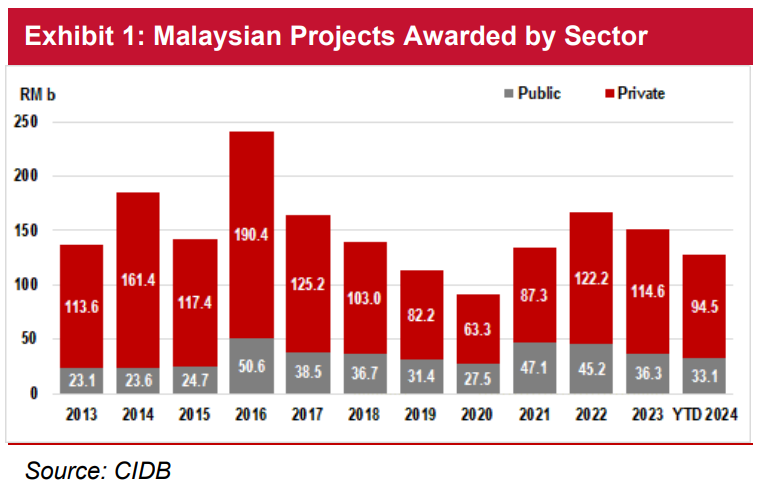

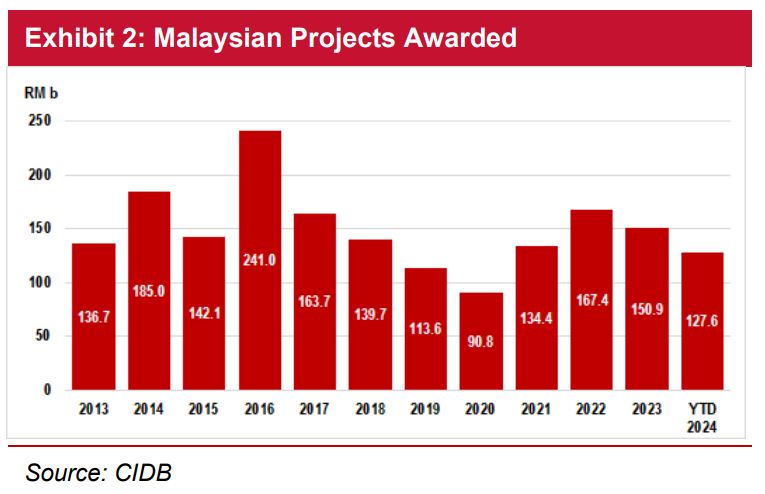

ACCORDING to the Construction Industry Development Board (CIDB), a total of RM127.6bil in main contractor construction contracts was awarded year-to-date (YTD) as of the end of August 2024, representing 85% of the total contract awards of RM150.9bil in 2023.

“Of the RM127.6bil, government projects accounted for 26%, while private projects made up 74%,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

Although contract flows remain strong, Kenanga believes total awards in 2024 are unlikely to surpass the previous upcycle record of RM241bil in 2016 which included the lumpy East Coast Rail Link, given the remaining three months of the year.

With several public projects in the pipeline, coupled with robust private sector projects, especially in the data centre sector, 2025 is expected to be another busy year.

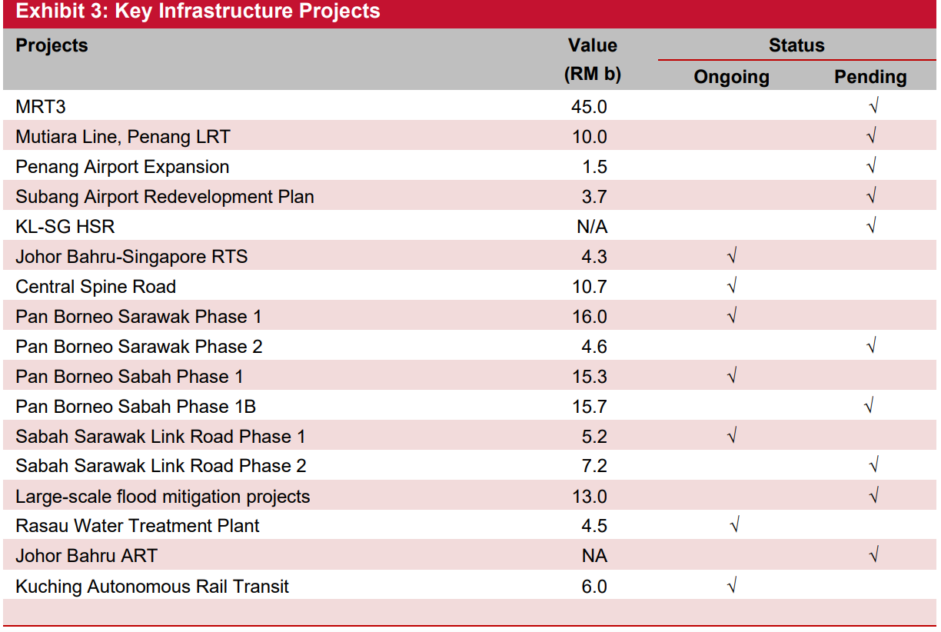

The MRT3 is undergoing public inspection until early December, with booths available at 35 designated locations along the alignment areas as well as government offices.

This gives the public an opportunity to review and provide feedback on the proposed plans, as a required step alongside railway scheme approval.

MRT Corp expects construction of the MRT3 to begin in 2026, with the entire MRT Line anticipated to be fully operational by 2032.

“If this timeline materialises, we believe 2025 could surpass the 2016 peak for contract awards. Other major projects in the pipeline include the Penang LRT Mutiara Line, currently pending negotiation between SRS Consortium and MRT Corp, and the Penang Airport Expansion, which is expected to conclude soon,” said Kenanga.

Additionally, the Pan Borneo Highway, Sabah Sarawak Link Road, and Subang Airport Redevelopment Plan are on the horizon.

“We view the high-profile KL-Singapore High-Speed Rail as a medium-term prospect, while the upcoming Johor-Singapore Special Economic Zone (SEZ) also presents opportunities for the construction sector,” said Kenanga.

The construction index has performed exceptionally well this year, partly driven by the data centre boom, with the KLCON index soaring 50% YTD compared to the FBMKLCI’s 15% gain.

Large-cap contractors have also seen their share prices rallied, between 62% and 133% over the same period. This puts the sector’s valuation on par with, or even surpassing, the 2016 upcycle.

“However, we believe higher valuation multiples are justified this time around, given the expected higher annual contract awards of RM180bil over 2024-2026, 11% higher as compared to RM161bil annual contract award during the previous up-cycle in 2016-2018,” said Kenanga.

Kenanga maintains their sector rating of OVERWEIGHT with GAMUDA as their Top Pick for the sector for being in the driver’s seat for the Mutiara Line of the Penang LRT and front-runner for the tunnelling job for the MRT3.

Also, GAMUDA is favoured for its ability to secure new jobs in overseas markets, its strong war chest after the disposal of its toll highways, and its strong earnings visibility underpinned by a record outstanding order book of RM26.5bil (excluding Upper Padas Hydro and Penang LRT), and its inroads into the renewable energy space. – Sept 25, 2024

Main image: traynorgroup.com