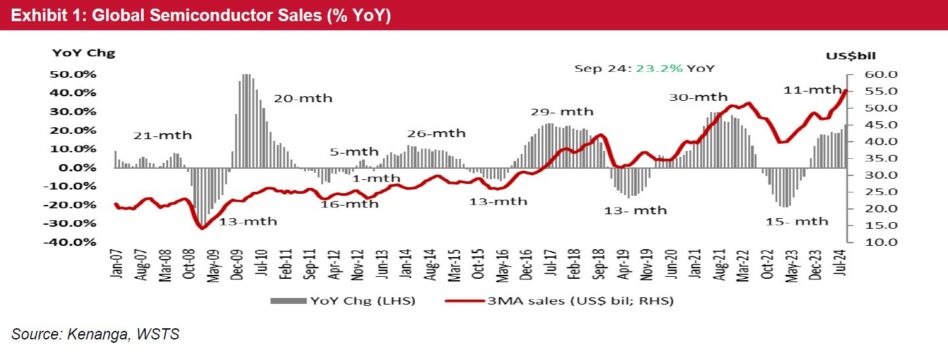

THE semiconductor industry remains cyclical, with uptrend and downtrend cycles averaging 22 months and 12 months, respectively.

The current uptrend, which began in November 2023, has now continued for 11 months, indicating that approximately 50% of the cycle has been traversed.

If historical trends persist, the current uptrend could extend through late CY25 or mid-CY26.

This uptrend is being fuelled by transformative growth drivers, particularly the adoption of artificial intelligence (AI), high-performance computing (HPC), and 5G deployment.

Demand for advanced logic chips, GPUs, and AI accelerators is surging, supported by applications such as generative AI, autonomous systems, and large language models.

Simultaneously, the memory segment is rebounding strongly, with rising demand for DRAM and NAND flash in AI infrastructure, data storage, and 5G systems.

The capex-to-inventory ratio serves as a key indicator of the semiconductor industry’s adaptability to demand fluctuations and investment cycles.

Historical analysis showed that the ratio declined from 10.2x in CY12 to a low of 6.3x during the pandemic, before rebounding to approximately 7.0x.

Notably, upward cycles have historically been initiated when the capex-to-inventory ratio noticeably compresses from the prior year, as old inventory is still being moved/sold, but this dovetails with with a ramp-up of capex.

The projected decline in this ratio from 7.3x in CY23 to 6.9x in CY24, followed by a moderate rebound to 7.2x in CY25, suggests that the current uptrend still has legs, potentially extending until late CY25 or mid-CY26.

This underscores the industry’s focus on balancing capacity expansion with inventory management, ensuring resilience against potential supply chain disruptions and demand shifts.

The global smartphone market grew 3.6% YoY in 3QCY24, reaching 315m units, marking the fifth consecutive quarter of YoY growth.

This is a strong start to the second half of the year, despite ongoing macroeconomic challenges and subdued consumer demand in some markets.

Samsung (18.4% market share) and Apple (18.1%) maintained their leadership in the premium segment, while Chinese manufacturers expanded aggressively in the mid- and low-end segments to capture volume.

The anticipated smartphone replacement cycle and the rise of generative AI smartphones are set to be the next major growth drivers.

These AI-powered devices are expected to revolutionise user interactions, shifting from traditional touch interfaces to intelligent voice commands.

According to IDC, generative AI smartphone shipments are projected to grow by 364% to 234m units in 2024, surging to 912m units by 2028, chalking a remarkable CAGR of 78%.

The KL Technology Index (KLTEC) revenue demostrates a positive correlation with global semiconductor sales, unsurprisingly, reflecting Malaysia’s strategic role in chip packaging, assembly and testing.

Historical trends showed that KLTEC’s turnover implied an approximately 0.8%−1.1% of the global semiconductor sales since CY12.

Assuming Malaysia’s market share is unchanged, consensus forecasts for KLTEC revenue growth in CY24 has slid, with expected contributions of 0.6% to global sales before rebounding to only 0.7% in CY25.

We think this gap could likely be narrowed if the data centre fit-out phase and rising AI-related driven demand translate to greater orders for the top 10 KLTEC members, which account for 75% of the index’s weighting.

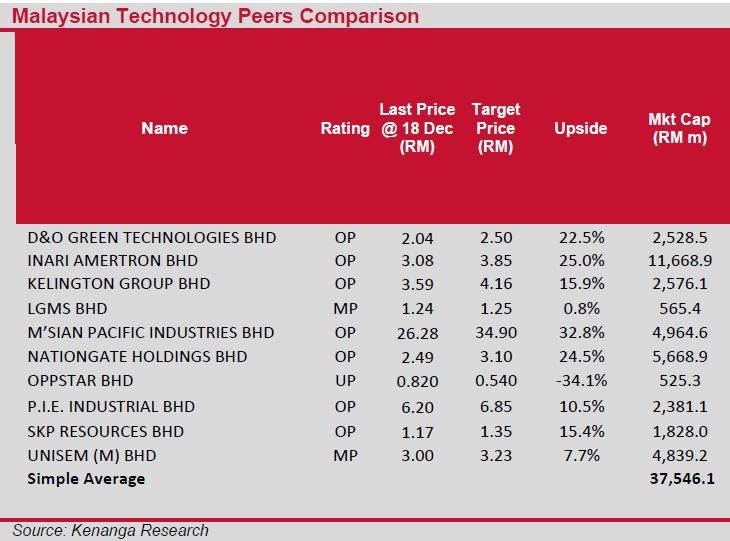

INARI, NATGATE, KGB and PIE remain our top picks for the sector.

These companies stand out with clear earnings visibility and are well-positioned to capitalize on the data center fit-out phase and growing demand for AI-related infrastructure.

These factors make them strong contenders for outperformance under the ongoing semiconductor uptrend cycle. —Dec 19, 2024

Main image: fairobserver.com