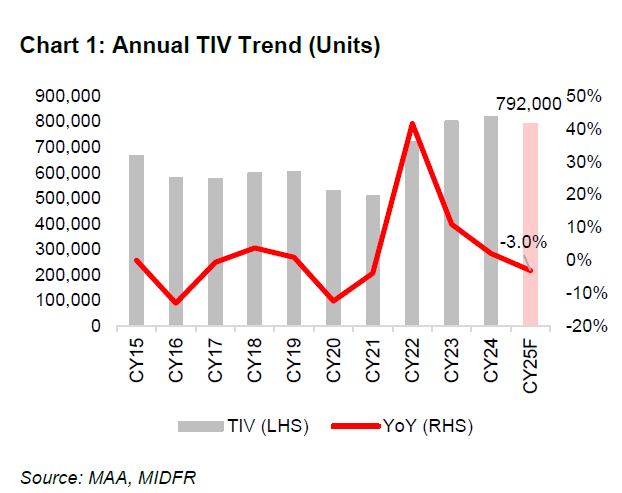

DECEMBER 2024 total industry volume (TIV) exceeded expectations, reaching a record 81,735 units, or an increase of 4.2% year-on-year (yoy), which pushed calendar year 2024 (CY24) TIV to an all-time high of 816,747 units (+2.1%yoy).

“This is compared to our earlier flattish estimate of 800,000 units, mirroring MAA’s forecast, which underwent two upward revisions in CY24,” said MIDF Research (MIDF) in the recent Sector Update Report.

On the production front, Dec-24 volume stood at 63,962 units (-3.4%yoy), likely reflecting anticipated softer sales ahead, while the full-year figure increased by +2.0% yoy.

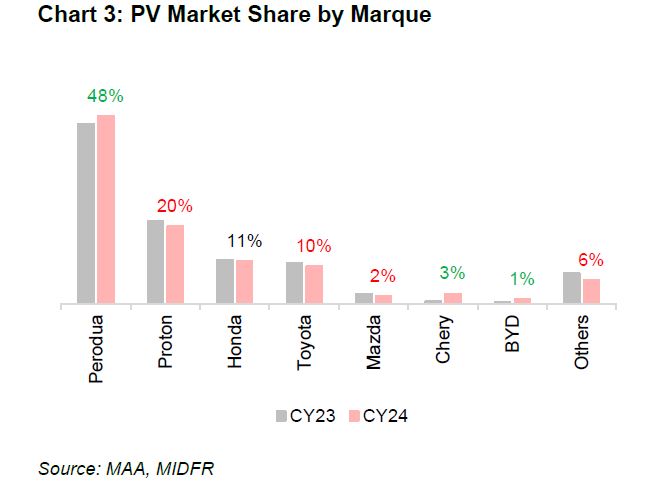

The overall TIV growth was not broad-based, as it was primarily driven by Perodua, which achieved a record 358,102 units, exceeding its target of 330,000 units last year.

Notably, newer entrants like BYD and Chery posted the strongest full-year growth, with TIV surging 2.3x and 4.4x year-on-year, respectively, signaling their increasing market share in the passenger vehicles (PV) segment.

The only other major marque to record an increase in TIV in CY24 was Honda, delivering 81,699 units (+2.1%yoy) and maintaining its market share of 11% in the PV segment.

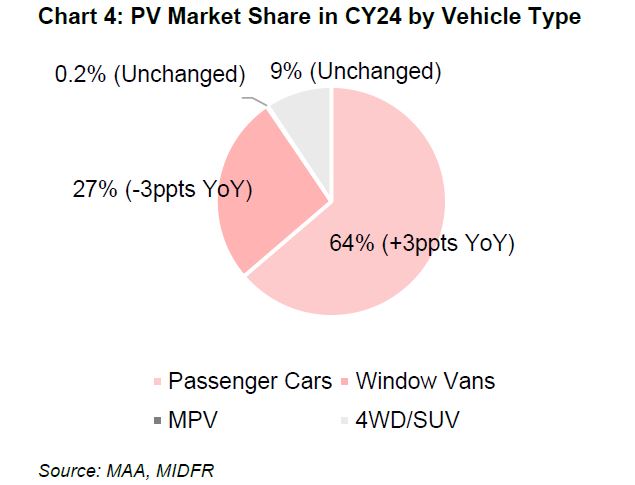

Hybrid vehicle sales for CY24 totaled 30,796 units (+9.8%yoy), maintaining a 4% TIV penetration.

Meanwhile, BEV sales grew to 14,766 units (+45.3%yoy), increasing TIV penetration to 2% from 1% the previous year.

A spike in CBU BEV purchases is expected this year as buyers capitalise on the duty exemption before it expires in Dec-25.

“We foresee a gradual easing of TIV in CY25 after years of elevated backlog, with our projections at 792,000 units,” said MIDF.

This is broadly consistent with MAA’s forecast of 780,000 units. It is worth noting that order backlog for Perodua has declined to 90K, down from 128K at the end of CY23, with a similar trend observed across other major marques.

Several positive factors to consider include the minimum wage increase to RM1,700 effective Feb-25, the recent public servant salary revision of up to +15%, and the overnight policy rate which is expected to stay at 3.0%.

This year’s focus will be on rationalising RON95 fuel subsidies for the top 15% income group (T15), reportedly in its final stages.

“We believe this group is more likely to transition to electric or hybrid vehicles,” said MIDF.

MIDF maintains their neutral call on the sector due to the anticipated downcycle.

BAuto is their top pick, as its share price decline, driven by concerns over weaker TIV, has led to an attractive valuation. —Jan 24, 2025

Main image: Auto World Journal