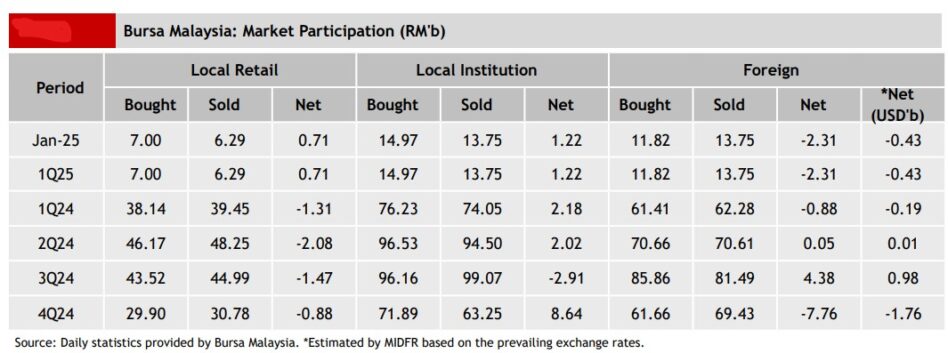

FOREIGN investors extended their selling streak on Bursa Malaysia to a 13th consecutive week with net outflows amounting to -RM1.33 bil for the Jan 13-17 period, the second-highest single week outflow since April 2024. This surpassed the previous week’s outflow of -RM502.2 mil.

Outflows were observed every trading session with the largest on Monday (Jan 13) at -RM328.2 mil while other days ranged between -RM212.2 mil and -RM325.5 mil, according to MIDF Research.

“The only sector that recorded net foreign inflows was REITS (RM1.0 mil),” observed the research house in its weekly fund flow report.

“Meanwhile, the top three sectors that recorded the highest net foreign outflows were construction (-RM313.0 mil), property (-RM156.9 mil) and consumer (-RM127.1 mil).”

On the contrary, local institutions remained net buyers for the 13th successive week with RM797.8 mil in net purchases to extend their buying streak to 41 trading days in a row.

Local retail investors, too, remained net buyers for as second straight week by contributing to a robust RM530.8 mil in net inflows.

Trading activity declined across two out of three categories with average daily trading volume (ADTV) increasing by +13.7% for foreign investors, -4.5% for local institutions and –7.5% for retail investors.

In comparison with another four Southeast Asian markets tracked by MIDF Research, only Indonesia recorded a net inflow of US$14.9 mil to end its two-week streak of foreign exits.

However, Vietnam posted a net outflow of -US$184.8 mil – a surge of 4.3 times from the previous week’s outflow which also marked its third consecutive week of foreign exits.

Elsewhere, Thailand saw a net foreign outflow of -USD160.1 mil which extended its streak of consecutive outflows to three weeks while the Philippines extended its streak of foreign exit to two weeks with a net outflow of -US$56.6 mil last week. – Jan 20, 2025