THERE has been a lot of concern about the proposed expansion of KLIA and KLIA2, particularly with the involvement of foreign entities and the perceived reliance on public funds.

While scrutiny of such major projects is vital, some criticisms fail to consider the larger picture of Malaysia’s aviation challenges and the potential benefits of strategic partnerships.

The fact is that Malaysia Airports Holdings Bhd (MAHB) operates 39 airports nationwide and has long been grappling with operational inefficiencies and underwhelming performance.

Once ranked among the top five airports globally, KLIA has seen its Skytrax ranking plunge to 71st due to issues ranging from broken aerotrain systems to deteriorating passenger experiences.

Hence, the proposed takeover of MAHB by a consortium led by Khazanah Nasional Bhd and the Employees Provident Fund (EPF) alongside partners such as Abu Dhabi Investment Authority and Global Infrastructure Partners aims to address these persistent challenges.

The consortium has committed to significant investment in infrastructure upgrades, passenger services and airline connectivity to position the airport operator for long-term growth. Such private-sector involvement offers Malaysia a chance to unlock capital and expertise that could help restore KLIA’s standing as a regional hub.

Some critics claim that foreign investors like BlackRock which has a stake in Global Infrastructure Partners (GIP) prioritise profits over public interest.

However, with MAHB requiring billions of ringgit to address years of under-investment, partnerships with entities that bring financial strength and global expertise are essential.

Investors cashing out at premium

It has also been argued that the offer price of RM11/share undervalues MAHB with claims that its value should be closer to RM16/share. However, the offer represents the highest historical price for MAHB shares, reflecting a substantial premium over the current market price.

Furthermore, most research houses covering MAHB have indicated that the price is fair and recommend acceptance. Such overwhelming consensus highlights the soundness of the valuation.

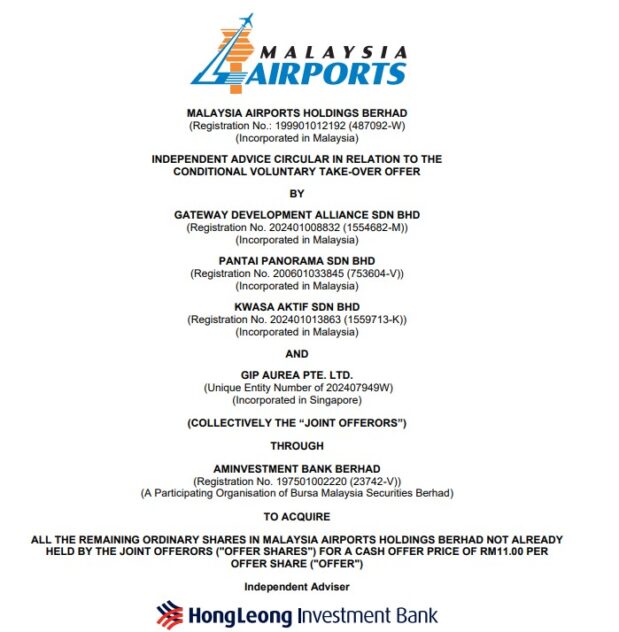

This includes Hong Leong Investment Bank Bhd (HLIB) which yesterday (20 Dec) recommended MAHB shareholders to accept the offer made by the joint offerors to acquire the remaining ordinary shares in MAHB not already owned by them at a cash offer price of RM11/share.

HLIB is of the view that the offer is “not fair” but “reasonable”. The offer price represents a premium ranging from 60 sen (5.77%) to RM3.02 (37.78%) over the last traded market price of MAHB shares as at the pre-conditional offer announcement last full trading day (May 14, 2024).

Whatever the case is, the government has emphasised that its special rights in MAHB remain intact and that all operations will continue to be regulated with national interests in mind.

Not unique but a necessity

A glance at the global landscape shows that such partnerships are not unique. Heathrow Airport recently announced a £2.3 bil investment to upgrade its infrastructure, funded entirely by private-sector capital.

If one of the world’s busiest airports sees value in private investment to enhance operations, why shouldn’t Malaysia adopt a similar approach to rejuvenate KLIA?

Beyond immediate operational improvements, the expansion proposals for KLIA and other airports nationwide underline the urgent need for capital injection.

The KLIA Masterplan, for example, includes long-term upgrades such as Terminal 3, a fourth runway and increased capacity to accommodate up to 140 million passengers annually.

These ambitious goals cannot be achieved without significant investment. On its own, MAHB lacks the financial resources to fund these projects while maintaining its current operations.

Partnerships with entities that can provide such capital are therefore indispensable. Concerns about the use of public funds to finance a partially privatised entity are valid but they often misinterpret the nature of these partnerships.

The proposed consortium has reiterated that public funds will not subsidise shareholder dividends. Instead, funding mechanisms will be carefully structured to ensure private stakeholders bear the financial burden of expansion.

With foreign ownership capped at 30%, Malaysia retains significant control over MAHB’s strategic direction. Moreover, agreements can be structured to ensure local employment and participation, protecting the interests of ordinary Malaysians.

The government has underscored that MAHB’s operations will remain under regulatory oversight to guarantee equitable access and affordability for domestic airlines and rural air services.

Transparency and strict adherence to concession agreements will further ensure that these upgrades benefit all Malaysians, not just shareholders.

For Malaysia to reclaim its position as a regional aviation hub, bold and collaborative decisions are needed. The partnership involving Khazanah, EPF, and their international allies presents a pathway to modernise KLIA while protecting national interests.

Critics are right to demand oversight but dismissing private-sector involvement entirely risks leaving KLIA stagnant.

By welcoming global expertise and capital within a robust regulatory framework, Malaysia can ensure that airport expansion drives economic growth, enhances passenger experiences and strengthens the nation’s global standing.

At the close of market trading yesterday (Dec 20), MAHB was down 14 sen or 1.32% to RM10.50 with 10.77 million shares traded, thus valuing the airports operator at RM17.52 bil. – Dec 21, 2024