THE automotive industry is transitioning, driven by the rise of EV players, with current investments focused on downstream areas like showrooms and service centres, alongside growing interest in EV assembly.

“The expiration of complete build up EV incentives is expected to boost local sourcing, creating upstream opportunities in the EV supply chain,” said Maybank Investment Bank (MIB) in a recent report.

Traditional automakers face pressure from Chinese EV makers and the capital demands of EV transitions, spurring global consolidation that could impact local players.

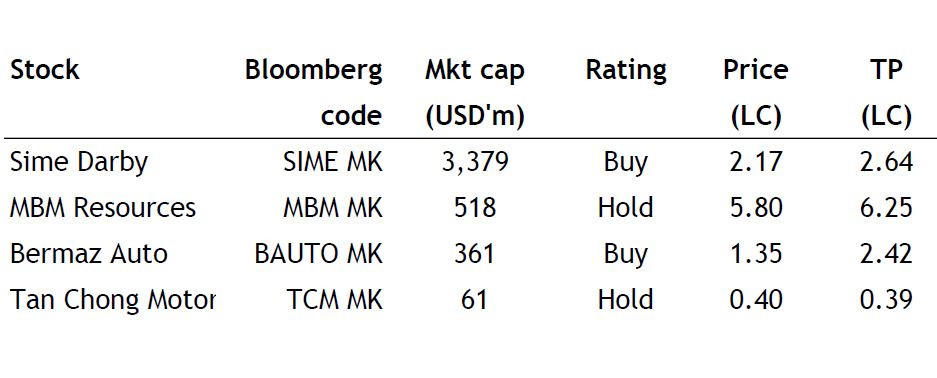

Despite this, Perodua and Proton’s dominance shields the market. MIB’s top picks for the sector are Sime Darby and Bermaz Auto.

They have identified four key EV investment hotspots in Peninsular Malaysia, which are Perlis, Perak, Pahang, and Johor.

Local auto parts players can capitalise on the EV transition through technical partnerships and upskilling to expand their customer base and access global supply chains, while traditional auto parts suppliers risk losing out.

“We see MCE Holdings as a proxy for EV component supply, while SIME’s diversified portfolio positions it well to navigate the transition and seize consolidation opportunities,” said MIB.

Global consolidation among traditional original equipment manufacturers is expected to create ripple effects, impacting local automotive players.

Global consolidation among traditional original equipment manufacturers is expected to create ripple effects, impacting local automotive players.

However, Malaysia’s auto market remains resilient, dominated by national marques like Perodua and Proton, which account for nearly two-thirds of total industry volume.

This presents a dual challenge for Japanese automakers, competing against both national brands and emerging players. The potential Honda-Nissan merger could present opportunities to DRB-Hicom and Oriental Holdings, while potentially challenging Tan Chong Motor.

“SIME, our top pick is poised to benefit with its strong presence across the value chain, covering EVs, hybrids, and ICE vehicles, and stands at the forefront of Malaysia’s EV transition,” said MIB.

BAUTO is MIB’s other top pick as we see its vehicle sales slowdown to bottom out in quarter four calendar year 2024, with its entry into the Chinese EV market enhancing competitiveness; BAUTO also offers an attractive dividend yield of more than 11%.

MBM is positioned to benefit from Perodua’s dominance and its foray into Chinese brands; MIB has a hold rating due to limited upside but they believe share price would be well supported by its dividend yield.

TCM may face headwinds from the potential Honda-Nissan merger, with challenges traditional automakers face amidst industry consolidation.

“But with limited downside, we upgrade TCM to hold from sell; target price unchanged at MYR0.39,” said MIB. —Jan 28, 2025

Main image: Praxie