WHILE near-term market risks will stay elevated, RHB Research expects 2025 to remain constructive for equities amid the US Federal Reserve’s dovish pivot with recent economic data should support a soft-landing scenario for the global economy.

In this regard, news flow should retain a positive bias with the strong ringgit offering upside to corporate earnings as stable politics support further progress on the reform agenda, according to RHB Investment Bank’s regional equity research head Alexander Chia.

“Our investment strategy is centred on navigating 4Q 2024’s volatility, protecting realised gains and positioning for 2025,” he penned in a market strategy note.

“We believe that global recessionary concerns are exaggerated with a soft-landing base case still the core expectation for investors.”

This view, according to Chia, is supported by the aggressive monetary policy pivot and recent better-than-expected US economic data prints.

As it is, RHB Economics forecasts both the US and China to achieve above-consensus year-on-year (yoy) 2025 gross domestic growth (GDP) growth of 2.0% and 4.8% respectively.

“The US Fed’s emphasis on employment implies a continued easing Federal Funds Rate (FFR) bias and a stronger ringgit in 2025 on the back of narrowing interest rate differentials,” projected Chia.

“This increases the propensity for investors to re-look at emerging market (EM) opportunities. Troubling events in the Middle East and escalation of the conflict there bring renewed inflation risks, hence is a major caveat to this base case outlook.”

Back home, RHB Research foresees that the steady pace of foreign and domestic direct investments will re-build productive capacity to sustain growth supported by an acceleration in trade and manufacturing activities and resilient domestic demand from increased consumer spending.

“We expect that the stable domestic environment will allow the unity government to see out its five-year term in full with ample political capital to make further meaningful progress on subsidies and initiatives to broaden the tax base in order to improve public finances,” envisages Chia.

With anticipated market volatility in 4Q 2024 nevertheless, RHB Research expects such trend to likely compel investors to consider a two-pronged strategy to protect realised gains made year-to-date (YTD) while identifying opportunities to position for 2025.

“Bursa Malaysia’s relative outperformance indicates that we are not likely to see aggressive window-dressing activity towards the year-end,” opined Chia.

“Key investment themes include near-term defensive posturing, staying nimble to build positions on broad-based market weakness, a tactical focus on laggards as well as concentration on stocks with a Johor angle coupled with a bottom-fishing strategy on small-mid caps.”

All in all, RHB Research maintained its “overweight” on the banking, property, M-REITs, construction, technology, healthcare, basic materials, oil & gas (O&G), utilities and rubber products sectors.

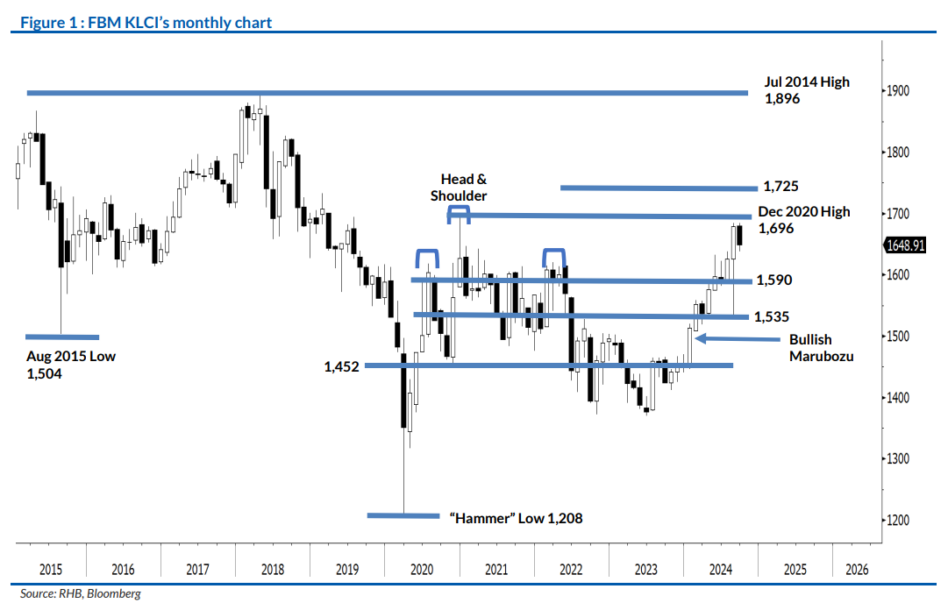

“We also retain our end-2024 FBM KLCI target of 1,720 points on forward FY2025F earnings,” noted the research house.

“Key risks include negative geopolitical developments, a flare-up of inflation causing the US Fed to re-evaluate its monetary policy and an escalation of the US-China trade war.” – Oct 10, 2024