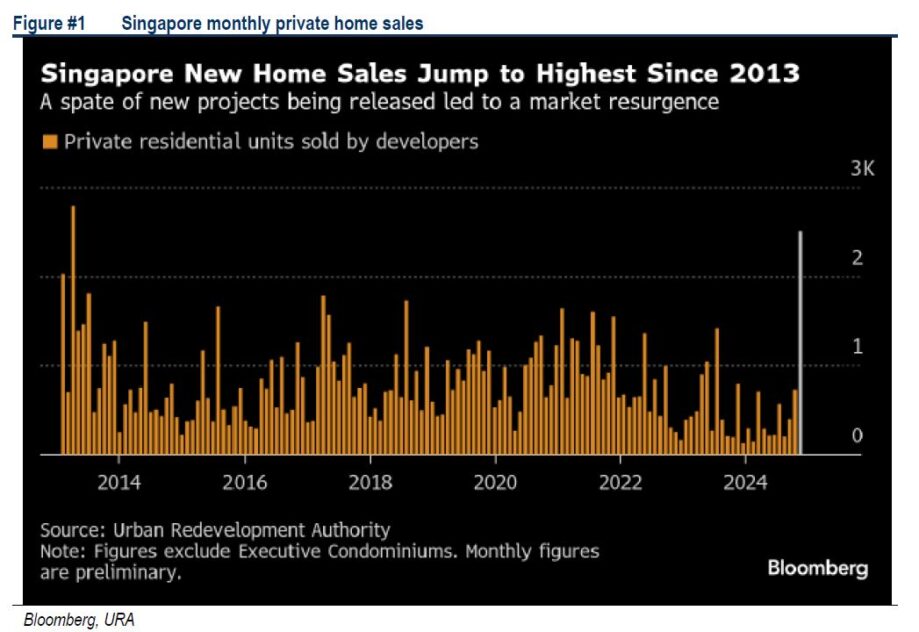

IN HONG Leong Investment Bank (HLIB)’s report dated 3 Dec, they projected that Singapore developers were likely to record the highest private home sales in over a decade in Nov 2024.

This has now been confirmed by data released by the Urban Redevelopment Authority (URA) on 16 Dec.

According to URA, developers sold 2,557 private homes (excluding Executive Condominiums) in Nov 2024, marking a +246.5% month-on-month (MoM) and +226.1% year-on-year (YoY) increase.

This is the highest monthly sales figure since Mar 2013, where 2,793 units were sold. It also represents the first time in over 11 years that monthly sales surpassed the 2,000-unit mark.

Drivers behind the surge are:

(i) high number of new launches as Nov saw five private residential projects launched, totalling 2,871 units; and

(ii) pent-up demand and improved sentiment as buyers’ confidence improved following the Federal Reserve’s interest rate cut in Sep, which lowers mortgage rate and improves affordability.

Notably, The Continuum by Sunway-Hoi Hup was the fourth best-selling project of the month, recording 131 units sold (16% of total units).

The project benefited from the spill-over demand after the nearby Emerald of Katong sold 99% of its units upon launch.

The robust sales figures indicate a revival in Singapore’s property market, following a slowdown of more than a year caused by rising interest rates and the Additional Buyer’s Stamp Duty (ABSD) hike for foreign buyers from 30% to 60% in Apr 2023.

However, the resurgence has also raised concerns about potential government cooling measures, especially with a general election expected within a year.

On one hand, the government may seek to address voter concerns over housing affordability, while on the other, it might refrain from introducing new policies that could heighten uncertainty and disrupt market stability.

“In our view, it remains premature to anticipate government intervention as the market has only begun to recover following an extended lull period previously,” said HLIB.

The government is likely to wait for more data points to assess whether the market is genuinely overheating. In 3Q24, private home prices declined -0.7% QoQ.

The upcoming 4Q24 private home price data will be a critical indicator to watch.

Early signs suggest a price rebound, with developers raising launch prices amid overwhelming responses (e.g. Chuan Park launched at higher than those indicated in marketing materials).

The Federal Reserve’s rate decision on 19 Dec will play a pivotal role in shaping sentiment and impacting developers’ interest costs.

CME FedWatch projects a 97.1% probability of a 25 bps rate cut. If this materialises, further decline in Singapore’s 3-month SORA is anticipated.

This should benefit IOIPG, whose Singapore debt is pegged to floating rates based on 3-month SORA plus a fixed margin.

Since the Fed began its rate-cut cycle, the 3-month SORA had been steadily declining.

Since early Sep, the 3-month SORA had dropped by approximately 43 bps, signalling reduced borrowing costs for IOIPG.

Nov 2024 record-breaking home sales highlights a resurgence in Singapore’s property market, driven by strong launches, pent-up demand, and declining interest rates.

Developers like IOIPG and Sunway stand to benefit from both rejuvenated market activity and easing financial costs.

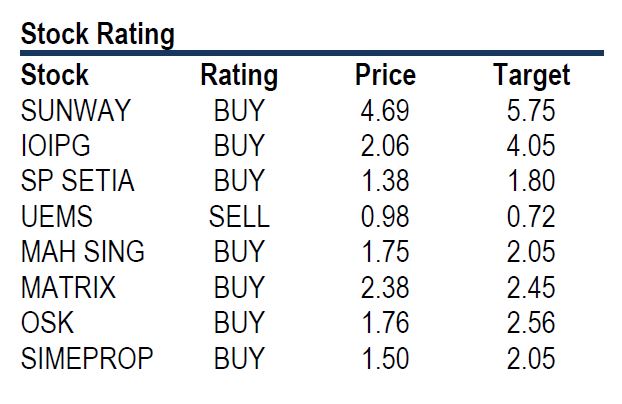

“We maintain our OVERWEIGHT rating on the property sector with IOIPG, OSK, SimeProp and Sunway as our top picks,” said HLIB. —Dec 19, 2024

Main image: Invest Indonesia