FIRST thing first: Regardless of whether Kamala Harris or Donald Trump wins the upcoming US presidential election, Malaysia’s economy will feel the effects, mainly through trade and investment flows.

Nevertheless, the protectionism policy of Trump who is the predecessor of current US president Joe Biden could challenge existing trade relations while that of Harris – the sitting vice-president – may strengthen the US-ASEAN trade ties.

“In either scenario, we believe Malaysia stands to benefit from shifts in trade flows and increased regional investment,” opined Kenanga Research in its economic view of the “US Presidential Election 2024”.

“If Harris wins the election and Democrats secure a second term, we can expect continuity in policy, particularly regarding US-ASEAN trade relations and possible efforts to enhance market access and reduce trade barriers between the regions.”

On the contrary, if the 78-year-old trump wins, the research house expects a resurgence of protectionist measures which may lead to higher tariffs and stricter trade restrictions, especially toward China.

“This shift could indirectly impact Malaysia’s exports due to the complexity of the global supply chain involving manufactured goods in the electrical & electronic (E&E) sector,’ suggested Kenanga Research.

‘Short-term pain, long-term gain’

“While this could harm the economy in the short term due to its uncertainties, Malaysia could benefit from trade and investment diversion in the medium to long term. This is already happening as Malaysia has seen a significant increase in exports to the US since the US-China trade war began in July 2018.”

Notably, Kenanga Research pointed to Malaysia’s exports to the US which surged 17.6% year-to-date (as of September) while exports to China declined by 2.1% over the same period.

Similarly, Malaysia has seen an increase in regional investment over the past three years despite a 46.4% drop in net foreign direct investment (FDI) to RM40.4 bil in 2023.

“This decrease was partly offset by significant FDI inflows from Northeast Asia (46.3%; 2022: 90.8%), and Southeast Asia (57.8%; 2022: 65.9%), underscoring Malaysia’s growing appeal as an Asian investment hub,” noted the research house.

At a glance, the 60th US quadrennial presidential election on Nv 5 (Tuesday) will determine the next president based on each state’s popular vote with a minimum of 270 out of 538 electoral votes needed to win.

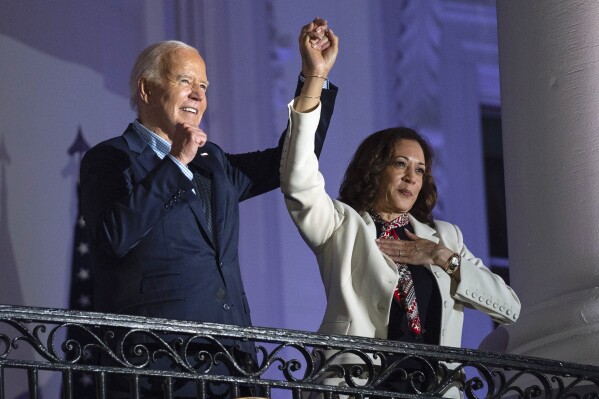

Harris had launched her presidential campaign on July 21 after Biden withdrew and endorsed her bid.

Her campaign slogans of “A New Way Forward” and “When We Fight, We Win” project progress, optimism and a future-focused approach which contrast Trump’s “Make America Great Again” which throws the spotlight on restoring past values.

Polls indicate a tightly contested race, particularly in swing states, where both candidates are neck and neck.

Below are other potential outcomes from either Trump or Harris’ victory by Kenanga Research:

- A Harris win could weaken the US dollar in the near term – stabilising the DXY (US Dollar Index) to around 102-103 – thus supporting the ringgit as the US Federal Reserve rate cuts proceed and policy continuity prevails.

Our base case is a Harris victory without a decisive sweep assumes the current economic conditions persist with greenback-ringgit forecast at RM4.25/US$1 by end-2024 and RM4.10/US$1 by end-2025.

- A Trump presidency could boost the US dollar and fuel inflation, hence impacting the US Fed policy and emerging currencies, including the ringgit.

These factors could constrain US Fed rate cuts to only around 4.0%-4.5% by 2025, leading to a US dollar boost that might drive greenback-ringgit exchange to RM4.48/US$1 by end-2024 with a moderate recovery to RM4.37/US$1 by end-2025.

- In the short term, Harris’ victory could lower US Treasury (UST) yields, benefiting Malaysian bonds.

On the reverse, Trump’s win might heighten volatility, limit US Fed rate cuts and push yields higher. Both scenarios suggest a persistently high US deficit, influencing investor sentiment and bond market dynamics in Malaysia. – Nov 1, 2024

Main image credit: Gallup News