A RECENT report states that only 35% of youths aged 25-34 are homeowners in Malaysia and that the younger generation is not interested in purchasing a home.

Speculation is rife that this trend has taken shape because of the cost of the properties. Despite government initiatives, affordability remains a challenge.

Many millennials delay homeownership due to financial burdens and prioritise other expenses, preferring long-term renting.

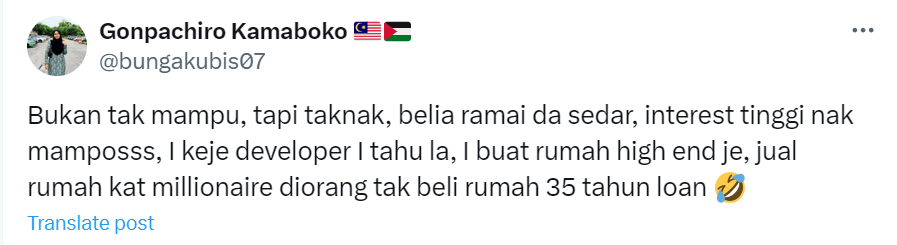

A property developer, writing on X, attributes the issue to high interest rates, making the monthly payments for even affordable properties significantly higher.

Consequently, many young people are compelled to rent instead of owning homes.

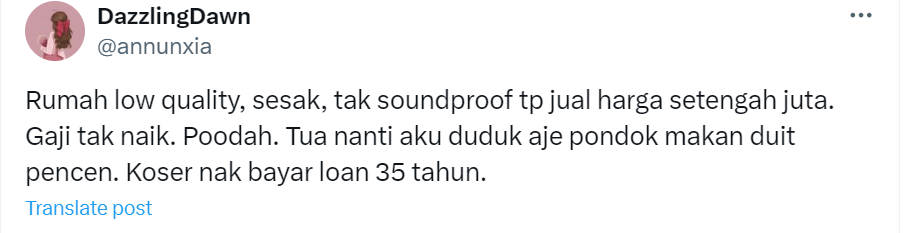

X users are alleging that newly constructed houses are built with low-quality materials, leading to facilities and fixtures deteriorating after just a few years of occupancy.

This situation highlights a significant contrast with the superior quality often found in older homes.

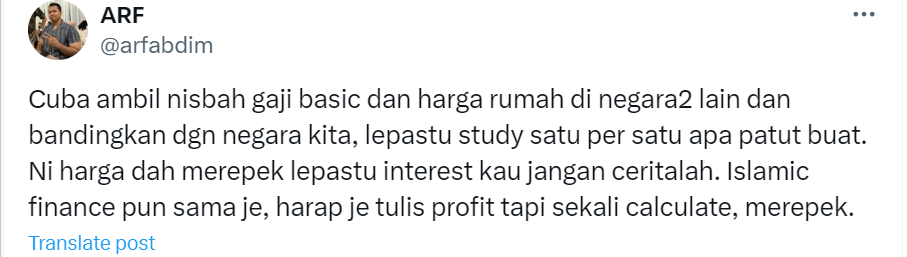

Many are criticising the global interest rate system, especially as central banks around the world continue to raise rates to combat inflation.

Critics argue that Islamic Finance, while not explicitly labeling its charges as interest, still imposes comparable amounts under the guise of “profits.”

A significant number of X users have expressed dissatisfaction with the higher rates that banks are now offering, questioning whether these financial practices truly align with ethical principles.

This growing discontent reflects a broader concern about the fairness and transparency of financial systems in the current economic climate as it impacts the purchasing power of individuals who are looking forward to owning a property. – Oct 20, 2024

Main image:equitablegrowth.org