AUTOCOUNT Dotcom Bhd, a renowned developer and distributor of financial management software (accounting, point-of-sale and payroll) has recorded significant growth in its revenue and net profit across its core business segments during its 3Q FY2024 ended Sept 30, 2024 financial quarter.

AutoCount saw its net profit for the quarter under review jumped 71.4% to RM5.77 mil from RM3.36 mil in the corresponding quarter of FY2023 driven primarily by robust sales in financial management software and early contributions from the company’s e-invoicing solutions.

Meanwhile, AutoCount’s net profit for the 9M FY2024 period spiked 53.1% to RM14.36 mil from RM9.38 mil in the same period last year.

This is in line with the revenue growth of 57.1% to RM45.53 mil (9M FY2023: RMRM28.99 mil) buoyed by strong contributions from the group’s software distribution segment which accounted for 88.9% of total revenue.

The Malaysian market remained Autocount’s largest revenue generator with RM39.85 mil.

“We are encouraged by our continued growth and the demand for our solutions, especially in Malaysia and Singapore,” commented AutoCount’s managing director Choo Yan Tiee.

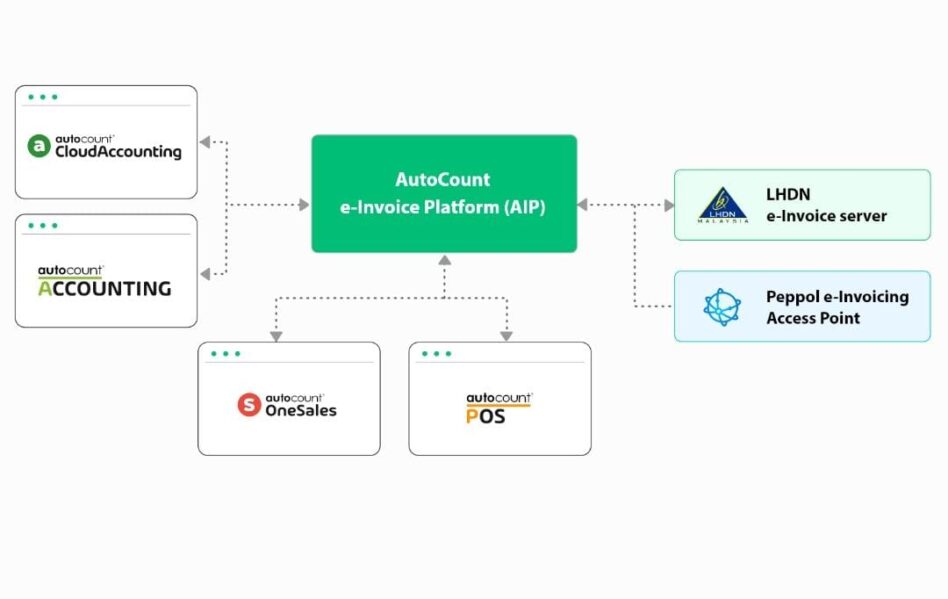

“Our strategic focus on the financial management software industry, particularly with the introduction of our e-invoicing solutions has positioned us well to capture the growing needs of businesses seeking digital transformation and efficient financial management solutions.”

Looking ahead, AutoCount remains optimistic about its growth trajectory in the financial management software market on the back of supportive government initiatives across Southeast Asia.

As it is, the recent announcement of RM50 mil in digitalisation grants by the Malaysian government is expected to benefit over 10,000 small and medium-sized enterprises (SMEs), thus creating a substantial opportunity for AutoCount’s software solutions.

Additionally, the implementation of e-invoicing which began on Aug 1 aligns with regulatory shifts and is expected to enhance compliance and operational efficiency for businesses across the region.

“Our commitment to innovation and regional expansion continues to be a core pillar of our strategy,” enthused Choo.

“With our IPO (initial public offering) proceeds fuelling research and development (R&D) as well as market penetration efforts, we’re confident in delivering value to our shareholders and driving growth for the company.”

He added: “With the e-invoicing initiative already showing early success, we anticipate it will become a key growth driver as more businesses adopt this technology to streamline processes and meet compliance requirements.”

At the close of today’s (Nov 21) trading, AutoCount was up 2 sen or 2% to RM1.02 with 87,900 shares traded, thus valuing the company at RM562 mil. – Nov 21, 2024