Am Bank Group (AMB) believes that the still-resilient outlook is supported by domestic growth and the moderating inflation environment (4Q2024: 1.8% versus 3Q2024: 1.9%).

“Additionally, we view the overnight policy rate (OPR) last year’s level as neutral, aligning with Bank Negara Malaysia’s assessment which supports the economic growth,” said AMB.

This is reflected via consumer spending amid an uptick in credit card disbursement (4Q2024: 6.3% vs. 3Q2024: 5.7%) during the quarter.

With the positive performance in the labour market as the unemployment rate hits decade-low at 3.1% as of December last year, AMB posits the OPR level will remain steady at 3.00% in the near term.

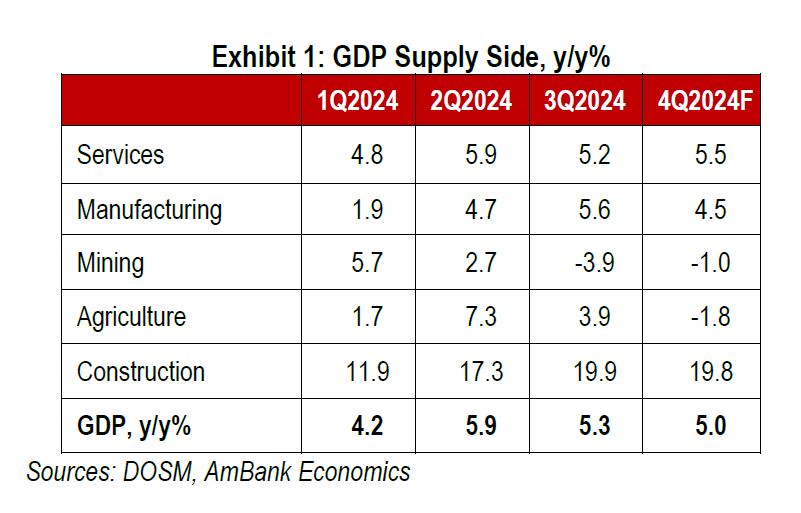

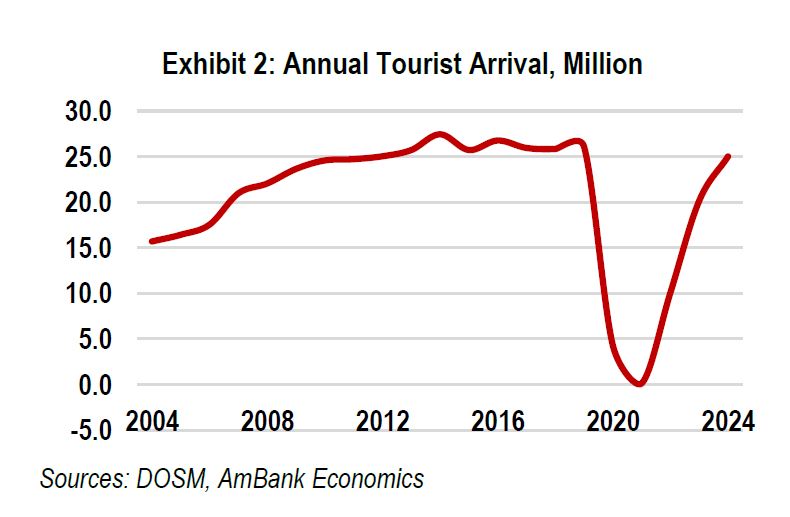

On the supply side, the services sector led the growth in the quarter with their projection at 5.5% year-on-year (3Q2024: 5.2%), which they believe is supported by the tourism sector as Malaysia recorded over 25 mil international tourists arriving in 2024 (2023: 20.1 mil) despite missing Ministry of Tourism, Arts, and Culture’s target of 27.3 mil.

On the supply side, the services sector led the growth in the quarter with their projection at 5.5% year-on-year (3Q2024: 5.2%), which they believe is supported by the tourism sector as Malaysia recorded over 25 mil international tourists arriving in 2024 (2023: 20.1 mil) despite missing Ministry of Tourism, Arts, and Culture’s target of 27.3 mil.

Additionally, they foresee that the construction sector will continue its double-digit growth during the quarter (4Q2024: 19.8% vs. 3Q2024:19.9%), thanks to data centre development, which could be among other reasons that contributed to such stronger performance in 4Q2024.

“Looking ahead, we expect Malaysia’s economy to start 2025 on a firm footing, driven by resilient private consumption amid festive demand, an ongoing private investment upcycle, and robust trade supported by frontloading activities ahead of potential US tariffs,” said AMB.

AMB sees Malaysia’s full-year 2025 gross domestic product (GDP) growth coming at 4.6%, with risk to growth weighted somewhat to the downside due to external development.

“Our GDP forecast aligns with the lower bound of the official estimates range of 4.5% to 5.5%,” said AMB. —Feb 14, 2025

Main image: The Exchange, TRX (X)