THE United States will hold its presidential elections on 5 Nov, which will see a contest between Kamala Harris and Donald Trump for the nation’s top position.

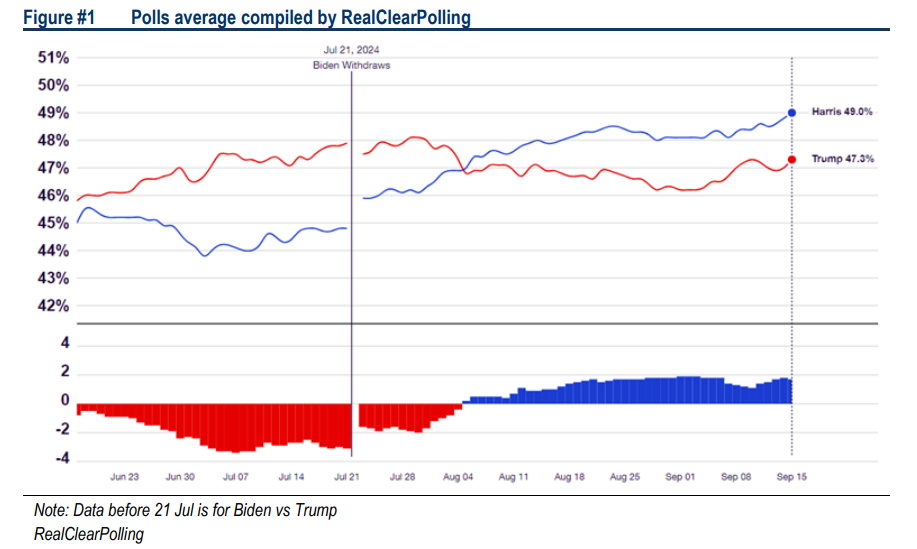

Based on polling averages, Harris is currently leading at 49% or +1.7% higher vs Trump’s 47.3%. There are 538 electoral college votes across America’s 50 states, and the candidate that has the most votes (which is at least 270) becomes president.

“According to a compilation of consensus predictions, the Democrats have 226 votes, ahead of the Republicans’ 219. The remaining 93 votes are located in seven “swing states”, which could be viewed as the determinants of this election,” said Hong Leong Investment Bank (HLIB) in the recent thematic report.

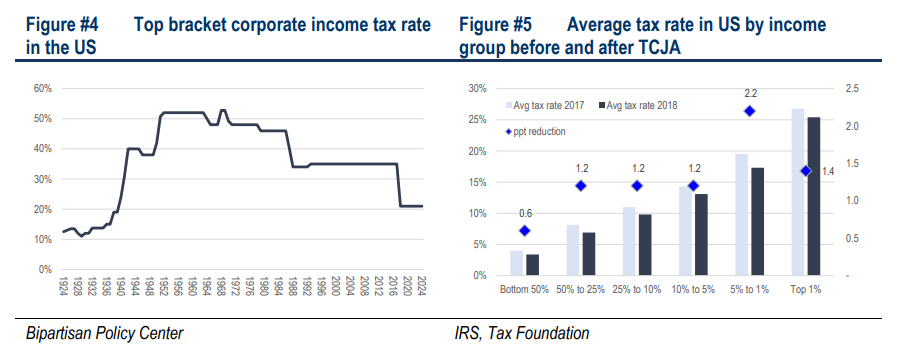

Harris intends to raise the corporate tax rate from 21% to 28%, while Trump wants to preserve existing tax cuts under the TCJA and perhaps lower corporate tax to 15%.

Judging from the past “Trump tax cuts”, this would be positive for Wall Street (KLCI is 60% correlated) – while the opposite would be likely under Harris’ proposal.

Trump’s policies have mixed implications to inflation. His “tariff tantrums” will fuel it, while boosting oil output may cool it.

“That said, in the near term, we keep our stance for the Fed to pivot soon on the back of moderating inflation and softening the labour market which augurs well for the ringgit and local bourse,” said HLIB.

Trump’s push to “drill, baby, drill” could be a bane for oil prices, given the increased supply, while Harris’ potentially restrictive oil policies may offer some price support.

Any swings in oil price could have implications on Malaysia’s fiscal position as “petroleum” formed 18-32% of government revenue post GST abolishment and Petronas’ capital expenditure, which has implications to local oil and gas, services and equipment players.

Harris will likely continue Biden’s pro-climate policies, while a Trump win could mean a regression from this.

The latter scenario may help keep solar module prices low, offering conducive conditions for Malaysia’s energy transition under the National Energy Transition Roadmap and benefitting local solar developers and engineering, procurement, construction and commissioning contractors.

Trump is expected to ratchet up the trade war with China as he has called for a ≥60% levy on Chinese goods, alongside a 10-20% blanket rate on all other imports.

Harris’ approach could likely mirror Biden’s targeted style by focusing on strategic sectors.

Continuation or escalation of the US-China trade war could be beneficial for Malaysia via trade diversion and proliferation of the China+1 strategy.

While ending the wars involving Russia-Ukraine and Israel-Gaza will be a Herculean task, Trump is likely to have a better chance with the former and Harris with the latter. A resolution would ease the geopolitical risk premium on oil price.

“Generally, we expect more economic fluidity and market volatility under Trump given his confrontational “shoot from the hip” style though this isn’t necessarily a bad thing since Malaysia did benefit from the trade war,” said HLIB.

On the flipside, a Harris win will likely see more familiar waters as she continues on with the policies laid by her predecessor.

Regardless, being geopolitically neutral, HLIB believes Malaysia is in a relatively better position to manoeuvre from any external policy changes that may arise post 5 Nov. – Sept 18, 2024

Main image: businessinsider