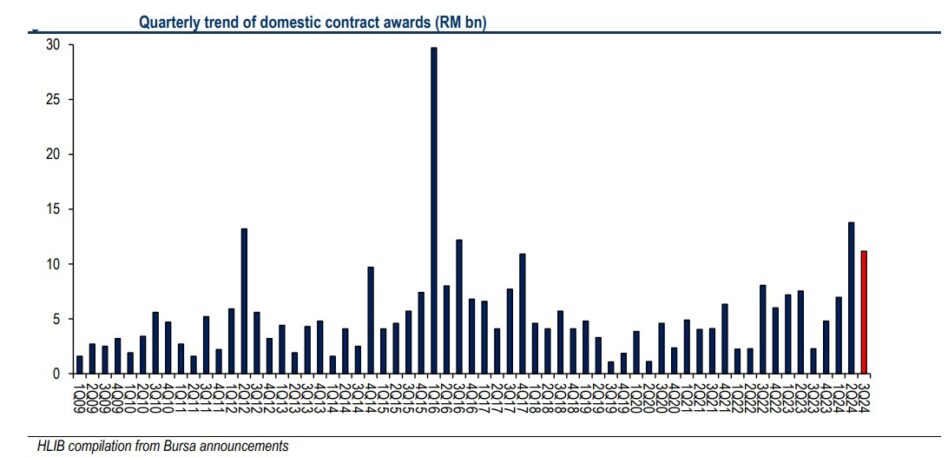

AFTER having netted highly anticipated contracts valued at RM31.9 bil (+88% year-on-year) in 3Q 2024, Hong Leong Investment Bank (HLIB) Research foresees rolling out of more sizable public infrastructure projects with that of data centre (DC) featuring more prominently in 4Q 2024 after a lull period in 3Q 2024.

Among the prospects identified by HLIB Research are Sabah hydroelectric, Sarawak-Sabah Link Road Phase 2 (SSLR II), Saah portion of the Pan-Borneo Highway (PBH), Penang LRT, water and airport projects.

“Positive sector sentiment could also come from the Johor-Singapore Special Economic Zone finalisation and Budget 2025,” envisages analyst Edwin Woo in a construction sector outlook report.

“Maintain “overweight” riding on structural DC and Johor rei-invigoration themes. Top picks are unchanged: Gamuda (“buy”, target price: RM9.08) and Sunway’s construction arm.”

Specifically on DC which in recent times has been hailed as star performer, HLIB Research noted that there was a sequential slowdown in DC-related contracts which only valued at roughly RM909 mil in 3Q 2024 after having registered RM4.04 bil in 2Q 2024.

“There was only one main contract secured by Binastra Corp Bhd (previously Comintel Corp Bhd) from EXSIM DC,” noted the research house.

“There was also slightly lower commercial/residential project quarter-on-quarter (qoq) which was predictable given the exceptional pace of jobs in 2Q 2024.”

Going into the final quarter of 2024, HLIB Research is sticking to its view that “value of contracts in 2024 can easily surpass the RM40 bil mark and potentially inching above RM50 bil – highest since 2016 (based on our data compilation)”.

“The trickling out of works packages from SSLR Phase 2 and PBH Sabah 1B projects in 3Q 2024 reaffirms this,” justified the research house.

“Infrastructure projects that could deliver contracts in 4Q are the remaining Sabah hydro, PBH Sabah Phase 1B WPCs (works package contract), Sabah Sarawak Link Road Phase 2, Penang LRT, water and Penang airport, among others.”

Job flows aside, sector sentiment could also be lifted by developments on Johor LRT and the Kuala Lumpur–Singapore high-speed rail (KL-SG HSR).

“We view the former as a critical dispersal system for the Johor Bahru–Singapore Rapid Transit System (JB-SG RTS) with efforts to revitalise Johor requiring high-capacity connectivity infra for the greater JB area,” opined HLIB Research.

“In our view, DC and Johor re-invigoration themes still has room to play out. Investors’ preference for the picks and shovels trade for the DC boom should continue to drive sector multiple rerating,” added the research house. – Oct 3, 2024