MALAYSIA’s manufacturing sector is expected to sustain positive growth, supported by resilient domestic demand and gradual improvements in supply chain conditions.

“However, downside risks to external demand remain elevated, particularly in the second half of 2025, as subdued global growth prospects and escalating geopolitical tensions weigh on export-oriented industries,” said Public Investment Bank (PIB) in a recent report.

Heightened uncertainty surrounding global trade policies, especially following President Donald Trump’s policy stance, could add further pressure on industrial activity.

Despite these challenges, steady domestic consumption, fiscal measures supporting investment, and a gradual recovery in key trading partners may help mitigate external headwinds.

The JPMorgan Global Manufacturing purchasing manager’s index rebounded above the neutral 50.0 mark to 50.6 in January, signalling a return to expansion.

Solid gains in the new orders and future output PMIs, which rose by 1.3 points and 2.6 points respectively, indicate improving growth momentum at the start of the year.

Regional disparities persist, with robust PMI readings in the US and China contrasting with continued weakness in the Euro Area and Japan.

The recovery has yet to translate into stronger hiring, as the global employment PMI fell by 0.9 points to 48.5 in January, its lowest level in four and a half years.

The US manufacturing sector returned to expansion at the start of the year, supported by a surge in business confidence.

Both output and new orders rebounded in January, while optimism for year-ahead production reached a 34-month high.

S&P Global attributed part of the improvement in sentiment and demand to expectations of more favourable business conditions under President Trump.

The US manufacturing PMI rose to 51.2 in January, signalling a modest improvement in sectoral health at the beginning of the year.

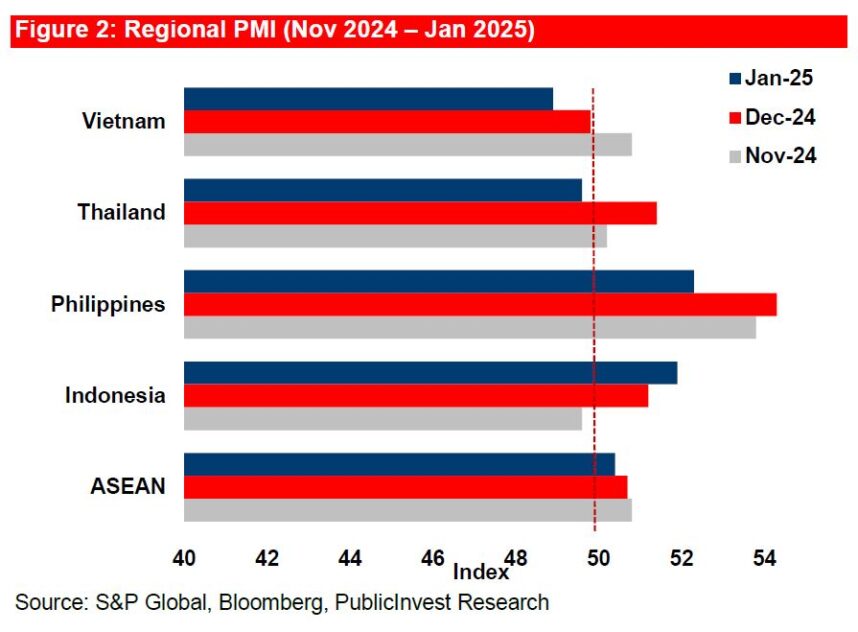

The ASEAN manufacturing PMI pointed to only a modest improvement in operating conditions in January, easing to 50.4, the weakest reading in nearly a year.

Both new orders and output expanded at a slower pace, while external demand remained a drag on overall sales growth.

On a positive note, inflationary pressures softened, and after two consecutive months of job cuts, employment saw a slight uptick.

Business confidence among ASEAN manufacturers was broadly unchanged from December, with firms expecting output to rise over the next 12 months, though sentiment remained historically subdued.

Malaysia’s manufacturing sector remained under pressure at the start of 2025, with firms reporting continued moderations in both production and new orders.

In response to subdued demand conditions, manufacturers cut selling prices for the first time since June 2023, with the decline, albeit modest, marking the sharpest reduction since January 2015, according to S&P Global.

Purchasing activity was scaled back, while stock levels were drawn down further. Employment also moderated, with firms utilising spare capacity to clear outstanding backlogs. Cost pressures picked up but remained softer than the 2024 average.

The manufacturing PMI edged up slightly to 48.7 in January, signalling a sustained but modest deterioration in sectoral conditions.

According to S&P global, the latest PMI reading indicates that gross domestic product growth remains on a positive trajectory, albeit at a more moderate pace, while also signalling sustained year-on-year improvements in official manufacturing output.

Business sentiment remained upbeat, with firms anticipating higher production over the next 12 months.

However, confidence eased to a seven-month low, reflecting lingering uncertainties despite expectations of improved demand conditions. —Feb 4, 2025

Main image: Mech Daily