THE Malaysian property sector continues to navigate longstanding challenges, including oversupply and affordability gaps, but there are growing indications of stabilization and gradual recovery.

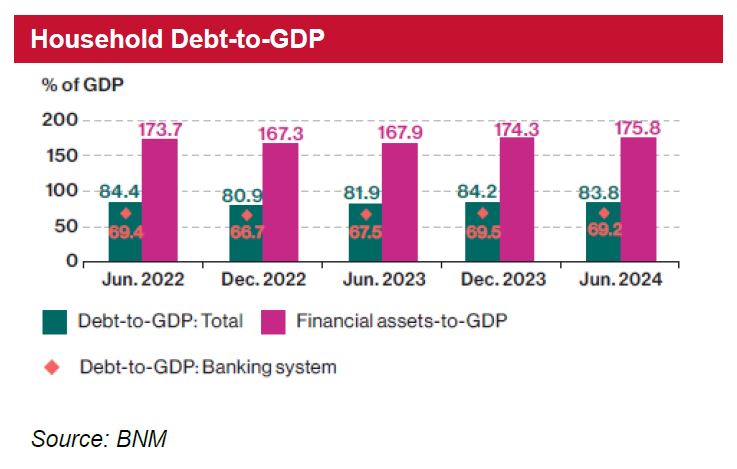

While the household debt-to-GDP ratio has inched higher to 83.8% (2HCY23: 84.2%, 1HCY23: 81.9%) against pre-pandemic levels of c.88%., this suggest that households still have room to rebuild borrowing capacity.

Additionally, the absence of OPR changes for more than 1.5 years has provided a much-needed stability to the interest rate environment, allowing buyers and developers to adjust to earlier hikes.

Inflationary pressures persist, particularly with the potential rationalization of the RON95 fuel subsidy, which could tighten consumer spending power and slow property demand.

Despite this, the appreciating MYR has offered some relief, easing import costs for materials and improving overall sentiment.

The combination of these factors suggests that while hurdles remain, the property sector is showing resilience and is better positioned for recovery compared to prior quarters.

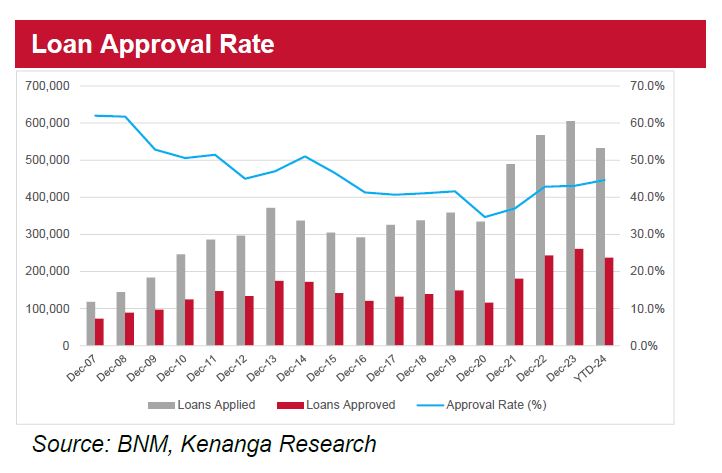

According to BNM’s latest data as of Oct 2024, industry loan approval rates came in at 43.2% with a YTD average of 44.7%, an improvement compared with CY23’s 43.1% and CY22’s 42.9%.

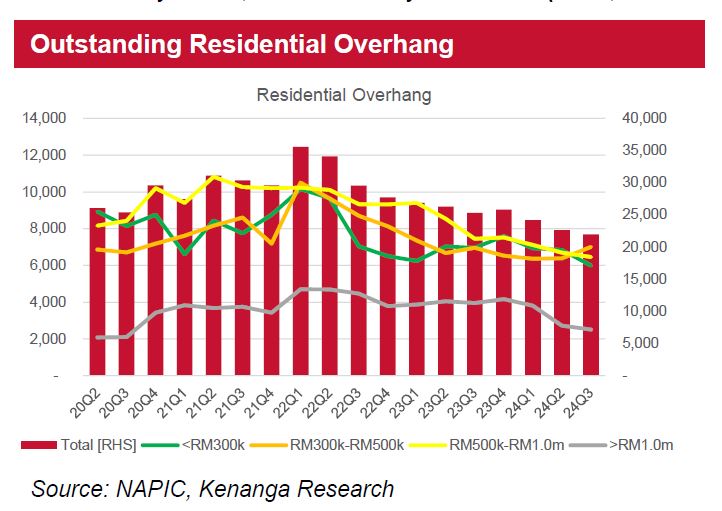

This is indicative on a growing appetite for homes in both the affordable and higher-priced categories as seen in the declining inventory overhang for homes priced between RM500K and RM1 mil.

That said, we have observed some tightening on approvals during the recent months as banks take stock of mortgage disbursements, gradually leaning towards higher value applications which is also in line with the shifts seen in the market.

Our previous concerns on home affordability seemed to have eased. According to NAPIC’s 3QCY24 data, we observed a steady decline in overhung residential units to 22.0K (2QCY24: 22.6K, 3QCY23: 25.8K), particularly seen within higher priced products (>RM500K).

There was a meaningful uptick for affordable homes (RM300K−RM500K) which is explained by a stronger emphasis by developers to inject supply into these markets to cater to first-time home buyers and young working adults.

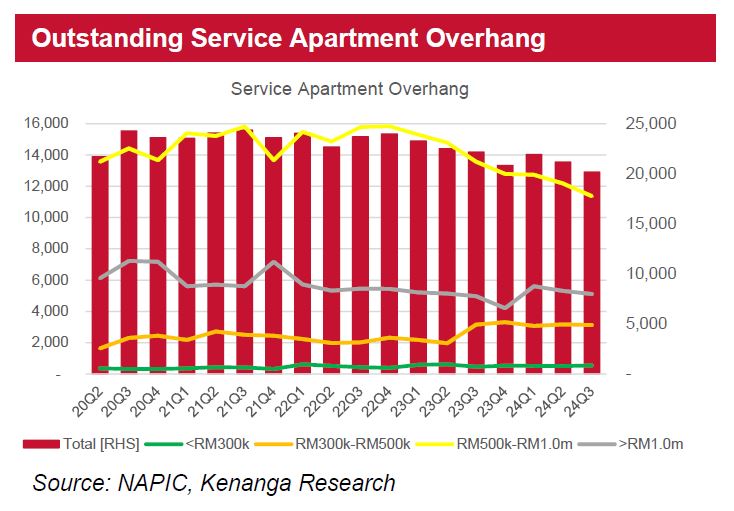

We see similar improvements over at service apartments with 3QCY24 overhang reporting at 20.2K units (2QCY24: 21.2K, 3QCY23: 22.2K) with higher priced homes (>RM500K) being absorbed by the market.

Supporting a renewed appetite, we also saw a steady increase in unsold units under construction (i.e. still developing projects) in 3QCY24, which signals that developers are launching more aggressively in anticipation of a pick-up in market demand in the near term.

Not surprisingly, Penang appears to be the state with the highest sequential increase with supply at 8,121 units (2QCY24: 4,669) following the impending growth of the manufacturing and semiconductor scene there.

This is not withstanding the recently Rumah Bakat Baru Madani Affordable Housing Scheme which looks to inject a further 50,000 units there by CY30, undertaken by SKYWLD (ADD, TP: RM1.14).

Developers are increasingly focusing on monetizing landbanks, thanks to a budding data centre scene, expanding recurring income streams (e.g. industrial properties and rentals), and aligning their offerings with evolving market needs.

The industrial segment, driven by demand for logistics and warehouse spaces amid the e-commerce growth, has emerged as a sustainable revenue contributor, helping offset weaker residential demand.

Additionally, transit-oriented developments in key urban areas like the Klang Valley are gaining traction, providing a strategic response to rising living costs and household debt pressures.

Developers’ focus on affordable housing and industrial properties suggests a growing adaptability to a challenging economic environment.

With the added optimism from reinvigorated consumer appetite for higher priced homes as well as data centres uplifting the realisable land value of specific developers, there has been a pivot towards offering narrower RNAV discounts across the industry.

To further investigate this, we derived a 10-year RNAV discount range for IOIPG,

MAHSING, SIMEPROP, SPSETIA and UOADEV as well as their respective standard deviations, as illustrated below:

Based on their respective historical 10-year data, we gather that our discounts on IOIPG (65%), SPSETIA (65%) and UOADEV (55%) are reasonably within their mean and +1/-1 standard deviation range.

This would suggest that these stocks are most well reflective of fundamentals, being tied more closely to earnings and project pipelines.

On the flipside, we have applied for MAHSING (30%) and SIMEPROP’s (50%) discounts to be at the tail-end of their 10-year historical run, granted by greater optimism shown towards their non-property initiatives (i.e. data centres).

Given that there is ongoing development in this space, we believe that investors are willing to continue ascribing a premium to MAHSING in spite of it being beyond its +2/-2 SD range.

We highlight the absence of MKH in this study due to it being a relatively recent coverage (since Nov 2023) which we lack sufficient historical information.

That said, we believe our applied 60% discount to RNAV is justified, being above the 55% industry average for its slower project pipeline and longer realisability.

We had not included SUNWAY in the abovementioned 10-year study as we believed its recent reporting of Sunway Healthcare as a JV since FY21 could have rerated valuations.

This was evident following our dissection of valuations across its listed entities, which would have implied a highly volatile RNAV discount for its property unit.

As such we believe our applied 55% discount to SUNWAY’s property RNAV is justifiable as its project launches and developments remain relatively stable.

The Malaysian property sector is showing signs of stabilization, driven by improving sales, recurring income from industrial properties, and strategic landbank monetization.

The industrial segment remains a key growth area, supported by strong demand for logistics and warehouse spaces from the e-commerce expansion. Transit-oriented developments and a focus on affordable housing further reflect developers’ adaptability to changing market needs.

The affordability gap and oversupply gradually improve with ongoing government initiatives and developers’ strategic adjustments aiding absorption rates and rebalance supply-demand dynamics.

With stronger sales momentum and more sustainable revenue streams, we upgrade the sector to NEUTRAL, reflecting a more balanced and resilient outlook for the near-to-medium term.

Our top sector picks are MAHSING, due to its strong focus on affordable homes priced below RM500K, which are in high demand among first-time homebuyers, and SIMEPROP, which is expanding its recurring income streams, providing greater earnings stability and long-term growth potential. —Jan 6, 2025

Main image: Gloria Jeans Coffee