FOLLOWING Maybank Investment Bank (MIB)’s recent site visit to Johor, they are more positive on the Johor-Singapore Special Economic Zone (JS-SEZ).

The collaboration between Malaysia and Singapore has garnered strong interest, with more investments and projects expected in the next 6 to12 months.

Encouragingly, the state government has assured that it will leave property prices to market forces while focusing on ensuring an adequate supply of affordable housing.

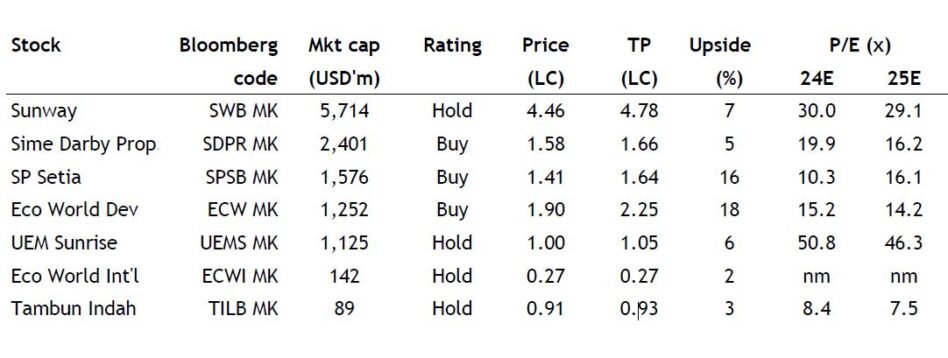

“We believe that increasing investments and better infrastructure will boost job opportunities and drive population growth, boosting property demand. Our picks for JSSEZ: ECW and SPSB,” said MIB in a recent report.

JS-SEZ has attracted strong interest from companies in Singapore, Qatar, and China, with potential investments in food, tourism, and data center related upstream and downstream businesses.

JS-SEZ has attracted strong interest from companies in Singapore, Qatar, and China, with potential investments in food, tourism, and data center related upstream and downstream businesses.

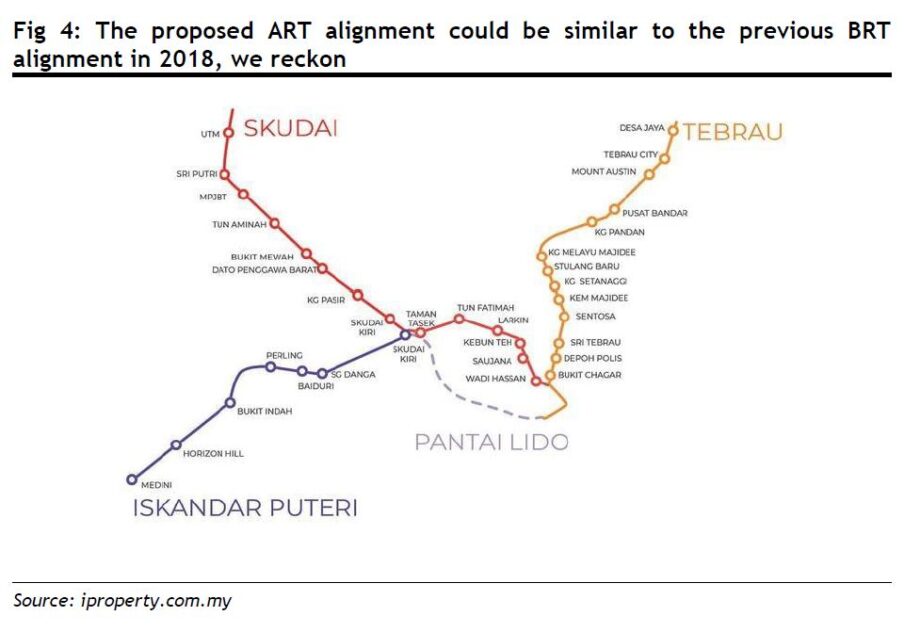

Special incentives may be offered based on investment type and economic impact. The state has proposed to enhance connectivity, potentially via ART system and ferry services to accommodate increased traffic and population growth after RTS operations begin in Jan 2027.

The state government is leaving market forces to determine property prices, but will ensure adequate affordable housing to safeguard local interests.

“Our mosaic theory suggests that a G2G industrial park could possibly be developed in the future, considering Singapore’s proven success with industrial parks in China, such as Suzhou Industrial Park (SIP), and in Vietnam, with the Vietnam-Singapore Industrial Park (VSIP),” said MIB.

Establishing such a park is expected to enhance investor confidence and attract more Singaporean businesses to the region.

“We believe that Sedenak is a strategic location for this initiative, as it has the potential to become a new growth area in Johor,” said MIB.

With Singapore’s investment and expertise, the development of Sedenak could be accelerated, leading to the creation of job opportunities and driving economic growth in the surrounding areas.

“We maintain our neutral stance on the property sector. Sector fundamentals and themes remain intact but at cheaper valuations following the recent sell-down,” said MIB.

That said, MIB advised selective investing, focusing on companies with proven track records. There are no changes to their earnings forecasts and target prices. —Jan 22, 2025

Main image: Ven Jiun (Greg) Chee