THE incentive packages for Forest City (FC) Special Financial Zone (SFZ) are significant and should have a positive spillover effect on Iskandar Malaysia in the longer run, for example, demand for property, commercial and retail activities.

“If the ecosystem (regulations and infrastructure) is well established, the push for family offices makes sense as FC situated next to Singapore, which has been a hub for family offices in the region,” said RHB in the recent Malaysia Sector Update Report.

Incentives for other financial institutions and logistics sectors should also attract investments into FC, creating more job opportunities.

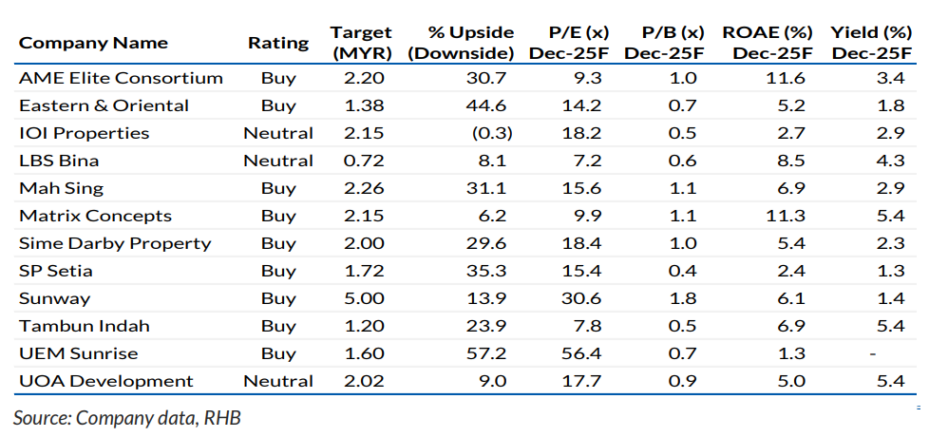

The government’s intention to revive FC is very clear. With the incentive packages, RHB believes the SFZ will not only attract interest from local asset management companies, financial institutions and high net worth individuals, it should also lure international capital to FC, especially the high net worth individuals in the region.

“We understand that there are already a few Singapore-based financial institutions expressing interest in the SFZ, pending the official guidelines released by the Securities Commission over the near term,” said RHB.

Over time, RHB believes there will be additional need for more office space within FC and, more importantly, the existing residential properties there will be occupied gradually.

The real property gains tax for foreigners have also been “harmonised” to 0% after five years (just like the tax perk for Malaysians buying property there), and property buyers in FC will also enjoy a 50% stamp duty exemption on property transfers and mortgage financing.

“Although the incentives are mainly centred around the FC, as more job opportunities are created, we will likely see more business activities in nearby areas like Nusajaya and Medini, benefitting the retail, entertainment and F&B sectors,” said RHB.

To a certain extent, UEM Sunrise, Sunway and Eco World Development (ECW MK, NR) may experience some spillover effect in future.

Media reports indicate that Sultan Ibrahim Iskandar, the current Yang di-Pertuan Agong, is seeking funding from China investors for the KL-SG HSR during his 4-day state visit to China.

If this mega infrastructure project is revived, this will be a major re-rating catalyst for the overall property sector.

Not only the developers in Iskandar Malaysia (especially in the Nusajaya area) will benefit, developers that have landbank exposure along the alignment area from Singapore to Kuala Lumpur should also have better development prospects going forward.

Apart from a conducive macroeconomic environment (stable interest rates, better economic growth, stronger ringgit), government economic incentives for special zones and the influx of investments should continue to buoy market sentiment on property stocks. – Sept 23, 2024

Main image: forestcity