COMING off from the Hari Raya festive period and school holidays, earnings for quarter three calendar year 2024 (3QCY24) trailed off with an equal mix of those inline and below estimates.

“Within our coverage, four came inline with expectations (99SMart, Aeon, FocusP, QL Resources) and the remaining four came in short (BFood, Mr DIY, Nestle, and Panasonic). The disappointments were mainly due to the softness in sales,” said Hong Leong Investment Bank (HLIB) in the recent Sector Outlook: 2025.

Malaysia’s GDP growth is forecasted at 4.5%-5.5% for 2025 (HLIB: +4.9%), driven by robust domestic demand and sustained investment flows.

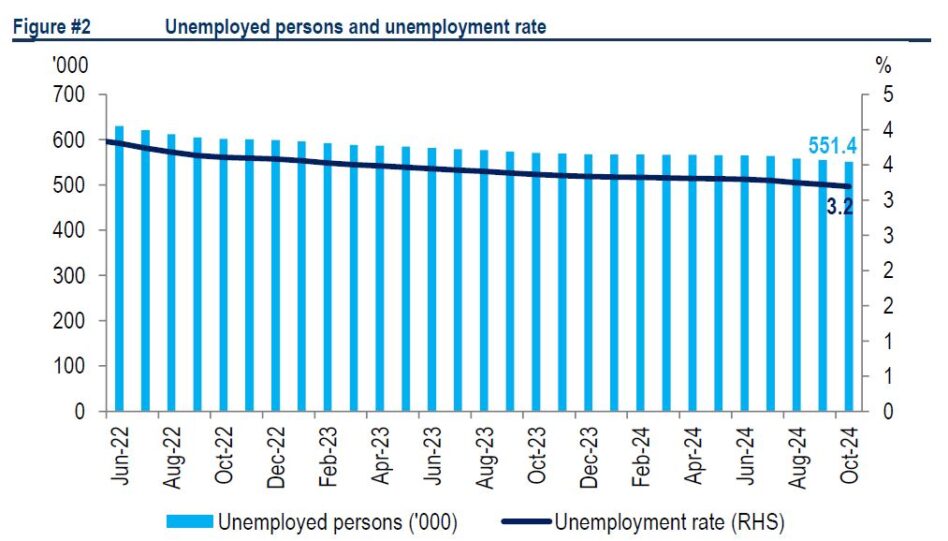

Complementing this, the labour market continues to strengthen, with the unemployment rate stabilizing at 3.2% and a reduction in the number of unemployed individuals.

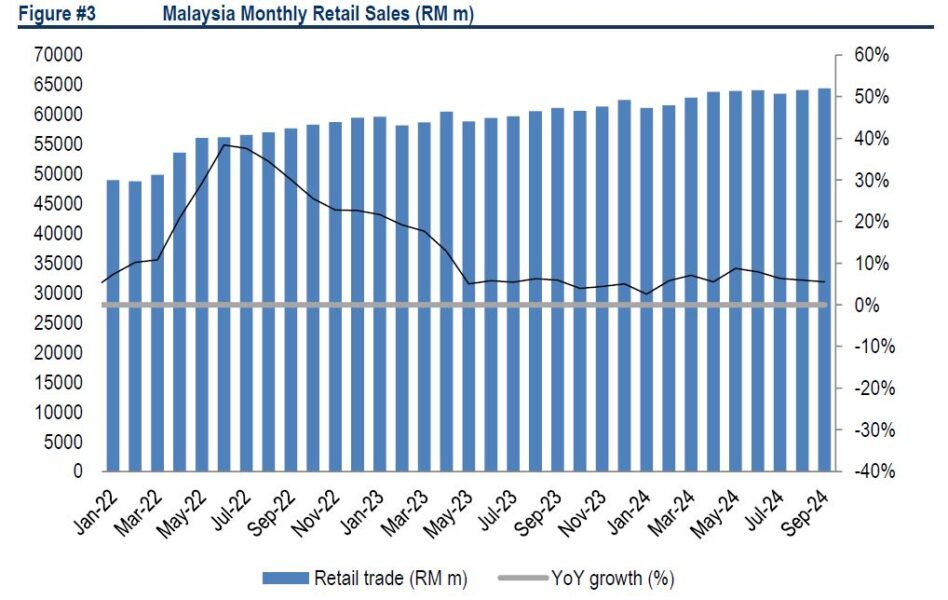

These developments are likely to bolster consumer confidence and stimulate spending. Retail performance also reflects steady growth, with sales increasing by 5.5% YoY in September 2024 to RM64.4bil.

This growth is primarily supported by elevated demand in key categories, including F&B, tobacco, and non-specialized retail stores.

Together, these factors indicate a resilient consumer sector poised for sustained momentum in the coming quarters.

Budget 2025 includes initiatives to boost household purchasing power, with

(i) increase in minimum wage to RM1,700 from RM1,500;

(ii) civil servants pay hike; and

(iii) EPF Account 3 withdrawals.

We reckon that these measures would be beneficial in stabilising prices and encouraging spending. We believe that F&B as well as retail operators who provide discretionary goods and services would benefit most.

Related companies under our coverage which are expected to benefit from the potentially higher discretionary spending include FocusP (BUY, TP RM1.14), MRDIY (BUY, TP RM2.60) given its low ticket items, alongside 99SM (BUY, TP: RM2.98) and Aeon (BUY, TP RM1.82) for their mass market customer reach.

The surge in tourist arrivals is another encouraging trend. According to Tourism Malaysia, international tourist numbers reached 20.6m in the 10M24, surpassing FY23 tourist numbers of 20.1m.

The sustained rise in tourist inflows is expected to continue driving spending in tourism-related sectors, particularly the F&B and retail industries.

With no resolution in sight for the Israel-Gaza conflict, the prolonged boycott of over a year has significantly impacted the earnings of targeted companies.

Among the hardest hit are Nestle (SELL, TP: RM80.00) and BFood (SELL, TP: RM0.25), both of which have seen substantial declines in revenue.

Nestle’s 3Q24 results reported a sales contraction of -5% QoQ and -18% YoY, down to RM1.4bil.

Similarly, BFood’s 1QFY25 earnings continued to trend downward, with revenue falling -5% QoQ and -55% YoY to RM124.2m.

The challenging geopolitical landscape suggests that the outlook for these companies remains bleak, with further headwinds anticipated.

On the flip side, a noticeable shift towards local FMCG products and café culture is reshaping the market.

Brands like Farm Fresh (Choco Malt and Cream Hauz ice cream) and Gardenia’s NuMee instant noodles are gaining traction as consumers prioritize domestic options.

Meanwhile, café chains, including ZUS Coffee, HWC Coffee, Kenangan Coffee, Richiamo Coffee, and the soon-to-launch Luckin Coffee, are thriving, appealing to a younger, and more conscious demographic.

This dual trend highlights both the vulnerabilities of international brands linked (perceived or otherwise) to geopolitical controversies and the growing resilience and innovation within Malaysia’s domestic consumer market.

All in all, we remain optimistic on consumer sector on the back of:

(i) positive macro environment;

(ii) expansionary government policy from income boosters with minimum wage increase, civil servants pay hike and EPF Account 3;

(iii) upward momentum in tourist arrivals; and

(iv) booming local options on the back of the prolonged boycott. —Dec 19, 2024

Main image: deloitte.wsj.com