HONG Leong Investment Bank (HLIB) Research has initiated coverage on convenience store chain 99 Speed Mart Retail Holdings Bhd (99SM) which debuted on the Main market of Bursa Malaysia today (Sept 9) with a “buy” rating and a target price of RM1.98 based on 30 times the company’s PE (price-to-earnings ratio) of its FY2025 earnings.

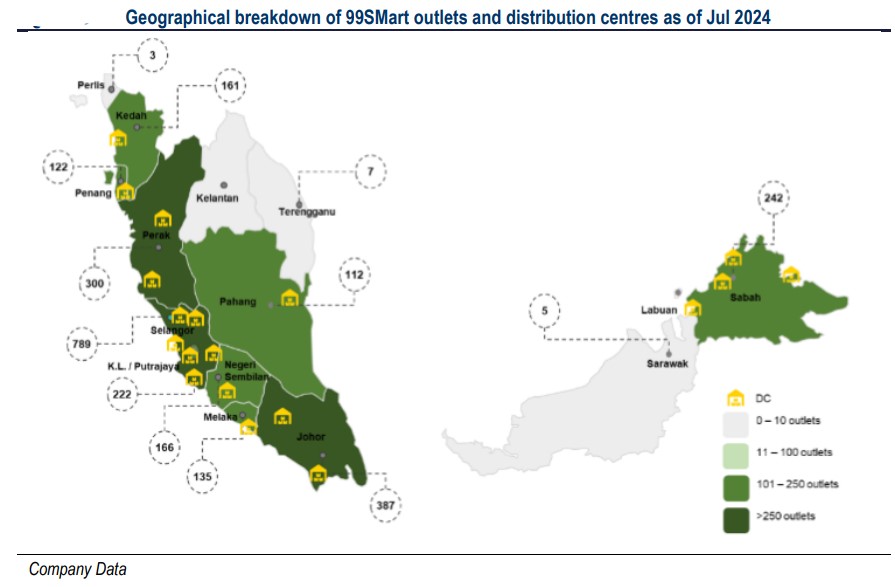

The initial public offering (IPO) of the popular “99 Speedmart” chain of mini-market stores operator who boasts 2,651 outlets nationwide (as of July 2024) has been deemed as Malaysia’s largest since that of South Korea’s Lotte Chemical Titan Holding Bhd in 2017.

“This PE (30 times) implies a ~40% premium to 99SM’s peers as we believe this is warranted on the back of its market leader position coupled with aggressive store expansion,” justified analyst Syifaa’ Mahsuri Ismail in an initial coverage note.

For the record, the country’s largest home-grown mini market chain retailer opened at RM1.85 or a 12.1% premium over its IPO price of RM1.65 with an opening volume of 53.8 million shares.

HLIB Research further expects 99SM to record FY2023-FY2026F revenue and net profit compound annual growth rate (CAGR) of 13.1% and 15.8% respectively.

“This projected growth will be driven by (i) the opening of 250 retail outlets annually and (ii) stable SSSG (same store sales growth) of 2% per annum,” projected the research house.

“The company is committed to a 50% dividend payout policy, supported by robust free cash flow generation and a healthy balance sheet with a net cash position. Nevertheless, based on its IPO price, its dividend yield is relatively unattractive at 1.8% (50% dividend payout policy).”

According to HLIB Research, 99SM’s high volume of purchases and direct negotiation with principal brand owners and wholesale suppliers has allowed the group to purchase goods at a lower cost.

“By achieving lower procurement costs, they are able to pass on some of the cost savings to customers. Its large number of outlets enables the group to generate other operating income such as product display fees, target incentives and advertising and promotional fees,” revealed the research house.

“These other operating income sources are relatively significant at 8.7%-9.3% when stacked against its FY2020-2023 revenue or 9.1%-9.6% against its gross profit.”

Beyond that, HLIB Research also hailed 99SM’s flexibility to accommodate future growth and scale efficiently given its (i) strategic positioning of outlets; (ii) uniformity of outlets’ layout with curated product selection; (iii) prime size of 2,000-3,000 sq ft for convenience; and (iv) short payback period of three years with minimal RM300,000 capex (excluding inventories).

“Apart from that, 99SMart also owns its nationwide network of 19 distribution centres in nine different states that support its retail management and control system,” added the research house.

With its listing price set at RM1.65/share, 99SM would have a market capitalisation of RM13.86 bil upon listing based on an enlarged issued share capital of 8.4 billion shares.

Its IPO aims to raise RM2.36 bil, including RM1.7 bill from the sale of 1.028 billion shares by CEO Lee Thiam Wah and his wife Ng Lee Tieng.

At 11.38am, 99SM was up 23 sen or 13.94% to RM1.88 with 327.30 million shares traded, thus valuing the company at RM15.79 bil. – Sept 9, 2024