SUCH was the question put forth by a well-followed finfluencer as Berjaya Food Bhd’s (BFood) financials continue to be dragged down by its Starbucks operations with another quarter of disastrous results.

For the period ended Sept 30, 2024 which is the premium coffee chain franchise owner’s 1Q FY6/2025, BFood saw its net losses extended to four quarters in a row now with a net loss of -RM33.68 mil (1Q FY6/2024: +RM19.03 mil) while its revenue edged down 55% to RM124.19 mil (1Q FY6/2024: RM278.53 mil).

“Starbucks is still surviving despite being hit hard from two directions, namely boycott and competition,” observed Azha Investing @azha_investing) who is also an independent stock market analyst and economist. “What is the strategy and (plans) to restructure operations?”

Latest. B Food, franchise owner Starbucks financials. Another qtr, another disastrous results.

Suku Sept 2024: Revenue RM124.19 mil jatuh 4%. Net loss RM34 mil. Revnue if compare sebelum perang collapsed 55%.Starbucks masih lagi bertahan walaupun kena hit teruk dari 2 arah:… pic.twitter.com/nT2jf3Esdb

— Azha Investing (@azha_investing) November 14, 2024

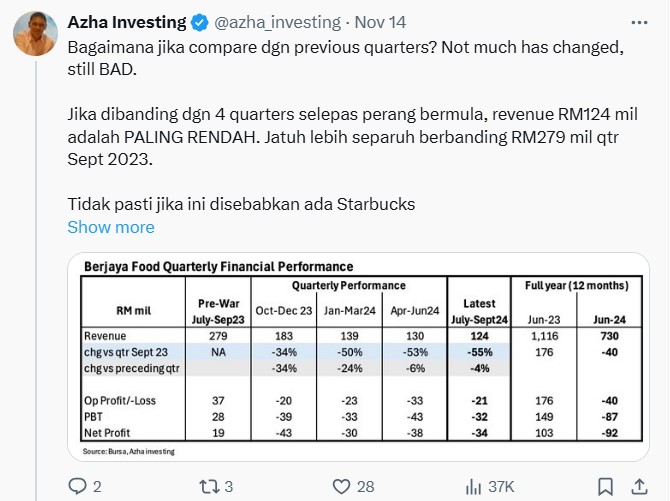

According to Azha Investing, not much has changed for BFood over the past four quarters since the Gaza war erupted on Oct 7 last year with prospect for the Berjaya Group’s food & beverage (F&B) arm to return to the black being bleak.

“If compared to the four quarters after the war started, the revenue of RM124 mil is the LOWEST (falling more than half year-on-year from RM279 mil in the corresponding quarter of 3Q FY6/2024,” he noted.

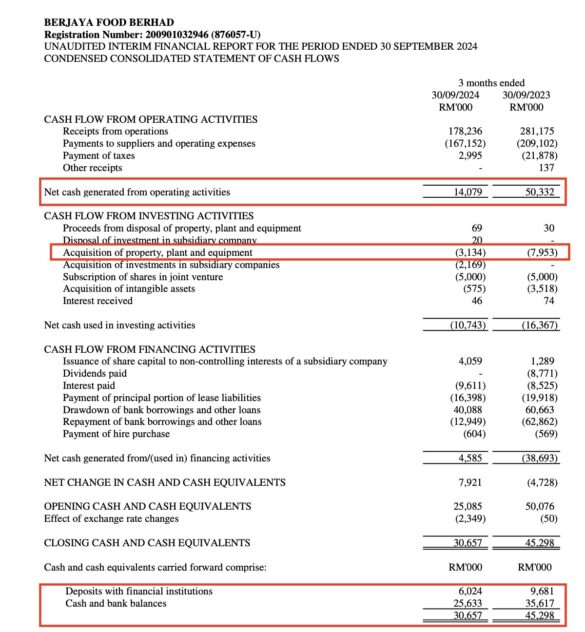

Wondering how much longer this performance can sustain Starbucks/BFood, Azha Investing further observed that the group’s operational cashflow has dwindled to only RM14 mil from RM50 mil in 1Q FY6/2025 while the debt level has escalated.

“What are the available options? (i) Rationalise network of outlets or (ii) continue cost optimising?” he wondered.

According to the management, BFood has thus far temporarily closed 12% of its Starbucks outlets (50 out of 408 stores) in 1Q FY6/25 from about 6% of its total store count in 4Q FY6/2024.

To-date, Starbucks still made up a big chunk of revenue for BFood, contributing close to 90% during the quarter under review while the remaining came from Kenny Roger Roaster (KRR) (10%).

Azha Investing further made one notable sharing that based on surveys, Starbucks’ competitors are enjoying good times with “customers who have changed direction” in terms of choice, taste and pricing.

“Other (premium coffee) chains like Zus and Gigi are doing quite well, traffic-wise. Meanwhile, BFood shares are still severely underperforming. The counter has been down 20% alone this week.”

In a nutshell, Azha Investing’s evaluation of BFood’s business outlook runs parallel with that of Maybank IB Research and Hong Leong Investment Bank (HLIB) Research whereby both research houses have retained their “sell” rating on BFood with even lower target prices of 25 (from 30 sen) and 20 sen (from 25 sen) respectively.

“Despite strong brand equity and active promotions, we opine the boycott headwinds will stay, at least for the near term which will greatly drag earnings,” projected HLIB Research analyst Syifaa’ Mahsuri Ismail in a BFood results review.

Added her Maybank IB Research counterpart Jade Tam: “Moreover, heightened competition within the industry also adds another roadblock to BFood’s earnings recovery.”

At the close of yesterday’s (Nov 15) trading, BFood was down 3.5 sen or 8.54% to 37.5 sen with 10.73 million shares traded, thus valuing the company at RM730 mil. – Nov 16, 2024

Main image credit: Starbucks Malaysia/Facebook