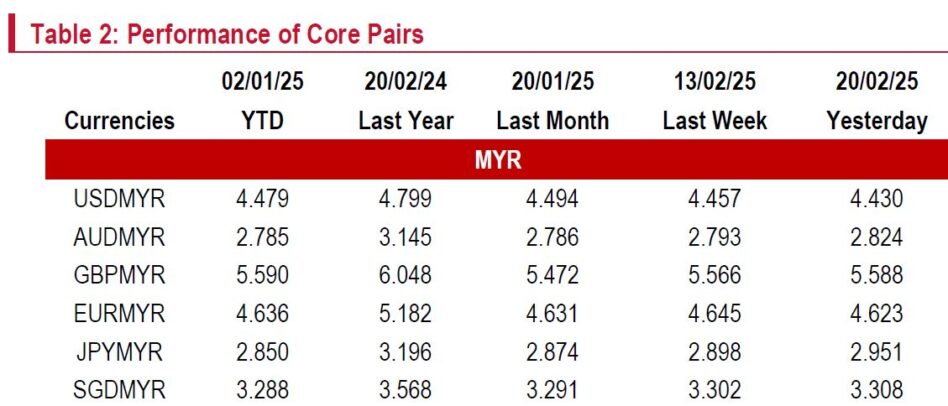

THE ringgit remained stable, trading between 4.42 and 4.45 against the USD.

“Meanwhile, the USD index (DXY) hovered in the 106.0–107.0 range, weighed down by easing market concerns over Trump’s tariff threats and weak US retail sales data, which signalled a softer start to 2025,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

The ringgit’s stability reflected broader market sentiment, with risk-on appetite buoyed by signs of a potential ceasefire in Ukraine.

However, the DXY found some support from signs of US-Russia cooperation, which pressured the EUR amid rising fears of Trump’s isolationist policies.

Trump’s floated idea of a 25.0% tariff on autos and chips also bolstered the USD.

Stronger-than-expected growth and a hot inflation reading in Japan renewed pressure on the DXY by raising the likelihood of another Bank of Japan rate hike.

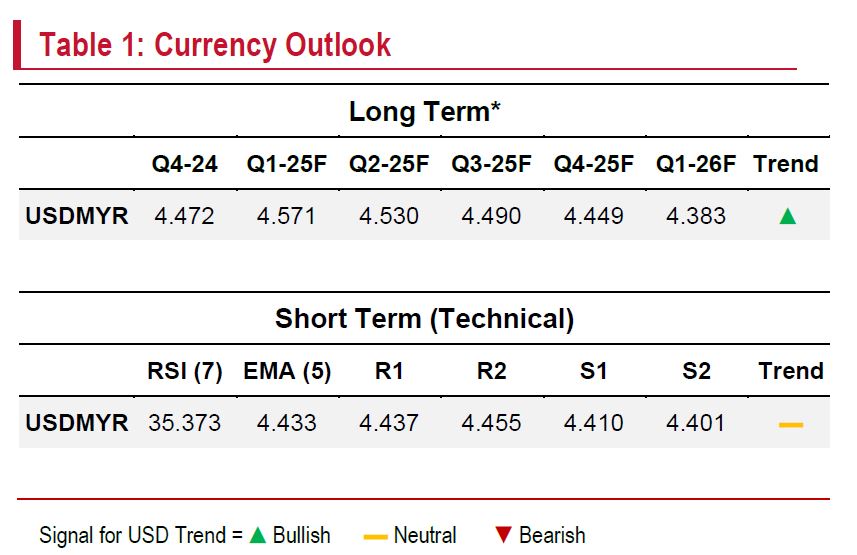

“Despite the Federal Open Market Committee minutes signalling inflation concerns, we continue to expect at least two Fed rate cuts this year, while markets price in just one,” said Kenanga.

Near-term focus will be on US core PCE inflation data, a potential US-China trade deal, developments in the Russia-Ukraine conflict and progress of US isolationism toward Europe.

The ringgit is expected to remain range bound between 4.40 and 4.45 against USD in the week ahead.

USDMYR remains neutral, likely to hover near its five-day exponential moving average at 4.433, with the relative strength index anchored in the mid-range zone. —Feb 21, 2025

Main image: Reuters