accelerate, reflected by the pickup in manufacturing IPI (+4.9% YoY). This was mainly due to the continued rise in export oriented manufacturing activity (+3.9% YoY) amid the improved global manufacturing environment (global manufacturing PMI Jun: 50.8; May: 51; Apr: 50.3), as well as the pickup in domestic-oriented manufacturing activity (+7.0% YoY).

Growth in the construction sector is also expected to gather momentum, in line with the jump in value of construction work done (+20.2% YoY). The civil engineering sub sector remained as the main contributor to overall work done.

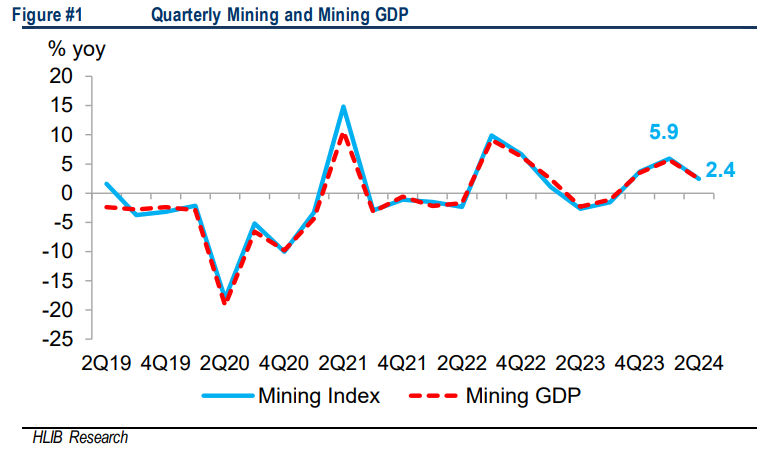

“We also expect an acceleration in the agriculture sector, largely due to the surge in palm oil production (+16.5% YoY). Meanwhile, a moderation is expected in the mining sector as production slowed (mining IPI: +2.4% YoY) mainly in natural gas (+3.0% YoY),” said HLIB.

On the expenditure front, Malaysia’s private consumption is expected to gain pace, underpinned by the healthy labour market situation (unemployment rate Jun: 3.3%; pre-pandemic: 3.3%) and higher wage growth in both the services (2Q24: +3.5% YoY) and manufacturing sectors (+1.4% YoY).

This is shown through the stronger retail sales posting for 2Q24 (+5.5% YoY), partially stimulated by the festivities and EPF Account 3 withdrawals which amounted to RM7.8 bil as of June 24, 2024. The improvement in exports activity (+5.8% YoY) is also expected to help lift overall GDP growth.

Malaysia’s economic growth is expected to remain firm for the rest of the year, supported by resilient domestic demand amid the stable labour market and supportive income measures, as well as continued improvement in trade activity, aided by low base effect and the gradual global manufacturing recovery.

“In line with the upgraded 2Q24 GDP forecast, we see upside bias to our 2024 GDP forecast of +4.8% YoY, pending the release of actual 2Q24 GDP print,” said HLIB.

Following recent developments, HLIB also now projects the Fed to administer three consecutive 25 basis points rate cuts for the remaining FOMC meetings this year.

This should further aid the ringgit’s recovery where HLIB now sees USD-MYR to end the year at 4.30 with a full-year average of 4.60. – Aug 13, 2024

Main image: worldatlas.com