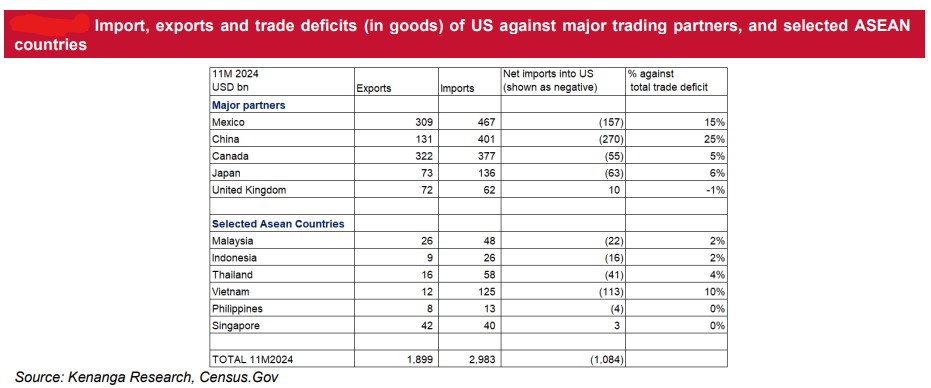

MORE sector-specific tariffs are being mulled by the US with that for oil and gas (O&G) seen as “largely crystalised” following a slew of additional tariffs to be imposed on Canadian, Mexican and Chinese goods effective tomorrow (Feb 4) amid a short notice by the White House over the weekend (Feb 1).

As per Kenanga Research’s observation, US President Donald Trump had in his weekend announcement mentioned that the US would “absolutely” place tariffs on the European Union (EU) in addition to having stated in end-January of sector-specific import tariffs for steel, aluminium and copper, O&G, computer chips, semiconductors and pharmaceuticals.

“Unlike the threat of Fentanyl (pain relief drug), it remains to be seen how expedient these tariffs can be imposed and if a broader study/buy-in would be required,” the research house pointed out in a market strategy note.

“Nonetheless, with the additional tariffs on Canadian energy imports of 10%, this is viewed as an O&G sector risk being largely crystalised given that Canada supplies nearly 60% of US crude oil imports.

“This move should induce more refining activity to be done out of the US rather than fulfilling requirements through imports. In other sectors, this could spell some overhang – there is no date yet regarding chip tariffs, for example, only saying it will be done eventually.”

As for the technology sector, prices of consumer electronics – including mobile phones, TVs, laptops, monitors and their essential components – imported into the US from China are expected to rise following the imposition of new tariffs.

US companies with significant trade exposure to China such as Nvidia, Broadcom, Qualcomm and Intel could face adverse impacts, potentially disrupting the global semiconductor supply chain.

“Malaysia as a key player in OSAT (outsourced semiconductor assembly and test) and back-end semiconductor services may experience varying degrees of impact depending on supply chain realignments, trade policies and broader geopolitical dynamics,” cautioned Kenanga Research.

“Challenges remain, particularly in raw material supply disruptions and uncertainties in market demand, especially from China-based clients.”

Although the sector is poised for near-term headwinds due to raw material supply constraints and demand fluctuations, Malaysian semiconductor players nevertheless stand to benefit from supply chain diversification as global technology firms may accelerate the adoption of a more aggressive China+1 strategy to reduce reliance on China.

“Over the medium term, Malaysian firms are well-positioned to capitalize on the structural shift in global supply chains,” opined the research house.

As it is, the US imposition of an additional 10% tariff on China gloves has made Malaysian glove makers prime beneficiary on sentiment boost and broadened ASP (average sales price) discount.

“We believe this latest tariff imposition is expected to boost investors’ sentiment on the Malaysian glove sector as we interpret the 10% tariffs is in addition to the 50% presently imposed on China’s rubber medical and surgical gloves’ exports into the US,” projected Kenanga Research.

Recall that the US Trade Representative (USTR) had in September 2024 unveiled tariff increases on Chinese imports which includes a higher tariff of 50% and 100% on China’s rubber medical and surgical gloves’ exports into the US beginning CY2025 and CY2026 respectively. – Feb 3, 2025

Main image credit: CroweLLP