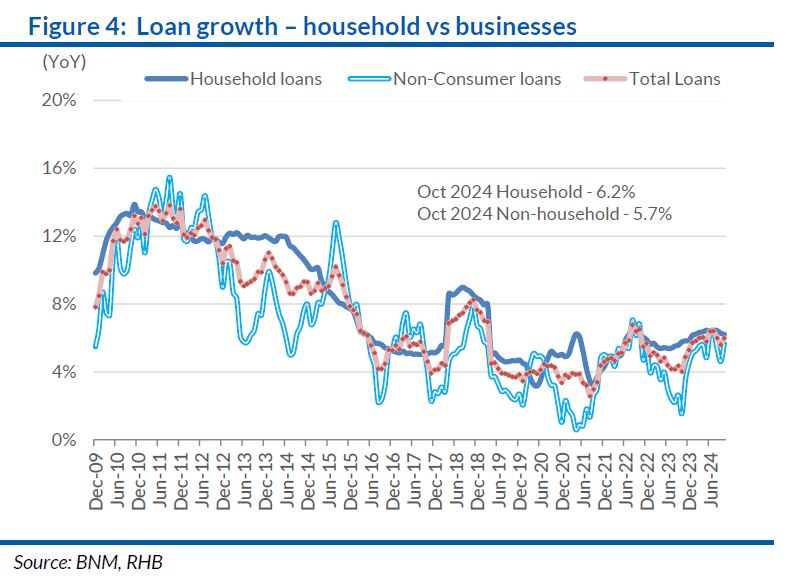

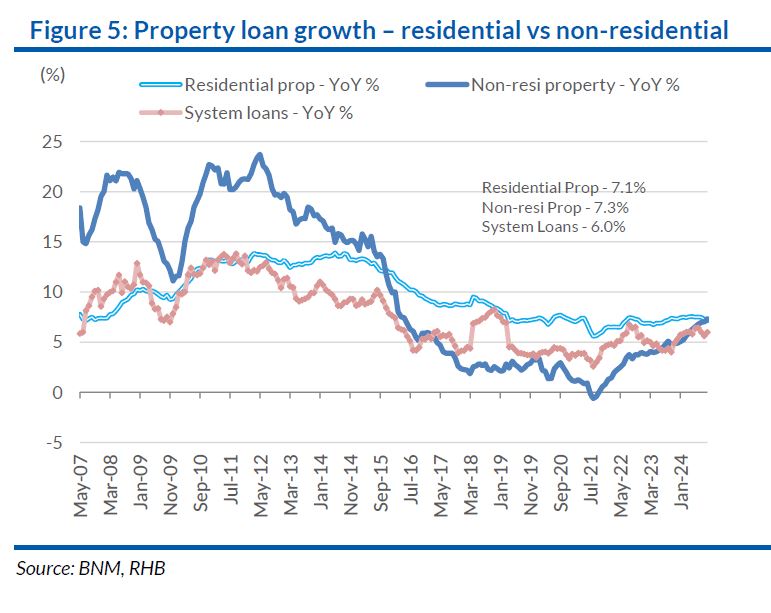

SYSTEM loan growth remained strong at 6% year-on-year (YoY) in October, with positive lending indicators, while deposits growth eased to 3% YoY compared to 5% in July.

Asset quality remained healthy across the board, with the system gross impaired loan (GIL) ratio nearing the pre-pandemic average.

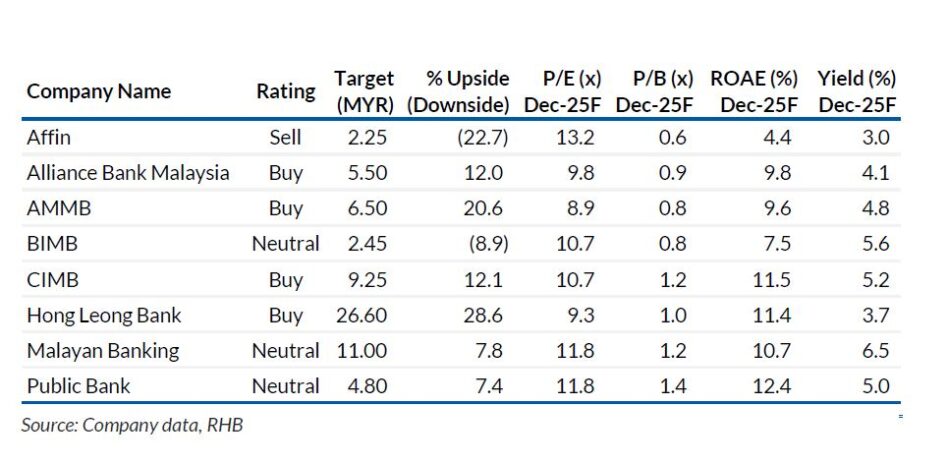

“We maintain our rating on the sector as we think the stable outlook for Malaysian banks under our coverage provides investors with a defensive shelter,” said RHB in the recent Malaysia Sector Update report.

System loans grew 6.0% YoY in Oct 2024, with household loans growing 6.2% YoY, and business loans by 5.7% YoY.

Sectors that recorded the most growth include wholesale & retail trade (+8% YoY) and finance (+18% YoY), while sectors such as agriculture (-6% YoY) and education & health (-3% YoY) contracted.

Year-To-Date (YTD) annualised loans grew by 4.9%, slightly below RHB’s 5-5.5% forecast for 2024.

After a slower September, October saw a sequential pickup in loan applications across both the household and business segments.

On a YTD basis, loan applications and approvals grew by 3% and 2% YoY respectively, but loan disbursements lagged behind, declining by 2%. As such, RHB thinks this could lead to a pickup in loans in the final two months of the year.

System deposits rose 3.1% YoY, at a slower pace compared to loan growth. As a result, Loan-to-Deposit Ratio (LDR) is up to 88% from 85.7% last year.

Current Account Savings Account (CASA) (+4% YoY) grew faster YoY compared to fixed deposits (+3% YoY), but recorded a slight decline month-on-month (MoM), leading to a lower system CASA of 31.0%.

System GIL fell 5% YoY with household GILs down 6% YoY from lower mortgage GILs, while business GILs fell 5% YoY thanks to the manufacturing, agriculture, and mining sectors.

Elsewhere, SME loans in Sep 2024 continued its strong loans growth trajectory at +9% YoY, while the SME GIL ratio has been broadly stable at 3.01%. —Dec 2, 2024

Main image: GreenBiz